Economic headwinds, regulatory requirements, and the fight to stay competitive make good payment practices more compelling than ever.

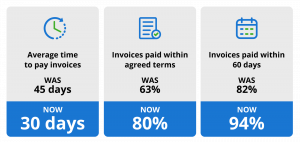

Investments in procure to pay solutions have increased because prompt payments improves relations, enhances your ability to negotiate better terms and saves you money by avoiding late payment charges. The UK construction industry, for instance, reduced the average time to pay invoices in the construction industry from 45 days in 2018 to 30 days in 2023. Invoices paid within 60 days also increased from 82% to 94%.

Key regulations prompting changes in the existing payment practice include the Reporting on Payment Practices and Performance Regulations introduced in 2017. The regulation requires companies and limited liability partnerships (LLP) meeting at least two out of the three criteria below to report payment policies, practices and performance publicly:

- Annual sales of GBP£36m or more

- Balance sheet footings of at least GBP£18m and

- At least 250 employees

Moreover, reports must be produced every six months for each entity in a group and not consolidated at group level and must be signed off by a director of the reporting entity. If reports are late or incorrect, directors could receive a fine.

The regulations say that reports are to cover “qualifying contracts.” These are defined as those that:

- are between two (or more) businesses – not limited to companies and could include sole traders, LLPs, companies, multinational businesses and public sector bodies

- are sufficiently linked to the United Kingdom

- are for goods, services or intangible property, including intellectual property

- they do not relate to the supply of financial services

The first payment reporting period was for financial years beginning 6th April 2017 or later. In 2021, the regulation introduced an additional clause for organizations to pay small businesses with 50 employees or less within 30 days. Existing regulation at the time required large companies to pay 95% of their invoices within 60 days, however, despite almost 3,000 companies in the UK signing the Prompt Payment Code, poor supplier payments practices continued.

In 2023, a proposal to amend the regulation proposed additional metrics for increased transparency, visibility, and accountability for the payment practices of large UK businesses.

Regulatory requirements should act as a wake-up call to many organizations and further enhance the need to prioritize payment practices and performance.

Why were these payment regulations introduced?

Late payment legislation is not new. The EU’s late payment directive was introduced in 2011, for example. Before that, there had been considerable debate over many years about payment practices, especially as they affected small and medium-sized enterprises (SME) that were disadvantaged by their lack of commercial leverage when trading with larger businesses.

The BEIS Payment Practices and Performance Reporting Requirements can be viewed as a further tightening of the EU’s late payment legislation in the UK. But if poor payment practices were a concern of the British, and indeed many other Governments, it has become a critical factor in the survival of the many larger businesses. Six in 10 companies anticipate an increase in late payments due to inflation, while 58% struggle to make on-time payments to vendors due to rising prices.

Soaring energy costs and the conflict in Ukraine pushed inflation to unimaginable levels. As a result, 51% of organizations indicate that inflation restricts their growth potential and prevents them from pursuing new opportunities. Nonetheless, payment performance reporting and monitoring has become a matter of major commercial concern, and so rigorous reports of payment practices is now required.

Commercially, as well as ethically, timely payment makes sense. Early payment discounts can reduce costs. Improved vendor-customer relations make for a smoother, less interrupted, more efficient trading environment. A healthy, solvent vendor is likely to be able to provide consistent supplies of goods and services. This can serve to reduce reputational risk among trading partners while, in the wider picture, predictable, efficient cash flows benefit all parties and, ultimately the wider economy.

Payment reporting requirements

Given the rigorous performance reporting requirements, well-organized and disciplined internal data procedures are a must. The reports are published using the business’ Companies House online account. The BEIS has set out three sets of criteria that define the scope for each half-yearly report: narrative descriptions, statistics and specific statements, and these are to comprise of the following elements:

Narrative descriptions

The standard payment terms of the business including length of time to pay invoices; the maximum contractual payment period and variances to the standard payment terms in the reporting period and how these have been communicated to vendors. There must also be a clear process for resolving payment disputes.

Statistics

These must include the average payment days in the period, from the date of receipt of invoice; the percentage of payments made at 30 days or less, between 31 and 60 days, and 61 days or longer. The report should show the percentage of payments not paid within the agreed payment term.

Specific statements

These should cover whether the business offered vendors e-invoicing and supply chain finance. Did the business make deductions from payments to preferred vendors or change its policy on this during the reporting period. Lastly, has the business a payment code and if so, this needs to be defined.

Procure-to-Pay Automation

This level of payment practices reporting may appear draconian at first sight but it need not be. Implementing a procure-to-pay system that provides complete control and visibility over the P2P process and incorporates reporting capabilities can standardize the reporting process and enable you to assess why payments are not always made on time and improve in these areas.

Such reasons for poor payment performance may include a disjointed approval process or issues with the invoice matching process, relating to the likes of human error or missing vendor information. If your approval process is leading to late payments, automated workflows can be configured to ensure that invoices are passed through the approval process without delay, by the most relevant approvers.

Likewise, if matching is causing delays to payments, an automated procure to pay solution will remove the manual element involved and automatically match invoices received to POs and GRNs providing all relevant data in present. An automated matching engine will even go as far as providing suggested matches in certain cases where enough but not all relevant data is present.

Whatever the reason may be for your P2P process leading to poor payment performance and missed discounts, a comprehensive P2P system will allow you to assess the issues and address them.

While an automated P2P system procurement will enable you to both analyze and address the reasons for poor payment performance, it will also provide the information required to seamlessly compile and submit payment practices and performance reports.

With visibility over the average number of days between invoice receipt and payment, the average number of payments made within agreed terms and the average number of days to pay vendors, organizations have everything they need to submit their reports on time and without having to manually assess each invoice within the reporting period.

Conclusion

Compliance reporting can sometimes seem like merely another government-imposed hoop to jump through. Some businesses may query whether they need more accounting to add to their existing statutory duties. Reporting on payment practices however is different; it is a chance to shine.

Businesses that pay their vendors in a timely manner and without delays beyond agreed trade terms are likely to be able to build good relationships with the vendors that fuel their activities with goods or services. Those with poor payment practices should not expect vendors to want to deal with them.

At the same time performance reporting, once automated using a procurement system with suitable reporting capabilities, is not onerous and will simply form a necessary part of an up-to-date compliance process that stands to enhance the reputation of the business.

If you are looking to automate your P2P system procurement process in order to reduce the time taken to pay vendors and also require a reporting dashboard to simplify the task of fulfilling your Payment Practice and Performance Reporting obligations, you can request a demo of our Procure-to-Pay solution.