The standard procurement process in many businesses today involves the use of a purchase order. Understandably, every dollar spent in an organization must be accounted for, and the purchase order process is preferred and even required by accounts receivable professionals in most businesses.

However, there are costs and inefficiencies associated with this process that may impact operations in critical ways. With a closer look at these challenges and with greater understanding about pre-approved spend, you may be inspired to make thoughtful improvements to your organization’s procurement processes.

The Pros and Cons of the Purchase Order Spend Process

Direct spend is a term that describes costs associated with the direct manufacturing processes, such as the cost of raw materials and related supplies. All costs that are not directly linked to this are described as indirect costs. A good example of indirect spend is office supplies. Maverick spend refers to purchases that are not in compliance with the purchase order process or that goes through unauthorized vendors or other sources to complete the transaction. Maverick spend is most commonly associated with indirect spend. We discussed how to improve indirect spend in a recent blog. While purchase orders provide accounts receivable professionals with an easier and more organized way to manage expenses and to generally do their job well, purchase orders are a source of frustration for many others across various departments.

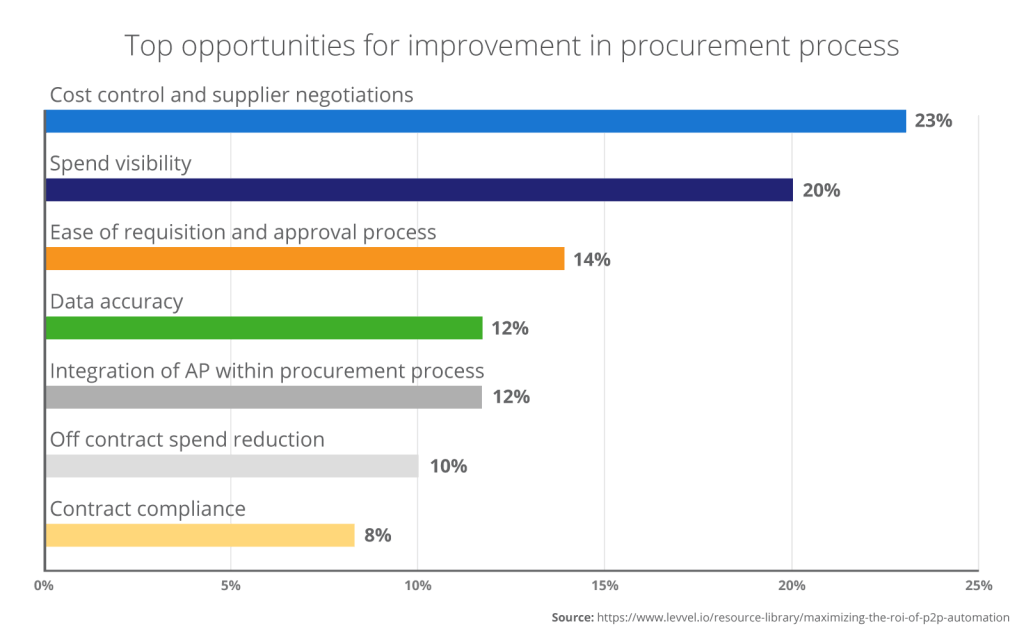

Consider that the administrative office may have an urgent need for office supplies. Taking the time to fill out a purchase order, wait for approval, and find the perfect supplies through an authorized vendor may be inconvenient and could even hinder operations. This is only one of many challenges that are directly linked to the purchase order procurement process. According to Levvel Research, “ease of requisition and approval process” ranks as one of the top challenges, along with the likes of “cost control, spend visibility and contract compliance.”

You can see that advocates and opponents of purchase order procurement have legitimate concerns and needs. The solution to bridging the gap in this area may lie in pre-approved spend.

Understanding Pre-Approved Spend in e-Procurement

Pre-approved spend is a process that empowers specific individuals, departments, or teams to take greater control of their spending while still complying with established procurement procedures. These individuals or groups are given a budget plan to work within, and they are provided specific vendors or suppliers who they can buy goods or services from. When they utilize this pre-established structure, the process may be automated, and it can deliver exceptional benefits as a result.

The Many Benefits of Pre-Approved Spend

With pre-approved spend, a certain dollar amount of purchases in various spend categories has already been approved. The employee simply needs to file the order under a specific GL code for tracking purposes. Since the purchase has already been approved, this process is faster and easy for all parties. There are numerous other benefits that open up to a business with the implementation of pre-approved spend.

Cost Savings

The entire process of preparing, reviewing, and authorizing a purchase order is eliminated with pre-approved spend. Accounts receivable and the individual or department who otherwise would have prepared the purchase order are saved valuable time, and this directly leads to improved productivity and financial savings.

Budgeting and Tracking

Through the automation of e-procurement, purchases can be tracked much easier and in real-time. Automation provides a faster and clearer analysis, which directly enables department heads and accounting professionals to determine how much of their budget remains at any given time. It also delivers the opportunity to review and to potentially adjust a budget based on actual to-date spend.

Compliance

The structure of pre-approved spend provides advance authorization for purchases from specific vendors. These may be from vendors or suppliers who the company has special discounts or a contract with. Through the use of authorized vendors and suppliers, those who are placing orders will be able to save time and energy by searching for what they need only through specific catalogs or product inventories. This compliance directly leads to potential savings on the cost of goods and indirect savings through improved efficiency.

Fraud Prevention

Invoice-related fraud may be committed internally by the company’s employees or by the suppliers and vendors. There are many types of fraud, such as those that occur with payment processing, contract management, vendor selection, and other areas. The automated enables clear and real-time reporting capabilities that may be used to discover red flags. It eliminates the need to match purchase orders to invoices so that billing-related fraud is not a concern. It also enables the segregation of duties to minimize the occurrence of internal fraud.

Improved Payment Processing

The standard purchase order procurement process requires accounts receivable professionals to reconcile approved purchase orders against invoices. In many businesses, unexpected invoices crop up that may impact budgeting and financial management. Pre-approved spend changes the game by eliminating these unexpected invoices entirely. In addition to improving financial management, it enables enhanced analysis of month-end statements.

Many of the inefficiencies, frustrations, and challenges that are associated with the traditional purchase order procurement process may be alleviated through e-procurement and a pre-approved spending process. It can be difficult to accurately gauge how much time and money are lost through the established process, but you can easily track the improvements after upgrading your system. Now is the time to look more deeply into pre-approved spending procurement processes and to make an upgrade in your organization.