Germany’s shift to mandatory structured e-invoicing for domestic B2B transactions is no longer a future milestone: it’s already underway.

Since 1 January 2025, businesses operating in Germany have been required to receive structured electronic invoices under the updated VAT rules. Now, in 2026, the focus has moved from understanding the regulation to strengthening operational readiness. Transition periods may still apply for issuing, but the direction of travel is clear: structured, machine-readable invoicing is becoming the standard.

For finance leaders, the question is no longer “when does this start?” but “are our processes robust enough now?” The real challenge lies not just in compliance, but in ensuring systems, supplier data, and workflows are aligned, without overcomplicating the solution.

This guide breaks down Germany’s e-invoicing mandate (the scope, timelines, formats, exemptions, and practical implications) so finance and AP teams can sharpen their focus and move forward with confidence in 2026 and beyond.

Why Germany’s e-invoicing mandate matters now

Germany’s e-invoicing reform is a live requirement under German VAT law, introduced through the Wachstumschancengesetz (Growth Opportunities Act) and supported by detailed guidance from the German Federal Ministry of Finance (BMF).

Since 1 January 2025, businesses have been required to receive structured electronic invoices that meet Germany’s updated legal definition. That milestone has passed. The conversation in 2026 is no longer about awareness: it is about execution.

While transition periods still apply to the issuing of structured e-invoices, the shift to machine-readable formats is already reshaping how invoices are exchanged and processed. Organisations that treated 2025 as a “wait and see” year are now reassessing their systems, supplier readiness, and internal workflows.

This development also reflects a broader European trajectory. Structured e-invoicing is becoming embedded in national VAT frameworks across the EU. As we’ve explored previously, e-invoicing isn’t optional anymore, and Germany is now firmly part of that operational reality.

For authoritative reference, the primary source remains the BMF’s official e-invoicing FAQ, which underpins the requirements outlined below.

Scope and legal basis of the Germany e-invoicing mandate

Which transactions are affected

Germany’s e-invoicing mandate applies to domestic business-to-business (B2B) transactions that fall under German VAT law (UStG).

The obligation is tied specifically to cases where there is a VAT obligation to issue an invoice. As a result:

- B2B domestic transactions are in scope

- B2C transactions are generally out of scope

- Many VAT-exempt supplies are excluded where issuing a VAT invoice is voluntary

This scope and its limitations are clearly outlined in the BMF FAQ on the applicability of the e-invoice mandate.

For companies operating across multiple jurisdictions, this approach mirrors (but doesn’t exactly replicate) other European mandates. A useful comparison point is the France e-invoicing mandate readiness guide, which highlights how national implementations can differ even under shared EU objectives.

What qualifies as an e-invoice in Germany

Germany’s definition of an e-invoice since 1 January 2025

Since 1 January 2025, Germany has applied a stricter legal definition of an electronic invoice (E-Rechnung).

Under the updated rules:

- An e-invoice must be structured and machine-readable

- It must support automatic electronic processing

- Paper invoices and simple PDF invoices no longer qualify as e-invoices under German VAT law

This definition is confirmed in the official BMF definition of an E-Rechnung and aligns with the European standard EN 16931.

For additional EU-level validation and context, the EU e-invoicing country sheet for Germany provides a concise overview of how Germany’s requirements fit within the broader European framework.

The practical takeaway is simple: emailing a PDF is no longer sufficient. Structured data is now the foundation.

Accepted e-invoice formats and standards in Germany

EN 16931, XRechnung, and ZUGFeRD

Germany requires e-invoices to be issued in structured formats aligned with EN 16931, the European e-invoicing standard.

Commonly accepted formats include:

- XRechnung (XML-based, Germany’s core EN 16931 implementation)

- ZUGFeRD (PDF/A-3 with embedded XML, using an EN 16931-compliant profile)

Germany also applies Core Invoice Usage Specifications (CIUS), which influence how EN 16931 is implemented nationally. These specifications affect validation rules, mandatory fields, and interoperability.

Details on format alignment and CIUS usage are outlined in the EU documentation on the use of EN 16931 and CIUS in Germany.

For finance teams, this reinforces a broader point explored in staying ahead of changing e-invoicing standards: format compliance is not static, and flexibility matters.

