In the quest to grow their core businesses, companies are laser-focused on driving innovation, possibly at the expense of internal infrastructure. Critical functions like Accounts Payable could get left behind even as organizations try to take a digital-first approach. Building in-house AP automation requires significant resources and expertise that most companies simply don’t have the luxury to maintain. In addition, in-house developed AP processing workflows cannot match the superior technology and benefits of a specific AP Automation Solution, developed and implemented by experts.

Implementing an AP automation solution provides businesses with powerful and accessible technology. AP automation technology improves efficiency, accelerates payments, and drives down invoice processing costs. In this article, we’ll take a look under the hood at the key technologies featured in AP automation.

1. Artificial Intelligence, Machine Learning, and AutoML

A traditional Accounts Payable process is littered with manual inputs – paper invoices, ad-hoc spreadsheet reconciliation, and approval workflows that have audit teams running for the exits. Although some automation can be done with simpler technology that relies on pre-configured rules, the gold standard is leveraging artificial intelligence to tackle the heavy lifting.

Artificial intelligence tries to mimic human intelligence and solve complex problems. Through its ability to crunch vast amounts of data, AI analyzes patterns and makes predictions. Machine Learning, a subset of AI, learns and optimizes independently without explicit programming.

Within Accounts Payable, AI can identify potential fraud more easily and faster than human review can. After processing information from diverse sources, AI highlights irregularities based on historical patterns and alerts AP teams for review. Instead of replacing human detection of fraud, AI augments it. Over time, Machine Learning analyzes how the AP team responded to further improve recognition in the future.

In a similar manner, AI & Machine Learning supports data and exception handling, smart invoice matching, smart coding and routing. With the help of AI, companies can implement straight through processing of invoices.

Machine Learning (ML) is a game-changer in automating both PO and Non-PO invoicing, with full transparency and auditability. Manual invoice processing cost $16 per invoice, whereas high automation driven by AutoML reduces processing costs by over 90%. Utilizing millions of real data from Industry, Operations, Organizations, and Suppliers, the AutoML Machine Learning engine ‘learns’ and improves based on 250+ match ‘patterns’ and applies this automation to Smart Matching models, including tolerance, aggregation, and confidence match criteria. In addition, the coding and routing of invoices are also optimized by AutoML based on continuous learned patterns.

Exceptions are flagged for review, and the results provide more insight to the system. As Accounts Payable teams increase interactions with the software by correcting errors, modifying accounting or project codes or changing routing workflows, the software becomes better at providing accurate information.

Superior automation solutions leverage the power of AutoML to learn from feedback instantaneously and support 90% touchless processing. The system provides a confidence level on invoice matching, and AP teams can fine tune the confidence threshold they are comfortable sending through without human intervention.

AI is a full-fledged partner for the AP team and not a replacement. Anti-Fraud technology applies industry-best practices (DMARC/DKIM/SPF) to flag potential fraud such as phishing and tailors the system to the unique needs of each Accounts Payable team with enhanced security, such as Two-Factor Authentication (2FA) and Single Sign-On (SSO).

2. Electronic Invoicing

Invoices can take over three weeks to approve and pay without automation. A lot can happen during such delays, and many of them are acute issues: late fees for missing payment deadlines, lost or misplaced invoices, duplicate payments, and more.

By creating, exchanging, and processing invoices electronically, preferably in a consistent format, organizations reduce handling time and errors. For vendors, e-invoices can be generated through portals that also provide real-time status updates. In addition, AP teams maintain complete digital audit trails that enhance recordkeeping.

Many organizations send invoices that are electronic data exchange (EDI)-compliant, which is a standardized format for business document exchange.

3. Smart Data Capture Technology

Smart Data Capture is often one of the first technologies employed on the road to automation.

Smart Data Capture extracts information from an image or a file and converts it into a digital format that can populate a database or automated AP software. It can handle multiple languages and types of inputs, like paper, email, or electronic. Invoice scanning and extraction eliminates manual data entry and reduces potential errors.

4. Powerful APIs

An Application Programming Interface (API) bridges communication between software systems. AP automation solutions use API integrations to exchange real-time information with other business apps like your ERP system, accounting system, or payment gateway. The SmartConnect platform seamlessly integrates with existing ERP systems by securely exchanging data files in any format, such as XML, Text or JSON exchange, over a sFTP or VPN connection. SoftCo SmartConnect provides seamless certified integrations with multiple ERPs, including Microsoft, SAP, Sage and Infor.

Integrated systems maintain up-to-date information, and businesses can automate more complex workflows. As businesses evolve and scale, APIs can also easily integrate with new tools.

5. Integrations and Application Programming Interfaces

Application Programming Interfaces (APIs) act as a bridge of programming code that enables different systems to talk to each other and share data seamlessly. This allows you to integrate your AP automation software with other platforms such as ERP systems. Payment APIs also allows AP platforms to process payments quickly and securely.

Leveraging APIs reduces manual data entry and errors, and you get real-time information exchange to ensure data is up to date. About half of those responding to a McKinsey survey said APIs reduced their costs by more than 10%.

6. Cloud Computing

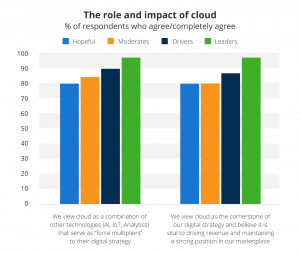

Source: Deloitte

Cloud-based platforms have significantly improved mobility, allowing AP teams to work remotely from anywhere and maintain real-time visibility. Cloud tools also allow for greater collaboration across team members and departments, facilitating easy routing and electronic approvals. Many of these solutions are hosted on AWS or Azure platforms with powerful security and updated compliance.

Cloud services scale easily so that you can expand capacity as your business grows without having to deploy additional infrastructure. They can also provide access to vendor portals to share information and facilitate smoother transactions.

7. Data Analytics

Data analytics operates behind the scenes on an automated AP platform, extracting insights that fuel strategic decision-making. Given precise data, businesses can better optimize invoice processing times, costs, vendor relationships, and early payment discounts. Pinpointing bottlenecks to resolve in the AP process becomes effortless, empowering teams to proactively increase operational efficiency.

Real-time data and insights from AP solutions also support financial analysis, offering deep visibility into spending patterns and cash flow. Armed with data-driven insights, organizations can employ efficient working capital strategies that improve financing costs or reduce the need for cash on hand.

Embrace AP Automation for the Future

Cutting-edge technologies like AI, cloud computing, and advanced data analytics provide the foundation for businesses to unlock a new level of efficiency, accuracy, and insight from AP automation. Businesses that embrace successful AP automation can significantly increase straight-thru invoice processing, reduce vendor queries, and drive strategic decision-making.

Boost operational and strategic efficiency with our step-by-step, practical AP Automation Guide today.