The Covid-19 pandemic has had a major impact on how accounts payable teams operate. AP teams still operating manually have been forced into adapting their processes to try and enable remote working, with many struggling with these changes.

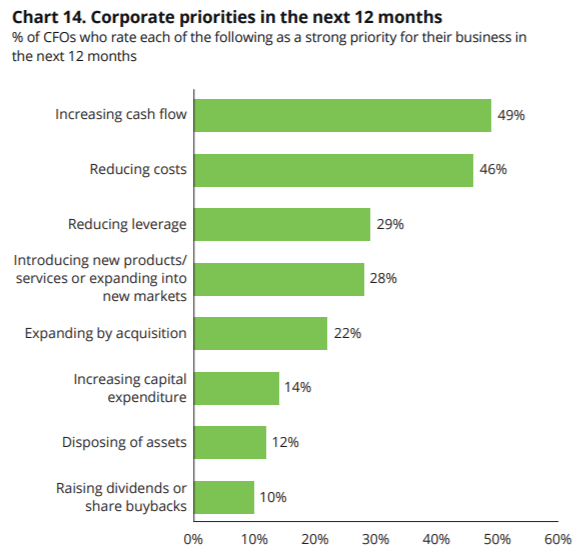

Along with the difficulties that remote working has brought to AP processes, added pressure has arisen from CFOs prioritizing cost reduction and cash flow management in response to the global economic uncertainty that the pandemic has brought. Unfortunately, there has also been a significant increase in the risk of invoice fraud, as reported by the EU’s law enforcement agency, Europol, and this is a challenge that AP teams must address in 2021.

While these are challenging times for accounts payable teams, new technologies will present AP with opportunities to transform its role.

In order to assist in tackling the challenges during the year ahead, we have outlined 5 key areas that all AP teams and Senior Finance professionals should be aware of throughout 2021.

5 Key Areas of Accounts Payable in 2021

1.Remote Working is Here to Stay

While “manual” accounts payable teams have struggled to adapt to remote working, the fact is that the necessity for remote working will continue into the months ahead and therefore must be addressed.

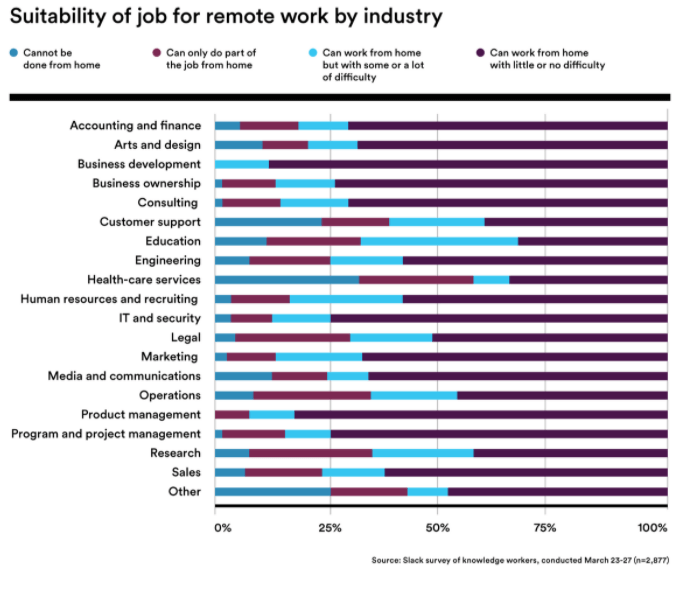

Those that chose to invest in automation prior to the pandemic have experienced a seamless transition to remote working and as such will be more open to continuing to work fully or at least partly remotely once it is safe for staff to return to the office. In fact, according to a report by Slack, Accounting and Finance roles score highly when it comes to roles that can be done from home with little or no difficulty.

Cloud-based AP automation has been a huge enabler for AP teams in working remotely, with the removal of paper and the automated scanning and approval of invoices just some of the benefits. It is therefore unsurprising to hear that, according to Gartner, 74% of CFOs intend to shift some of their workforce to remote working permanently.

Studies also show that 65% of workers feel more productive when working remotely while for organizations there is the added benefit of lower operating costs when staff are working from home, with savings in the areas of office space, electricity and catering.

Given the benefits of remote working to both employer and employee, it is clear that it is here to stay in one form or another. If your AP function has struggled with the move to remote working, you need to address this now.

