As the pressure to drive cost and time savings intensifies, finance leaders realize they need to be agile. With earnings and revenues estimated to increase by 7.8% and 9.6%, respectively in 2022, business models, budgets, and processes need to evolve to keep up with growth.

Investing in procure to pay solutions reduces stress levels for finance teams, ensures efficient operations, and improves spend transparency. Efforts to support digital transformation are popular, and a Deloitte survey reveals that 92% of finance leaders plan to introduce more technologies and automation into operations.

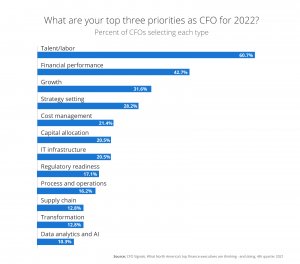

Addressing strategic priorities and refining processes provides the necessary support for finance leaders to step into a more strategic role. CEOs now want visibility into all aspects of the finance process, as well as recommendations based on data and trends.

Why are organizations modernizing their P2P process?

Firstly, modernizing a P2P process does not require a full ERP replacement. It is simply leveraging technology to streamline the process of buying and paying for goods and services. Companies who have successfully modernized their P2P process are experiencing significant benefits:

Cost Reductions

Automating the process allows a CFO to better understand how an organization is spending its money. With 63% of financial leaders expecting an increase in supply chain costs, companies require technology that supports better cost control and mitigation.

Deeper insights into procurement allows CFOs to negotiate better pricing, stop maverick buying, and prevent suppliers from overcharging.

Save Employee Time

Automation of the P2P process eliminates a number of manual tasks. Giving back more man-hours to the organization allows finance teams to focus on important tasks without dropping the ball on essential paperwork.

For instance, companies that leverage automation in processing payables process invoices 74% faster.

Visibility

Finance leaders often have very little visibility into the finance process. Many have no idea where a particular invoice is at any given time, or if a PO was fulfilled and received. The lack of visibility makes it difficult to complete timely accruals or to promptly resolve queries.

Using procure to pay automation, a finance leader can manage the entire P2P process on one system with a single interface. Decision-makers will have access to trends and the department’s progress towards goals.

Decreasing risk of human error

High exception rates pose challenges for almost half of Accounts Payable teams. Leveraging automation programmed to match invoices to purchase orders and validate information reduces the risk of human error.

By automating the procure to pay process, organizations reduce problems like duplicate invoicing, paying an incorrect amount, or paying the invoice to the wrong supplier.

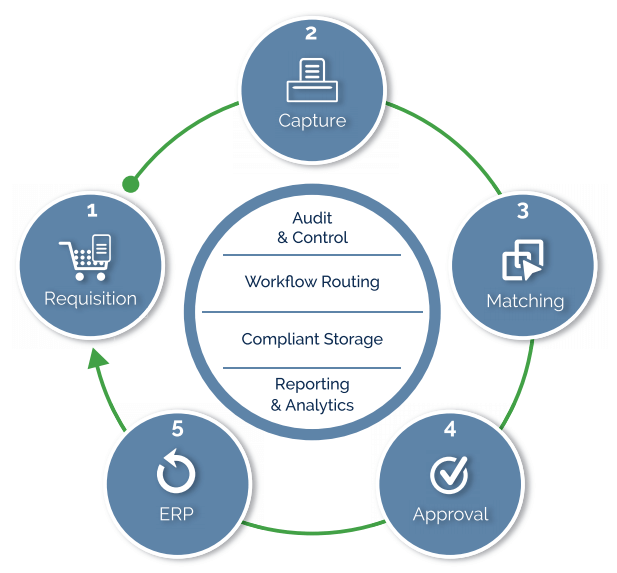

The 5 Stages of P2P Automation

The P2P process starts from the request for the product to the issuance of the PO, receipt of the goods, and finally the processing and payment of the supplier invoice. Successful organizations are modernizing their processes by automating procure to pay. Procure-to-pay software transforms the following tasks:

1. Requisition

Requisition automation ensures that an organization is always in complete control of company spend from the start. Finance leaders create predefined catalogs with approved suppliers. Requisitioners can then choose products and services directly from this collection. This means that full visibility is maintained over what is being purchased and why.

2. Invoice Capture

All types of invoices (including paper, PDF, fax, EDI, XML, and email) can be automatically captured through automation. Touchless processing for most invoices through capture, matching, and approval means that only exceptions need to be handled by AP team members. Problems such as duplicate invoices, missing PO numbers, and unregistered suppliers are stopped at the source before they cause more significant problems and more work downstream.

3. Invoice Matching

Automated matching of POs, invoices, and goods received notes eliminates manual paper-based processing. Technology such as intelligent character recognition (ICR) typically results in the straight-through processing of up to 80% of all invoices.

4. Invoice Approval

Approval automation allows for invoices to be routed electronically, reducing approval times. In addition, complex rules based on roles, hierarchies, and varying approval limits can be configured to ensure adherence to company spending policies. Sophisticated workflow automation can even enable approval routing across multi-entity organizations.

5. ERP Integration

P2P automation software integrates seamlessly with an organization’s existing ERP system. This ensures complete visibility of the entire P2P process, along with a complete audit trail for every transaction. Reporting analytics enable finance leaders to continuously monitor and improve operational P2P processes while also delivering timely and accurate month-end reporting.

Conclusion

Accounts Payable departments play a critical role in supporting decision-making, and 69% of businesses believe that smarter systems are the key to improving AP teams. Getting rid of repetitive tasks and tapping into analytics turns AP departments into intelligence hubs.

When CFOs leverage technology, they can seize growth opportunities or risk being left behind by competitors.