Germany e-invoicing timeline and transition rules

Germany’s mandate includes clearly defined transition periods, designed to give businesses time to adapt while still setting firm expectations.

Key dates finance teams need to know

From 1 January 2025

- All domestic German businesses must be capable of receiving structured e-invoices

- The new legal definition of an e-invoice takes effect

From 2025 to 31 December 2026

- Businesses may continue issuing non-structured invoices (such as PDFs or paper)

- This is only permitted with the recipient’s consent

Extended transition until 31 December 2027

- Applies to businesses with annual turnover of €800,000 or less

- Also applies to certain EDI arrangements that are not yet fully EN 16931-compliant

These transition rules are detailed in the BMF’s official guidance on e-invoicing transition arrangements and supported by practical summaries such as the IHK overview of BMF e-invoicing guidance.

While issuing obligations may be phased, the direction of travel is clear: structured e-invoicing becomes the default.

Exemptions and special cases under the German mandate

When structured e-invoicing does not apply

The BMF guidance also outlines explicit exemptions where structured e-invoicing is not mandatory. These include:

- Small-amount invoices below €250 (gross)

- Passenger transport tickets (Fahrausweise) that qualify as invoices

- Certain VAT-exempt supplies

- Kleinunternehmer under §19 UStG

- Certain invoices issued to non-entrepreneur legal persons

These exemptions are set out in the BMF FAQ on exemptions from the mandatory e-invoice.

However, a critical nuance remains: most exemptions relate to issuing, not receiving. Even where a business may delay issuing structured e-invoices, its ability to receive and process them remains essential.

What Germany’s e-invoicing mandate means in practice

Impact on finance, AP, and shared services teams

Germany’s mandate is not simply a technical file-format change. It has direct implications for:

- Invoice intake and validation processes

- Supplier onboarding and communication

- Master data quality

- Exception handling and audit readiness

- Electronic archiving and retention requirements

Structured e-invoices enable automation, but only when upstream data and processes are aligned. As KPMG Germany’s analysis of e-invoicing and digital reporting highlights, many challenges emerge not from the regulation itself, but from operational readiness.

This is why CFOs and finance leaders are increasingly treating e-invoicing as a strategic capability, not a compliance afterthought — a theme explored further in our 2026 e-invoicing CFO guide.

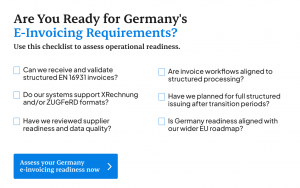

How to prepare for Germany’s e-invoicing requirements

Practical first steps

A measured, phased approach works best:

- Assess your ability to receive structured e-invoices today

- Identify which formats your systems can support

- Review supplier readiness and data quality

- Map Germany into your wider EU e-invoicing roadmap

For teams looking to build foundational understanding, SoftCo’s guide to e-invoicing provides a practical starting point without unnecessary technical depth.

Germany readiness is the starting point

Germany’s e-invoicing mandate is an important milestone, but it’s not an isolated one. Similar requirements are emerging across Europe, each with its own timelines and nuances.

The organisations that succeed are those that treat readiness as a capability, not a one-off project. Early preparation reduces disruption, protects AP operations, and creates a scalable foundation for future mandates.

If you’re assessing your next steps, now is the right time to evaluate your Germany e-invoicing readiness – and ensure your invoice processes are built to adapt as regulations continue to evolve.

Frequently Asked Questions

The Germany e-invoicing mandate requires structured electronic invoices for domestic B2B transactions where there is a VAT obligation to issue an invoice. E-invoices must be machine-readable and compliant with EN 16931.

E-invoices must be structured and machine-readable. Accepted formats align with EN 16931, including XRechnung and ZUGFeRD (EN 16931 profile). Simple PDF invoices are not compliant.

The mandate applies to domestic B2B transactions subject to German VAT law. B2C transactions and certain VAT-exempt supplies are generally excluded. Most businesses must be able to receive structured e-invoices.

Yes. Transitional rules allow some businesses to continue issuing non-structured invoices for a limited period. However, structured e-invoicing is becoming the standard for domestic B2B transactions.

Finance teams should ensure their systems can receive and validate structured invoices, support EN 16931-compliant formats, and prepare supplier data and processes for structured invoice exchange.