Do you find the processing of your invoices tedious and time-consuming? Establishing a robust accounts payable (AP) department is essential for your company’s overall fiscal well-being. The accounts payable function of your company shall be responsible for making sure that payments to vendors and suppliers are made on time. This helps foster good relationships with vendors and suppliers and ensures smooth business performance.

Accounts payable automation is a software solution that automates this process for businesses, which means they don’t have to spend hours each month on paperwork. It also allows companies to get paid faster by automating late invoice reminders and speeding up collection efforts.

According to the Institute of Finance and Management, one-third of practitioners working in accounts payable departments around the globe are working longer hours since the pandemic struck. 25% of individuals in decision-making positions claim that they find it difficult to reduce risk, adhere to compliance obligations or tackle fraud in their company’s accounts payable function.

These numbers simply illustrate the rising difficulty and friction created by manual processes in the accounts payable department. Despite the various challenges that manual AP processes create for businesses, many companies simply choose not to automate their accounts payable processes. According to the poll conducted by IOFM, only 9% of the respondents stated that their departments were fully automated.

What Prevents Organizations from Fully Automating Their Accounts Payable Function?

There are several perceptions that prevent companies from moving away from their manual AP processes.

Here are four of them.

1. The Misconception that AP Automation Costs More

Accounts payable (AP) automation can seem like a costly endeavour. While the ROI is considerably higher in the long term, many businesses simply stick with manual AP processes because they are under the misconception that AP automation has a significantly higher upfront cost.

The implementation of new technology and deployment of a new platform can seem daunting at first. However, most businesses often fail to take into account the cost savings over an extended period that come with AP automation.

2. Change Management Complications

Implementing a new system doesn’t just cost money; it also requires the C-level staff to come up with a comprehensive change management strategy to guide employees through the change. Most businesses believe that considerable preparation is required for such a comprehensive organizational change. Resistance to change is a deep-rooted problem in many organizations.

3. Resistance from IT

The IT department in an organization may put up some resistance for the implementation of an accounts payable (AP) automation platform. The increase in workload and perceived added burden on limited IT resources might be one of the reasons why the IT department could object to the integration of a new platform.

4. Ongoing ERP Project

There’s little doubt in the fact that your company’s ERP system is critical to effective management and financial accounting. Most ERP systems are able to record orders and invoices, but they are not capable of managing the supplier payments. This last step is taken by the individuals working in the AP department.

Several companies are hesitant to automate their accounts because they are unsure of how it’ll integrate with their ongoing ERP project. Businesses fail to understand that the goal of AP automation is to enhance the function of your ongoing ERP project. Businesses with an ongoing ERP system are often reluctant to integrate an external automation platform.

However, things are changing. Cloud-based AP automation tools like SoftCo ExpressAP don’t integrate with ERPs, so you don’t have to worry about any kind of disruption with your ongoing ERP project. Instead, it outputs a file that you can load into your ERP to ensure that all information is recorded.

The Long-Term Risks of Persisting with Manual AP Processes

The accounts payable risks increase exponentially for companies that choose to stick with manual AP processes.

Here are a few.

1. Increased Risk of Human Error

Handling supplier invoices, recording information, clearing payments, dealing with disputes and discrepancies, and managing contract obligations all increase the risk of human error. Since data has to be entered manually into the ERP system, the risk of human error is automatically high.

2. Increased Costs

Manual AP processes cost a great deal more than accounts payable (AP) automation. For starters, a sizable amount is spent on salaries for full-time employees responsible for handling invoices. Then, there are the costs associated with invoice distribution and getting approvals. Employees have to manually sort, check, record, and encode each invoice, and then distribute them to different departments for approvals. This increases processing times, and ultimately, the costs of operation.

Most businesses also fail to account for the opportunity costs. Your employees could add significant value to the business if they are not bogged down with menial, repetitive tasks on a regular basis. Auditory penalties also increase costs due to mismanagement.

3. Missed or Late Payments

Manual processing is a painstaking task that often becomes cumbersome for AP departments. Naturally, the increased invoice processing times could result in missed or late payments to vendors, which could expose the business to contractual penalties or adversely affect their relationships with longstanding vendors. This also affects business goodwill. The importance of paying vendors on time cannot be understated in today’s dynamic environment.

4. Fraud

Most businesses rely on three-way matching to reconcile invoices with purchase orders and goods received. While this is a viable approach, there are constraints. Manual three-way matching doesn’t account for duplicate purchase orders or incorrect inputs. In case an employee bypasses SOPs, three-way matching becomes redundant. This increases the potential for invoice fraud.

Businesses receive invoices in several different formats, and payments are made through various channels. This significantly increases the potential for fraud.

5. Lack of Compliance

Manual AP processes require a high degree of oversight. When volumes rise, it could result in errors with invoice matching and also increase compliance risks. Poor internal controls and governance, especially with approval procedures, could result in compliance issues, especially since most businesses started working remotely.

Depending upon your organization’s requirements, it may not be necessary to deploy a fully automated AP system right away. Why not dip your toes into AP automation, without taking the full step, and see how it helps improve business processes? If your business needs a robust solution for capturing invoices and managing approvals from multiple departments, the SoftCo ExpressAP automation solution might be just what you need.

What is SoftCo ExpressAP?

SoftCo ExpressAP is a fully cloud-based solution that offers accounts payable automation and contract compliance. It reduces processing times for vendor invoices by up to 80%. ExpressAP mitigates accounts payable risks by automating invoice capture, registration, and approval.

It’s incredibly secure and based in the cloud. You can set it up within a few hours and integrate it with your company’s existing systems. It’s an excellent solution for SMBs and corporations who want to automate their manual AP processes and ensure contract compliance.

