The majority of Accounts Payable teams still rely on a variety of manual practices that are labor-intensive, error-prone, and more susceptible to fraud. With capital getting tighter and companies looking to control costs, businesses need to streamline processes using AP automation software.

Modern Accounts Payable responsibilities extend far beyond simply paying bills. AP departments can create strategic business advantages for cost control and cash flow management while building stronger vendor relationships. Yet, such goals are often unrealized. With 86% of accounting teams still , the infrastructure isn’t in place to enable AP teams to optimize data.

Tired of wasting time on manual Accounts Payable tasks? Explore our Complete Guide to AP Automation.

1. Cash Management and Working Capital

71% of CFOs surveyed by EY say they expect working capital to tighten in 2024 amid rising costs and continued high interest rates. Improving control over cash flow requires an agile approach, but manual AP processes create significant roadblocks.

For example, manual methods extend processing times, increasing days payable outstanding (DPO) and cash conversion cycle times. Inefficient manual processes act as a drag on cash flow, forcing companies to hold more cash and potentially miss out on early payment discounts.

2. Lengthy Invoice to Payment Approval

Source: PYMNTS

98% of companies say they could improve their speed using automation and reduce lengthy invoice-to-payment approval times. Many AP departments spend as much as half of their time simply collecting invoices and paying suppliers rather than working on strategic initiatives that can add to the company’s bottom line.

Late payments can also harm vendor relationships and credit ratings.

As more companies transition towards real-time payments, this can become a significant hurdle. Deloitte predicts real-time payments will account for $18.9 trillion in transactions by 2028 and could double that number in some circumstances.

3. Time-Intensive Data Entry and Increased Error Rates

Manual data entry is simply inefficient. Re-keying information creates higher error rates, which can add up quickly. A 2% error rate translates into a $200,000 mistake for a company that handles $10 million in AP payments.

One study showed that errors in data entry take up to 17 hours per week at half the companies surveyed.

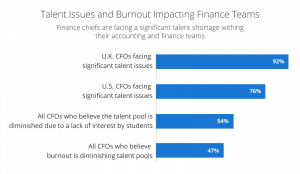

Source: CFO

75% of those responding to an Institute of Finance and Management (IOFM) study said they have seen increased order volume over the past few years. Manual workflows make payables for growing businesses harder to scale. As staff work longer hours to accommodate the workload, repetitive tasks such as data entry only aggravate the problem.

4. Lost or Incomplete Invoices

Longer timelines between invoice receipt and payment increase the risk of information loss. A common issue is a lost invoice or paper document sitting on someone’s desk waiting for approval, which causes problems downstream. Without automated tracking, manual processes provide poor visibility and complicated audit trails.

Accounting teams may have no idea an invoice is missing until a vendor sends a past-due notice, contributing to the 81% of suppliers that say they receive late payments.

5. Duplicate Invoices and Payments

Another challenge for AP teams comes from duplicate invoices, statements, and payments. When invoices are handled manually, it’s more difficult to catch duplicates. Invoices being processed may get entered twice. In some cases, they may get paid twice. That creates more workload to rectify the situation, chase down payments, and recover cash that could have been used elsewhere in the organization.

6. Manual Approval Routing

A paper-based workflow wastes time in routing invoices for department review and approval. It’s also time-consuming (and frustrating) trying to figure out where a particular invoice is in the approval process, especially when multiple levels of approval may be required. Approval bottlenecks delay payments, create more work and can lead to internal friction.

7. Document Storage, Visibility, and Compliance

Data silos are often a common issue with manual AP processes. Keeping paper receipts or storing scanned copies online may seem sufficient, but pulling up information related to a particular invoice may take hours if not days.

Discussions about invoice approval are also likely to happen in multiple places like email, text, messaging apps, and even phone calls. The absence of a single source of truth transforms data gathering for an audit or a review into hours wasted digging through old files. Without highly organized and instantly searchable documentation, it also becomes difficult to respond to queries quickly and comply with proper document retention policies.

8. Invoice Fraud Risk

Manual AP processing makes it harder to detect and mitigate fraud – there are many opportunities to tamper with documents and conceal fraudulent activities. Ineffective manual screening can easily miss fraudulent activity, including altered bank wire or ACH details, posing increased risks.

Source: PYMNTS

According to the 2023 AFP Payments Fraud and Control Survey, 65% of organizations have been victims of payment fraud attempts. Meanwhile, 98% of B2B retailers, manufacturers, and marketplaces report they have been victims or lost business due to fraud.

This is another area where AP automation software can more quickly detect unusual activity and flag items for review.

9. Inability to Scale

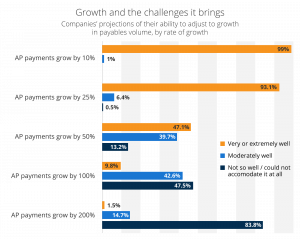

Source: PYMNTS

As your business grows, so does the complexity of a manual AP workflow. Even though 93% of businesses anticipate higher payables volumes in the next three years, just 47% of companies are confident in their ability to handle a 50% increase in AP volume. The stark reality is that most businesses are not prepared to support growth.

Improve Efficiency with Accounts Payable Automation

Manual processing challenges are compounded by looming costs. On average, one invoice processed manually costs $15.97. Automation and straight-through processing can reduce those costs to less than three dollars.

With so many challenges and risks, organizations today can no longer afford to rely on outdated, manual processes to handle their Accounts Payable. The right Accounts Payable and P2P software can automate up to 90% of invoices to generate substantial savings, reduce vendor queries by 70%, and accelerate approval times by 80%.