Manual Accounts Payable Pain Points

A recent report by Levvel listed the top challenges experienced by professionals in accounts payable.

The manual routing of invoices for approval is a major inefficiency in the AP process. By having a slow approval process, organizations may be missing out on early payment discounts, or worse, making late payments that affect your relationship with suppliers. In a previous blog, we discussed effective ways to enhance supplier relationship management.

Other manual processes such as scanning paper invoices, manually keying data, and printing and signing paper checks are also listed as major pain points. These tasks are both inefficient and lacking in value.

Manual processes can also cause many challenges. Invoices arriving in paper format can go missing, and a lack of visibility can cause panic and frustration within the supply chain. There are also storage issues attached to receiving invoices in paper format. Manual documentation often results in incorrect data included on invoices or duplicate invoices.

It’s clear to see that manual accounts payable processes have their issues and it is no surprise that more and more organizations are switching to accounts payable automation, given its benefits.

Benefits of Accounts Payable Automation

So what are the benefits of accounts payable automation? Here are a few reasons for making a case for AP automation:

1. Quicker approval of invoices

Through accounts payable automation, invoice lifecycles are dramatically reduced. Invoices can be approved anytime, anywhere on any device, leading to improved supplier relations and cost savings for the organization.

2. Increased productivity

Employee productivity also increases as a result of automation. Staff are no longer bogged down with low-value, tedious tasks like scanning paper invoices and manually keying in information. Instead, they can switch to more strategic roles which offer greater benefits to the business.

3. Increased visibility over the entire AP process

One of the biggest pain points of operating under a manual accounts payable process is a lack of visibility. Through accounts payable automation, however, finance leaders can track outstanding liabilities and audit the entire AP process in real time.

4. Lower Processing Costs

Organizations also experience lower processing costs after a switch to automation. Paper is instantly eliminated from the process, reducing storage and printing costs. Outsourcing of manual data entry is also no longer required as electronic invoicing and online data capture take on that role.

However, despite the benefits associated with accounts payable automation, securing investment in such software can often be difficult.

Barriers to Accounts Payable Automation Buy-In

In spite of the benefits associated with accounts payable automation and the important role the AP function plays in an organization’s financial success, buy-in can often be difficult. This can be due to the perceived position of the function – as a back-office function that deals with issues as they arise, rather than being strategic.

Often, CFOs are also of the opinion that current processes are working just fine and that there will be no return on investment. After all, there are costs attached to implementing accounts payable software.

Therefore, it’s critical when making a business case for accounts payable automation to create a detailed plan and calculate the potential return on investment.

Creating a Business Case

Calculate Current Costs Vs Potential Cost Savings

Lay out all of the existing costs attached to your organization’s current manual accounts payable process. Include costs like employee salaries and benefits, outsourcing costs, material costs like paper, postage, and printing, and the cost and maintenance of equipment used in the process.

Include less obvious costs associated with your current process. Analyze all of the losses resulting from errors, high invoice processing costs, and the cost of your current invoice lifecycle times, which may include late payments and missed early payment discounts.

Audit each individual that processes invoices and makes payments on a daily basis. The objective is to assess the total and individual time spent on accounts payable tasks.

Once you have gathered the necessary information, you can start presenting the potential cost savings from accounts payable automation.

Labor costs are optimized through the removal of manual, low-value tasks. This enables the reduction of headcount and reallocation to more strategic roles. When manual data entry is removed, organizations also save on the cost of equipment, such as scanners, used in the process.

Further value is gained from the removal of issues that staff would usually have spent a considerable amount of time on.

Additionally, automation optimizes the invoice approval process. Faster approval times mean invoices are paid earlier and early payment discounts are captured, which may previously have been missed.

Consider Your Circumstances and Choose the Correct Software

It is extremely important when choosing an accounts payable automation solution that the correct platform is selected to suit your organization’s current circumstances.

If automating completely from scratch, where all previous processes were manual, your organization may be lacking an established relationship with your IT department. As a result, this may increase the time taken to implement the solution and additional IT resources may need to be hired. However, a major advantage is that it allows you to design a completely new automation process without impacting any existing solutions and hardware.

Demonstrate the Impact on Current Invoice Processing

Invoice processing has a major impact on overall efficiency, productivity, and cash flow. If invoices are processed manually, each invoice must be sorted, entered, verified and matched against the purchase order. Such tasks are time-consuming, lacking in real value, and can also lead to mistakes, which means further delays and in some cases, duplicate payments.

By investing in a top accounts payable automation software, the invoice lifecycle is reduced dramatically, which ultimately improves cash flow. Additionally, organizations make all payments on time and realize the benefits of early payment discounts. Through a central repository for all invoices, POs, and approval routes, finance employees gain more visibility over the process, allowing them to identify and act on errors and discrepancies in real-time. Automated invoice approval workflows also shorten the procure-to-pay process, reducing the invoice lifecycle by removing paper and notifying approvers of outstanding invoices on-the-go. Automated PO matching removes the need for manual data entry and subsequent potential errors and discrepancies, which would then need to be manually investigated.

Show Timeline to Recoup Cost of Automation

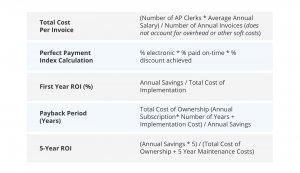

While a switch to accounts payable automation will yield many benefits and cost savings, ROI will not be instant, which is often a blocker to securing investment. It is important when drawing up a business case, that you outline a specific timeframe for when you will see a return on investment. The below table from Paystream Advisors is a good example of the type of metrics and timeframes that should be included in any investment pitch.

There will be initial implementation costs for the software that you choose. You should contact a few different providers in order to predict implementation costs. There will also be costs associated with system downtimes. If replacing an existing system, you should consider the time in which the current system will be offline.

In terms of costs, determine whether employees can be reassigned to more strategic roles where they may be able to add value. Will investment in automation software allow the business to scale more quickly as employees re-focus their attention on new areas of growth?

Conclusion

There are, quite clearly, a number of pain points associated with manual accounts payable processes and also several benefits from switching to accounts payable automation. However, the switch is often a harder sell than it may seem. Drawing up a business case may feel like a daunting, time-consuming task but with some detailed research of your organization’s accounts payable processes, you’ll find solid evidence to support your argument.

For those interested in delving deeper into AP automation, we invite you to explore our complete guide to AP automation for a thorough understanding.