The Covid-19 pandemic continues to cause global economic disparity and uncertainty. Industries such as pharmaceuticals and e-commerce have thrived, while the likes of hospitality and retail have been greatly affected. As countries and regions move in and out of varying levels of restrictions, the risk and uncertainties for industry sectors continue.

If there is one thing that 2020 has taught us it is that businesses need to adapt, think creatively and be decisive.

With that in mind, here are areas that CFO’s need to focus on for 2021.

CFO Priorities for 2021

Priority #1 – Digital Transformation

According to a recent report by KPMG, 80% of CEOs globally have seen the digital transformation of their businesses accelerate over the past few months, in response to the Covid-19 pandemic. This may come as somewhat of a surprise, given that CFOs have been focused on reducing costs for much of 2020. However, with many workforces now operating remotely, this has forced organizations into adapting their systems and processes. For finance teams operating manually, the switch to remote working has exposed a lack of control and visibility within accounts payable processes.

By investing in a centralized, fully-automated accounts payable system, AP staff can log into the system from wherever they are and view the status of invoices, approve and query invoices and communicate with suppliers. By automating each stage of the AP process, human error is removed and greatly reduced, leading to reduced costs for organizations. If you haven’t focused on digital transformation this year, it should be one of your biggest priorities for 2021.

Priority #2 – Managing Liquidity

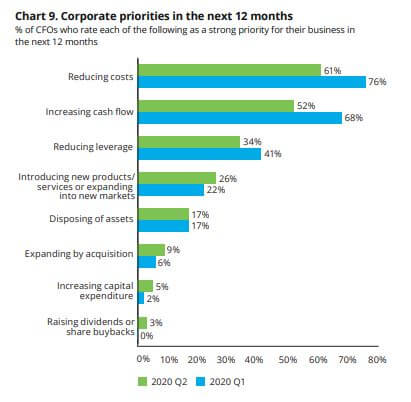

According to a recent Deloitte CFO Survey, increasing cash flow ranks as the second biggest priority for CFOs in 2020 and 2021.

We recently wrote a blog on Procurement Actions for Cash Flow Management During a Period of Crisis. Two key focus areas should be inventory and vendor management.

In order to mitigate any supply chain disruptions, you should ensure you have an adequate amount of excess stock but not an excessive amount that could prove costly if demand dries up. Similarly, you should focus on demand planning in order to be able to react quickly and invest in the correct inventory as consumer demand changes.

Engagement with vendors can also have a major impact on improving liquidity and cash flow. You may be able to negotiate discounts on large orders or be given the flexibility to make smaller orders if cash is tight. They may also be willing to include return policies so if your stock does not sell or expiries, you may be able to recoup the investment and bring cash back into the business.

Priority #3 – Alignment of Stakeholders

When referring to CFO priorities for 2021, it is easy to focus solely on the financial side of the business. However, CFOs must focus on aligning stakeholders as new technologies are invested in, business models change and products are developed, for example. Stakeholder communication was named in a recent Deloitte survey as one of the top actions being prioritized by organizations in response to Covid-19.

Instead of sectioning off different parts of the company, the emerging model is about improving communication and streamlining fluidity between divisions. This has become all the more important with workforces working remotely. You should no longer view your role as CFO as insulated. Instead, look to collaborate with other executives in 2021. A CFO has always been the key player to offer financial strategy to the company. However, with better integration throughout the company, the CFO can take on a more cohesive leadership role.

Priority #4 – Focus on Employees

According to a recent survey conducted by McKinsey, most companies managed to address basic employee needs of safety, stability and security, during the first phase of the Covid-19 pandemic. Those working remotely have seen more positive effects on their daily work in terms of productivity, engagement and a sense of well-being. However, at the same time, an overall 80% of respondents said the crisis is affecting their daily work lives in some way.

The changes to the ways in which we work have affected people in different ways and organizations need to be aware of this. Employee working conditions and well-being should be of major concern to CFOs, given it can have a direct impact on productivity and in turn, company growth and performance.

According to Jen Fisher of Deloitte, CFOs are becoming increasingly aware of the importance of aligning social responsibility with strategic goals and employee well-being.

By investing in well-being, companies have a much greater chance of attracting and retain top talent. Employee well-being initiatives should be designed to improve trust, loyalty and engagement with the aim of mitigating risk, producing positive ROI, and aligning with external stakeholder expectations. If employees are happier and engaged in their work, their productivity is going to be higher and company goals and growth are going to be more attainable. Employees will also be more likely to buy into the developments of new products, business models or technologies to automate business processes.

Conclusion

2020 continues to be a year of change. While global economic uncertainty will continue into 2021, the lessons and experiences learned this year will help businesses plan for next year. These plans will need to be flexible, however, if CFOs prioritize the 4 key areas mentioned in this blog when budgeting for next year, organizations will be best placed to tackle and overcome the challenges that 2021 will bring.