Covid-19 has created huge challenges for businesses in a very short space of time. It’s very easy to become disheartened in light of the situation unfolding. However, there are a number of ways you can help your organization through this incredibly difficult time. The alignment of Procurement and AP will provide senior finance leaders and their departments with not only the tools to effectively communicate, but it will generate visibility into their overall operations. Let’s delve into why Aligning Procurement and Accounts Payable is no longer an option, but now a necessity.

Procurement and Accounts Payable Alignment

1. Sourcing

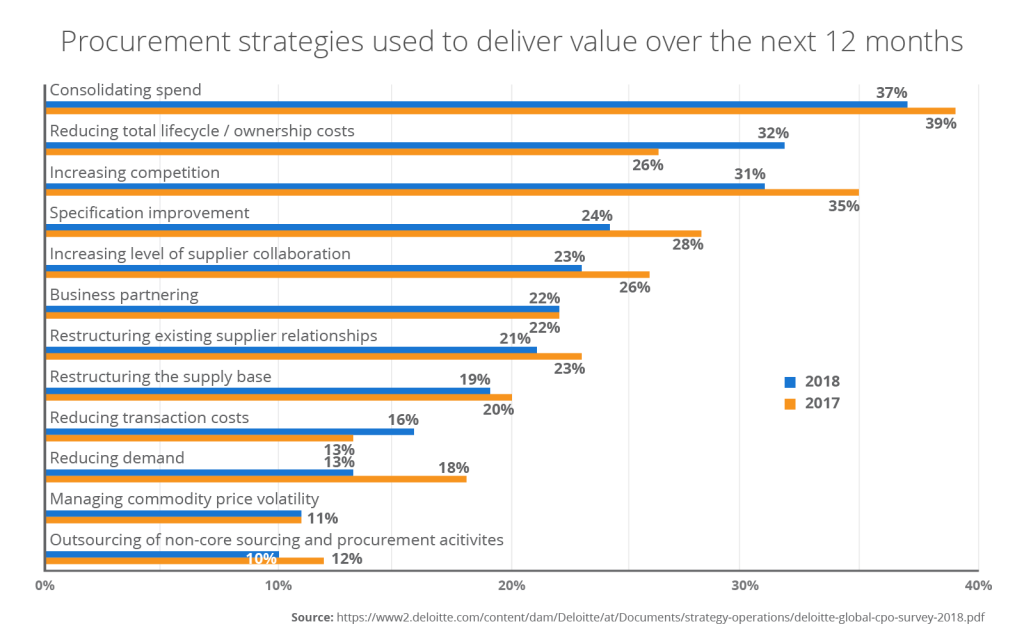

It may be an alien concept that another department besides Procurement would handle sourcing. However, correct alignment with Accounts Payable can offer invaluable information into budgets available to Procurement, and what the current relationship status is with vendors’ accounting or finance departments. Both these elements are crucial in such an unstable climate because AP can offer in-depth reports revealing any problems with particular vendors and their payment terms. This arms the Procurement and Senior Finance teams who are reviewing contracts, with crucial data for negotiating better terms with existing or new vendors. A Deloitte survey shows that analytics will have the most impact on Procurement in the next two years and that they will be used for cost optimization (50%), process improvement (48%), and management reporting (45%).

2. Spend Analytics

Finance leaders need clear and reliable data to fuel strong decision-making and accurately forecast their cash flow position as part of their Covid-19 crisis management plan. Data is now in abundance, IDC states that worldwide data will increase 10-fold in the next five years. To understand this huge amount of information, it’s critical your AP team and Procurement are on the same page. They will be able to provide qualitative data about the P2P process based on their expertise and experience. This adds context to the data that is already available in the ERP or P2P platform. To learn more about the importance of spend analysis, we have a blog here, that you can read.

