If you work in finance or accounting, you are most likely familiar with three-way invoice matching in accounts payable. The process of matching invoices to purchase orders (PO) and goods received notes (GRN) has been around for years and is a method of processing a supplier invoice to the point of accurate payment. Three-way matching in accounts payable also serves as an excellent method of validating different parts of the supply chain.

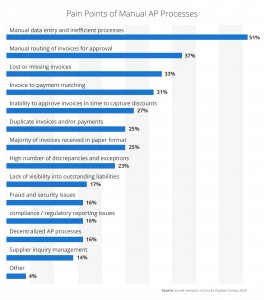

However, when done manually, the matching process is paper-based, which inevitably leads to human error and long delays. The perils of manual invoice matching are all the more apparent for accounts payable teams that have switched to working remotely. This is reflected in Levvel Research’s Payable Survey, with 31% of respondents naming manual invoice matching among the top AP pain points.

When the matching process is automated, as part of an end-to-end AP automation system, organizations can automatically process a high percentage of their invoices from the creation of a purchase order to the receipt of an invoice.

What is three-way matching in accounts payable?

The 3-way invoice matching process acts as the ‘handover’ between procurement and accounts payable. A successful three way match involves matching data on a PO, a GRN and an invoice. These three documents are critical to a successful 3 way match.

Purchase Order (PO)

A PO is a document that confirms an order from procurement to a vendor. Typically this document will include the purchasing company’s name and address, date, product/service description and quantity, price, and PO number.

Goods Received Note (GRN)

A GRN is proof that the product/service has been delivered or fulfilled. It is always matched with the PO to ensure that everything ordered has been delivered correctly. Typically a GRN will feature the same details as a PO with the addition of delivery details.

Invoice

Once the goods are received, or the service has been fulfilled, the supplier will send an invoice to the purchaser requesting payment. When an invoice is received, it is matched against both the PO and GRN. In addition to the information on a PO and GRN, an invoice will include an invoice number, vendor contact information, any credit details, total amount due, and payment schedule.

Traditionally, Accounts Payable would review the relevant information on each of the three documents. The information on these documents falls into two categories – line item data or header data. Line item data refers to a product or service that has been added to an invoice along with its relevant quantities, rates, and prices. Header data is all other information on an invoice, such as invoice number, total price, and document date.

Organizations that decide to match line item data will see their processing times increase in comparison to those that only match header data. The reason for this is that matching line item data requires validation of every individual product or service that has been purchased as opposed to only the header data.

Automating three-way matching in accounts payable

When the 3-way invoice matching in accounts payable process is automated, organizations can automatically reconcile a large number of their invoices. This means that the invoices will run straight through the accounts payable process without any manual intervention, saving employee time, and vitally reducing errors.

For example, Grafton Group plc, an international distributor of building materials with a turnover in excess of £2.2 billion, was able to automatically match 75% of all of their invoices. This contributed to other notable improvements including a reduction of their invoice approval process from 40 days to only 10 days.

What are the benefits of automating three-way matching in accounts payable?

Save employee time

One of the major drawbacks to 3 way matching in accounts payable is the time taken to verify individual pieces of data on each document, especially line item data. Automating the process means that the data is automatically verified and only exceptions are flagged for manual verification. This allows employees to re-allocate their time to other areas. Because less time is spent verifying the data, orders get processed and paid quicker, meaning organizations can also benefit from early payment discounts.

Improve supplier relationships

Seamless interactions between an organization and its suppliers lead to an improved relationship. A good relationship with a supplier can lead to preferential pricing and improved credit terms.

Protects against fraudulent and duplicate payments

Three-way invoice matching means that data is verified consistently throughout the process. Keeping close tabs on POs, GRNs and invoices ensure that organizations are not overpaying or paying for duplicate items or invoices. The process also protects against fraudulent or non-authorized purchases. Any inconsistencies will be flagged and will then need to be manually approved.

Be audit ready

POs, GRNs, and invoices are among the most common documents that auditors ask for. When these documents are already correctly approved, matched, and organized, the audit process becomes seamless and won’t take employee time away from their main focus.

Conclusion

With a lot of AP teams operating remotely, now is an ideal time to switch to an automated accounts payable system, if you haven’t already. The benefits include improved supplier relations, reduced human error, lower processing costs, and improved control and visibility. Adding technology to existing processes like three-way invoice matching can accelerate the power and control organizations exercise.