Traditionally, accounts payable (AP) hasn’t been recognized as an area where organizations could gain a competitive advantage. Today, however, this is not the case. Improving existing processes within AP is now being recognized as an area where organizations can free up some cash flow. Improving interactions with suppliers can improve credit terms, early payments lead to discounts, and improved reporting and analytics lead to better decision-making.

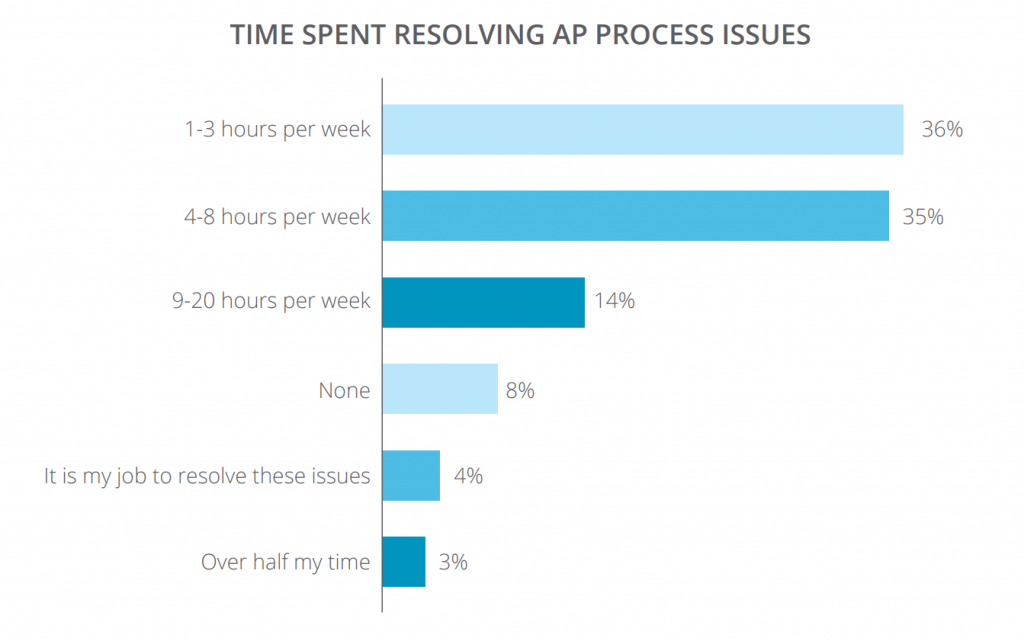

So much time is spent by accounts payable staff resolving errors that occur due to manual and dated processes. The graph below by PayStream Advisors shows how long AP staff are spending each week resolving issues within manual procure-to-pay processes.

An area of accounts payable that can prove to be troublesome is the invoice approval process. A report by Levvel found that 25% of accounts payables professionals listed ‘manual routing of invoices for approval’ as their number one challenge within the AP process.

Challenges within the invoice approval process

Ideally, invoices should be processed in a timely and efficient fashion. Unfortunately, in most organizations, this is not the case. There are a number of bottlenecks within traditional invoice approval processes that need to be addressed to achieve true AP transformation. The main challenges within traditional invoice approval processes are:

- Paper-based processes are still commonplace which means it takes time to manually process and approve each invoice. Slow processing times often result in AP departments falling behind or even missing deadlines. Employees are spending unnecessary time processing invoices and they could be penalized with late payment fees.

- As traditional processes are dealing with a physical invoice, it is not uncommon for an invoice to get lost along the approval process and never actually make it to the correct person(s) for approval or verification.

- Traditional invoice approval processes have very few controls in place to protect against duplicate payments and fraudulent behavior. It is more common than you think for a company to pay for the same invoice twice either by accident or due to fraud.

- Finance leaders often have very little visibility into the AP process. Many have no idea where a particular invoice is at any given time which often leads to organizations reacting to problems rather than being proactive.

What can you do about it?

Even the best in class AP teams, at one stage, had a manual, paper-based invoice approval process. Take Grafton Group plc for example. The organization is an international distributor of building materials with over 12,000 employees and a turnover in excess of £2.2 billion. The company’s AP team was able to reduce the time it takes to process an invoice from 40 days to only 10 days by altering their existing process and technology stack.

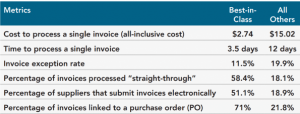

In fact, there are a number of best in class organizations who have reaped the benefits of innovating within their invoice approval process. A recent report compared important KPIs from the invoice approval processes of best in class organizations against all other organizations. The chart below shows the main findings. It is clear to see that the organizations who innovate within their existing process are experiencing exponential benefits. Invoice processing costs and the time to process an invoice reduced dramatically. A lot more invoices were being processed ‘straight through’ the AP process without any manual intervention. This reduces the risk of human error as well as allowing employees to allocate their time elsewhere.

There are a variety of different steps that AP teams can take to achieve these results. This post will outline four of these that will provide the best results.

1. Automate invoice approval routing

Invoices typically need to be approved by a minimum of 2 people. It can often be difficult to manually manage complex approval levels across multiple entities and handle exceptions efficiently. The pre-determined route that an invoice needs to take to become fully verified and approved can be configured into finance systems. This means that your AP team ensures compliance with internal procurement guidelines.

2. Email approval

Once a route for approval has been configured in your finance system, it takes seconds for verifiers and approvers to move the invoice along to the next stage. The verifier/approver can either log into the system to verify the invoice or they can do it on the go via email verification. Verifiers and approvers can verify invoices via email through a mobile device in only one-click meaning that requisitions can be verified and approved with no friction.

3. Automate matching of invoices, purchase orders, and receipts

Matching is a highly time-consuming and labor-intensive task which frequently results in human error or duplicate payments to vendors. Automating the matching of invoices, purchase orders (POs) and receipts will accelerate the invoice process time which frees up the time of employees. AP staff no longer need to match physical pieces of paper, finance systems can automatically match the required documents. Automated matching will also flag any exceptions and duplicate invoices offering extra control.

4. Tracking and measurement

AP teams are dealing with large sums of money on a regular basis so it is important that there is a ‘paper trail’ for all actions along the invoice approval process. With this added visibility, management can view the progress of any particular invoice. This functionality proves valuable when organizations are audited. Aside from tracking actions for compliance purposes, the data collected can also be used to fuel better decision making within the AP function enabling further innovation.

Conclusion

The benefits of innovating invoice approval processes are clear for all to see. AP staff will spend less time carrying out manual processes which means they can re-allocate their time, the cost associated with the process will be reduced, the time spent resolving AP process issues will be cut, and human errors will dramatically decrease. AP teams that implement these changes will begin to enjoy a frictionless process that many of their competitors are already experiencing.