3. Vendor Relationship Management

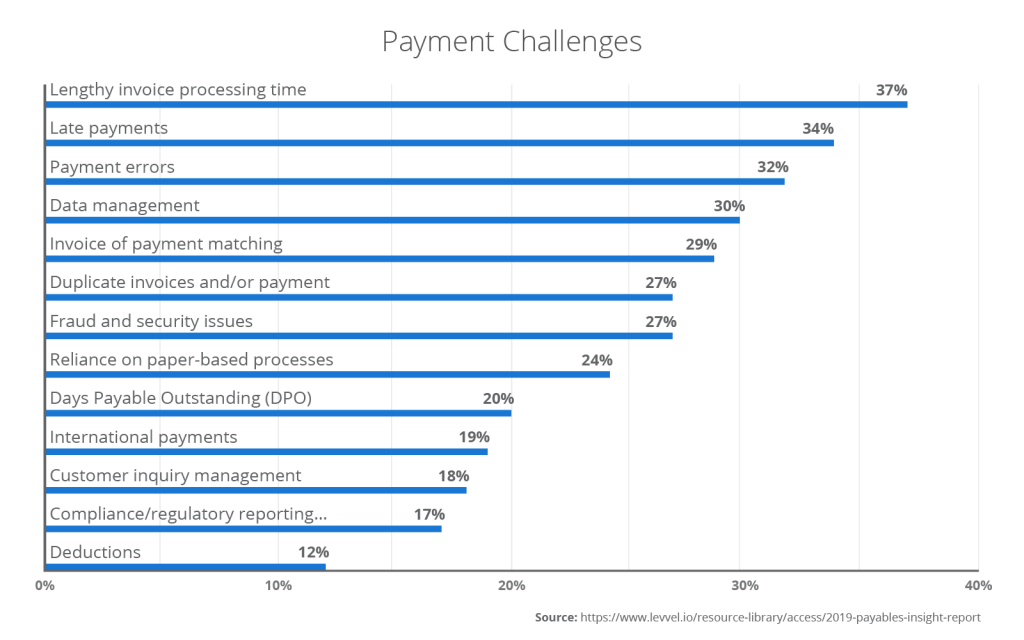

Over the last few weeks, organizations have turned their attention to their vendors/suppliers to evaluate their supply chain. But even before Covid 19, vendors played one of the most significant roles in implementing an effective P2P operation. If vendors overcharge or ship a different product, it delays your processes. Additionally, payment errors were the third biggest payment challenge (32%) as well as data management (30%), according to Levvel research.

Right now, there is no room for errors, to keep operations flowing you are dependent on vendors to produce the goods or services you required in accordance with your agreement. If you are attempting to downscale, you need to clearly understand termination penalties and force majeure clauses. Ample communication and a clear goal will help to resolve any issues effectively with vendors, but it will take both departments working together.

4. Culture and Team Building

Many organizations overlook the importance of culture within their organization. Now, culture and teamwork have been thrown into the spotlight as everyone sets up desks from their home office, bedroom, or kitchen table. Keeping morale high and getting everyone to work together will be key to productivity over the coming months in the Procurement and Accounts Payable departments.

A BIT.AI research stated that 91.1% prefer a workplace where people identify and discuss issues truthfully and effectively, less than 50% said it happens in their current organization. By giving Accounts Payable and Procurement the opportunity to openly discuss issues and problems they are facing with each other, you create a safe space for problem-solving and information exchange, even if that is over video call instead of popping down to the department in the office.

In turn, BIT.AI data revealed that those who have effective communication are 50% more likely to have lower employee turnover. Higher employee satisfaction leads to a much more productive team.

5. Positive Working Capital

Even in times of recession, you’re still able to grow your company’s working capital. Before the coronavirus outbreak, global balance sheets indicated that this is probably one of the largest areas that companies weren’t utilizing. Top US companies left a staggering $1tr tied up and almost 20% of profits just sitting on the table, a Hackett Group’s survey revealed.

Additionally, a PWC report forecasted that worldwide excess of Working Capital stands at €1.2tr. When the world returns to some sort of normal, it could be an opportunity for you to improve your Working Capital by aligning the departments. Using smart automation, Procurement, and Accounts Payable have a clear overview of the company’s incomings and outstanding liabilities, as well as payment terms and working together to ensure early discounts are captured. Stronger vendor relationships mean better negotiations for contract and payment terms, which will boost the growth of your Working Capital. If you want to read more about Working Capital, we have recently written a blog about the trends in 2020.

Tactics to Achieve Procurement and Accounts Payable Alignment

Now that we realize that Procurement and Accounts Payable need to align in order to achieve an efficient Procure-to-Pay process, how can you achieve this alignment within your organization? Below are tried-and-tested tactics that will help you to develop the strategy that is required to truly align Procurement and AP.

Common goals

Traditional Procurement metrics include Procurement cycle time, cost savings, and vendor quality rating. AP teams work towards goals including invoice approval time, invoice process cost, and discounts received. In the majority of organizations, these two functions work towards their own goals as separate entities.

When crafting their strategy, Procurement and AP need to agree on common goals and metrics. Once these have been decided, both functions have a way of identifying opportunities for improvement throughout the entire P2P process.

Technology Stack

Once Procurement and AP teams have agreed on common goals, the next step is to find a way to work towards the goal and track the progress together. In this situation, many organizations opt for a Procure-to-Pay automation platform to handle this. These platforms provide full visibility over Procurement and AP activities and provide extensive dashboard reporting of KPIs and associated metrics. 83% of professionals depend on technology to collaborate, according to BIT.AI, so automation will be able to slot easily into your teams. If you’re thinking of switching, this blog details what metrics to be aware of when automating AP.

Collaboration on data, in particular, helps both functions to gain an insight into savings that have been made and potential opportunities for improvement. Sharing one data source also encourages communication, accountability, and contributes to removing the silos that these two functions find themselves in.

Conclusion

It is time for Procurement and Accounts Payable teams to work together instead of independently. If you haven’t started thinking about aligning these two functions, then you’re going to struggle. A healthy relationship between Procurement and AP will lead to a clear picture of your company’s overall health and will provide you with fundamental information to help you take the next steps in securing your organization’s future.