Here are some of the main benefits of using SoftCo ExpressAP.

Goes Live in Hours

If you just want to “step into AP” and experience its benefits, SoftCo ExpressAP is an excellent choice. Since it’s based in the cloud, you can request a demo with their team to explore its features. It’s hosted on Amazon Web Services, one of the best IaaS providers in the world.

Within a few hours, you can take it live and experience its benefits first-hand.

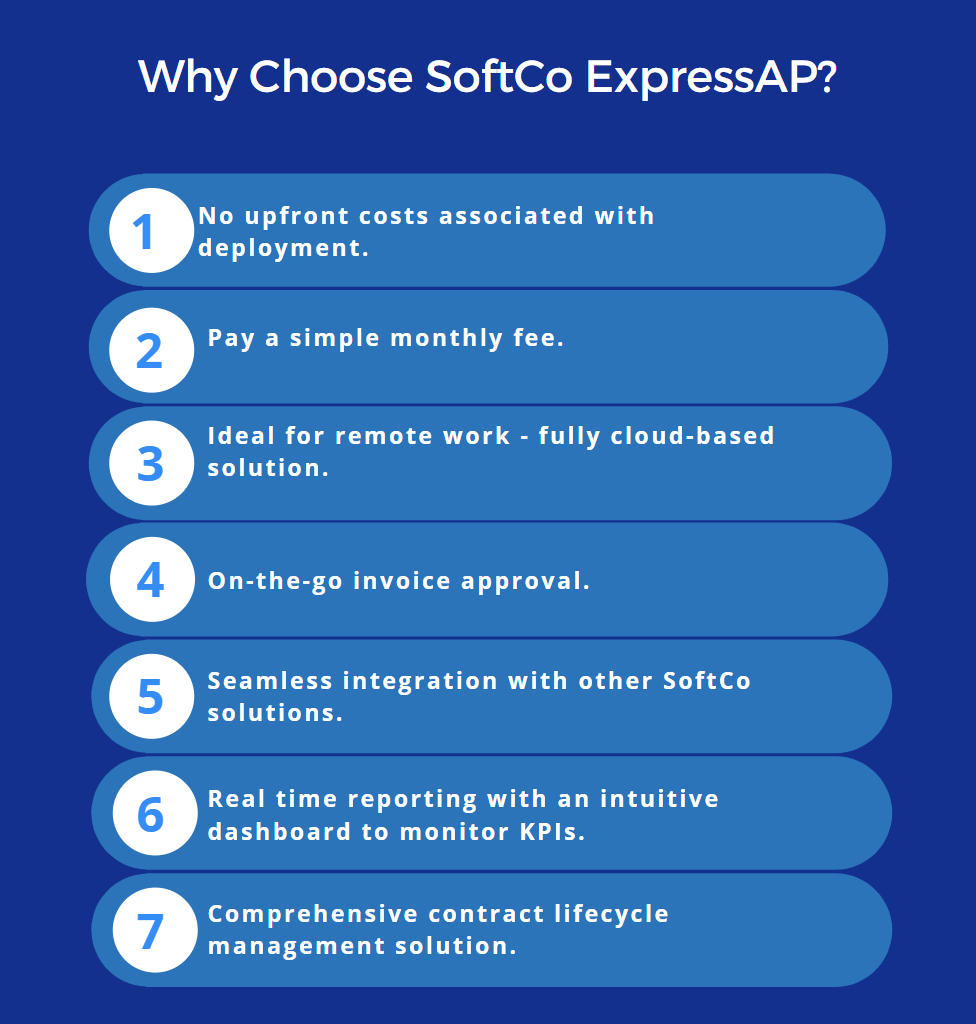

No Upfront Costs

As stated above, a major reason why businesses are reluctant to switch to AP automation is the high upfront investment. SoftCo ExpressAP has no upfront costs for deployment.

Simple Monthly Fee

You just have to pay a simple monthly subscription in order to use the AP automation platform. The investment is worth it when you consider the savings in the long term!

Supports Remote Working

Since invoice processing is 100% automated, it doesn’t matter if your team is spread around the country or all over the globe. Approvals can be requested and recorded via email. As the world moves rapidly towards digitization and remote work becomes the norm, companies can greatly benefit from a solution like ExpressAP.

On-The-Go Email Approval

SoftCo ExpressAP also reduces invoice processing times by requesting on-the-go email approvals based on the defined rules or hierarchy. The web app automatically seeks approvals and signoffs on received invoices, thus mitigating the chances of missed invoices.

Integration with Other SoftCo Solutions

ExpressAP is built on the same SoftCo platform as other SoftCo solutions like eProcurement, Vendor Management, and Procure-to-Pay. As your business grows, you can seamlessly integrate these Enterprise solutions into your company without a hitch.

As we have alluded to, organizations sometimes persist with manual AP processes, due to the perception that implementing AP automation requires extensive effort across the business and affects other ongoing projects. However, with SoftCo ExpressAP, there is no need to worry about lengthy implementation or deployment times. It also outputs a file that you can upload to your ERP, so you don’t need to worry about full integration. Ultimately, this helps save a great deal of time and effort for your IT team!

Embrace the Future – Step into AP Today!

As the world slowly begins to recover from the global pandemic, this is the ideal time for change. Don’t let certain fears or risks prevent you from adapting to a new model that streamlines cost inefficiencies and results in better performance in the long run.

You don’t have to fully overhaul your accounts payable function right away. There are simpler solutions that allow you to “step into AP” first and experience the benefits before you take the leap to full automation. Request a demo for SoftCo ExpressAP today and see how accounts payable automation helps your business!