Nearly 75% of finance, accounts payable, and P2P leaders expect smarter systems to drive next-level performance of their organizations. Unfortunately, some accounts payable departments still rely on tedious and a manual accounts payable reconciliation process.

AP teams scramble to finish everything during the month-end or year-end close, leaving little time to investigate discrepancies.

Putting an end to labor-intensive reconciliations improves efficiency and frees up AP teams for higher value activities.

Why Faster AP Reconciliation Matters

Accounts payable best practices include reconciling AP at least once a month. Reconciliation involves checking independent verifiable information such as accounts payable sub-ledgers, supporting invoices, and contracts to prove that balances are complete and accurate.

Discrepancies identified during the accounts payable reconciliation process, such as inaccurate accruals, discrepancies with vendor records, and other variances help companies discover potential problems due to errors or fraud.

Thorough and regular accounts payable reconciliation reduces the risk of misstatements and errors in your financial statements that could result in wrong business decisions, problems with stakeholders, penalties from regulators, or even worse consequences. However, AP teams relying on manual payables reconciliation often dedicate significant staff time and resources to tasks like gathering data, manipulating accounts, and matching transactions. Invoice approvals also take longer since approvers and reviewers check every invoice that enters the workflow and reconcile accounts afterward.

The average exception rate for vendor invoices is 20.7% – which means that one in every five invoices has problems like coding errors, missing information or PO data, or other reasons resulting in invoice approval bottlenecks. Investigating each invoice on top of the existing workload delays invoice approvals and creates more work for your team.

Businesses handling hundreds of thousands of invoices could spend countless hours reconciling AP accounts manually.

How to Reconcile Accounts Payable

Accounts payable reconciliation varies from one business to another. However, the reconciliation process typically follows these steps:

- Gathering data from multiple sources

- Compare the accounts payable balance in your accounting software to another source like the accounts payable aging report, supplier statements, and invoices.

- Match payment records and bank statements to payables and vendor statements

- Review and resolve discrepancies identified during reconciliation.

- Adjust balances if needed.

- Finalize reconciliation and prepare management reports.

- Monitor variances identified like discrepancies due to cut-off dates, etc.

How Often You Reconcile AP

As a rule of thumb, companies should reconcile AP accounts at least once a month. Many companies perform monthly balance sheet reconciliations as part of the month-end close. However, the time frame depends on the type of organization you have, your industry, and your financial transactions.

For some organizations, performing AP reconciliation twice a month or weekly may be necessary.

Roadblocks to Accounts Payable Reconciliation

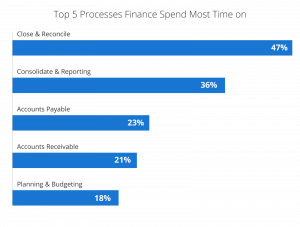

Matching your general ledger to subledger accounts and vendor statements may seem easy but finance teams spend the most time on this step. 47% of finance teams spend the most time on closing and reconciliation and 23% on accounts payable.

Here are some reasons why AP teams struggle with reconciling accounts at the end of each reporting period.

Source: Deloitte

- Manual data gathering

- Pulling data from different source data sources

- Reliance on multiple several Excel spreadsheets

- Lack of centralized monitoring for invoices requiring additional work to know the status of some invoices.

- Reliance on paper-based processes

- Manual AP reconciliations requiring AP teams to match transactions one by one

AP reconciliation is not necessarily a difficult task but it is tedious and time-consuming when done manually. Manual work also delays reporting, increases the risk of inconsistencies and errors in your financial statements, and redirects time away from strategic activities.

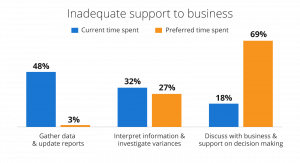

Executives want AP to dedicate 69% of their time to strategic initiatives such as supporting decision-making, but time spent on these activities is only 18%. Meanwhile, your AP team spends 48% of their time gathering information and updating reports.

With the demand for faster, more efficient, and strategic AP units, AP reconciliations need to happen faster — and companies are looking to automation and AI as part of the solution.

Source: Deloitte

How to Reconcile Accounts Payable with an Automated System

Automated reconciliation takes out most of the labor-intensive work during AP reconciliations. With technology, the AP reconciliation process follows a new process flow that includes:

- Intelligent data extraction and gathering from multiple sources

- Automatic matching of balances in the system to an independent source

- Artificial intelligence and machine learning support transaction matching, accruals, and alerts on exceptions that require further investigation.

- Real-time tracking of all reconciliation items and their progress

- Centralized management of accounting records that update all systems

- Automated reporting and analytics

Since technology performs the heavy lifting, AP teams can focus on handling exceptions.

Transform AP Reconciliation with Automation

Accounts payable reconciliation is a critical step in producing a reliable balance sheet, but it doesn’t have to be a tedious process for AP departments. Through automation, companies can continue implementing strict controls over AP without sacrificing speed, cost, or reliability.

Discover how accounts payable automation helps you reduce time spent on manual reconciliations, which can create a strategic advantage and improve your financial position.