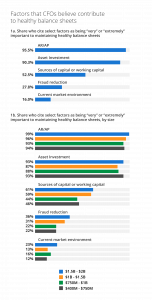

Regardless of the economic situation, finance leaders need capital efficiency to weather any storm and continue to grow. According to a PYMNTs survey, more than 95% of CFOs favor AP automation for helping to maintain a healthy balance sheet – and it’s easy to see why.

With automated systems in place, companies experience greater operational efficiency, fewer errors, and vastly improved visibility and control.

How Does AP Automation Reduce Costs

1. Optimizes Resources

Despite the high volumes of invoices to process, AP does not need to tie up resources on mundane tasks. If you can reduce the time employees spend on routine tasks with automation, productivity and time for value-added work increase.

AP Departments mired in manual processing need to hire more employees for tedious work like data entry and paper invoice matching. An APQC report reveals that the median number of required full-time employees required per $1 billion revenue is 6.9. Top performers need 3.8 employees, while bottom performers need as many as 11.9. Based on the survey, leading organizations maximize AP processing efficiency by leveraging technology, investing in continuous improvement, and implementing the right governance and delivery models. In a tight labor market, AP personnel will be easier to retain with appropriate technology support.

The benefits are clear: automation slashes the costs of repetitive work and allows your AP team to focus on strategic tasks like connecting with your customers and providing business insights.

2. Reduces Fraud Risks

Automation reduces risks related to business email compromise – a primary method of actual and attempted fraud attempts. For secure communication, AP automation includes features like intuitive supplier portals, which remove the risk of invoice duplication or fraudsters intercepting invoices.

Paper checks are also targets of fraud. Although companies have increased the usage of electronic payments, many still rely on paper checks. According to the AFP, 92% of organizations use checks for incoming payments, and 86% issue checks for outgoing payments.

Aside from being prone to fraud, checks are also expensive. The cost of issuing a check ranges from $2 to $4, and companies spend from $1 to 2 per check received. Automation makes it easier for AP departments to get rid of paper checks and offers more secure and affordable payment methods.

By embracing digital transformation, companies achieve greater cost savings by reducing susceptibility to fraud.

3. Decreases Supply Expenses

Manual accounts payable processes often literally rely on a paper trail. Paper documents may duplicate easily and require changes. Reprinting means additional administrative costs for paper, printing, toner, storage, postage, faxing, and other related expenses.

The average in-office paper spending ranges from $31,000 to $50,000. Why is automation cost effective? By introducing automation, companies can cut costs, save time filing and organizing documents, and reduce their carbon footprint. Going paperless is both more sustainable and productive in the long run.

4. Builds Trust With Vendors

Businesses spend from 15 to 27% of their revenues on external vendors – creating the need to improve vendor management to reduce procurement costs. Often, companies focus on the lowest bidder when dealing with supplies, but this needs to change.

According to KPMG, companies that prioritized growth, innovation, and risk management in vendor relationships over price reduction achieved 26% higher savings. Today, companies that focus on partnerships that value transparency build a culture of trust with vendors.

Implementing vendor management technology in AP reduces issues with payments and improves collaboration. For example, vendor portals that offer full visibility fosters a close relationship with vendors. Cultivating mutually beneficial relationships with vendors increases innovation and unlocks more cost savings.

5. Unlock Savings Through Early Payment Discounts

When companies gain complete visibility into invoice status with AP automation and speed up invoice processing, they can make timely payments and take advantage of early payment discounts. While many firms plan to pay early to receive discounts, they miss opportunities because they don’t have an efficient system to manage payables.

A PYMNTS study found that 47% of SaaS firms received early payment discounts from vendors and of those companies, two-thirds used an automated system. About 21% reported that they received discounts of more than 10% of their payment obligations in the past year while 26% received discounts of up to 10%.

While the study focuses on SaaS firms, the same principles apply to other industries. AP automation unlocks synergies and aligns procurement and AP teams to increase early payment discount capture rates. This plays an important role in driving growth and improving financial performance.

6. Improve Invoice Processing Costs

By reducing labor costs, errors and discrepancies, and processing time, automation can significantly reduce the average cost to process an invoice. Companies streamline their processes from start to finish by automating key steps such as managing vendor databases and auto-matching invoices with purchase orders and GRNs. An electronic record helps to resolve disputes quickly and accurately while archiving transactions in an organized format for easy retrieval.

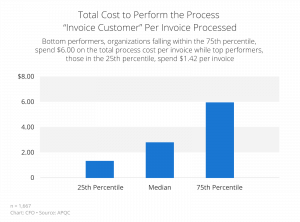

As a result of the increasing use of automated solutions and related technology, the median cost to process an invoice has declined from $3.94 in 2018 to $2.80 in 2022. For top performers, the cost is even lower, at $1.42 per invoice. Bottom performers spend as much as $6 per invoice and could potentially save more than $450,000 for every 100,000 invoices by becoming a top performer.

The numbers don’t lie – businesses can capitalize on cost reduction from AP automation – ultimately resulting in long-lasting returns.