2. Data-Driven Decision Making

According to KPMG, 80% of CEOs globally have seen the digital transformation of their businesses accelerate over the past few months.

Since the start of the pandemic, CFOs have become more familiar with processes involved in accounts payable and the difficulties in operating remotely for manual teams. As a result, many are now more open to automating AP than ever before. According to a recent article by PYMNTS.com, spending on AP automation will likely jump from $1.9 billion in 2019 to over $3 billion by 2024.

With CFOs prioritizing cost reduction and working capital management in response to ongoing economic uncertainty, many are turning to the data that such solutions provide, particularly in the areas of contract management and supplier management.

At an operational level, vendor management systems help minimize supply chain disruptions by enabling vendors and AP staff to communicate directly over the status of invoices, orders and payments. When it comes to the data, AP teams are seeing great improvements to vendor risk management with real-time information provided on spend by vendor and vendor compliance against agreed contract terms.

Data around contracts is another area that AP are leaning on in order to manage spend and reduce costs. Information over the likes of contract-based spend, contracts up for renewal and those soon to expire are providing AP with the visibility to better manage their contract spend. Actions from the insights provided may include re-negotiating contracts with vendors for improved terms and early payment discounts, blocking of auto-renewals on contracts no longer required and ensuring essential contracts are maintained in order to prevent any supply chain disruptions or negative impact on cash flow.

The availability of data within AP solutions for better decision-making will likely elevate the role of the function within many organizations.

3. Invoice Fraud is on the Rise

Invoice fraud is on the rise and remote working is part of the reason why. We highlighted this very trend back in January 2020 and as reported by Europol, the trend has gathered pace with the outbreak of Covid-19.

With the switch to remote working, more businesses have moved many of their operations online. AP staff are now working in isolation without the support of colleagues to verify potential fraudulent invoices and emails that arrive into inboxes. Both factors have increased the risk of invoice fraud occurring.

Fraudsters have developed sophisticated email strategies where they impersonate an actual vendor and attempt to convince an employee to pay an invoice. A number of other invoice fraud tactics currently exist, something, which we discussed in a recent blog, which we would encourage you to read.

Without an automated AP system in place, invoice fraud can often go unnoticed, resulting in huge losses for organizations. However, a system that includes an automated invoice matching process will ensure that if certain invoice data is missing, conflicting or mirrors an invoice already processed it will be flagged for investigation before being sent for approval.

4. Focus on Cash Flow Strategies

The management of cash flow has become a major priority in recent months, as organizations look to protect their financial health amidst huge economic uncertainties.

In fact, according to Deloitte, increasing cash flow ranks as the number one priority for CFOs over the next twelve months.

This has been difficult in recent months with disruptions to supply chains and changing consumer demands. These challenges will unfortunately continue while restrictions remain in place for different sectors and regions across the globe.

In 2021, organizations will look to the likes of payment terms, vendor management and inventory management as ways of boosting cash flow. We discussed such strategies in a recent blog.

5. The Road to Artificial Intelligence will Gather Pace

Another trend that will continue to gather pace in 2021 is that of Artificial Intelligence. According to Forbes, full AI is the end goal in terms of managing AP processes, however, the increased optimization and automation of processes currently taking place has us well on the road to achieving that end goal.

One such technology that is having a major impact on the automation of accounts payable processes is Robotic Process Automation (RPA). RPA automates manual, repetitive AP tasks, including data entry and routing of invoices for approval and will alert AP staff where manual intervention is required. This results in the removal of errors that occur when processes are carried out by humans, reduces the time taken to process invoices and in turn reduces the cost of processing invoices. You can read more about “RPA in Accounts Payable” by downloading our whitepaper.

While RPA offers many benefits to the AP process in performing repetitive, rules-based tasks, AI has the ability to develop its own logic and perform and improve tasks on its own. The emergence of RPA in recent years has gone a long way to bringing full AI to accounts payable and with a CAGR of 29.30% forecast between 2019 and 2026, the development is set to continue.

2020 was a challenging year for accounts payable, with the switch to remote working and the shifting of priorities in response to the pandemic. Many of these challenges will continue into 2021 but with the experience of last year, AP can look to 2021 as year of opportunity with technology an enabler in transforming the role of the function, automating tasks and protecting against risks.