Few could have predicted how quickly the world shut down during the pandemic, along with the strong rebound that followed as policy makers poured stimulus into economies. Confidence going into 2022 is strong and about 60% of CEOs anticipate an economic boom over the next two years.

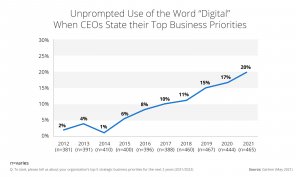

As global activity continues through the recovery phase, priorities have also shifted towards fast-tracking modernization goals. Technology initiatives are the second biggest priority for CEOs, following growth.

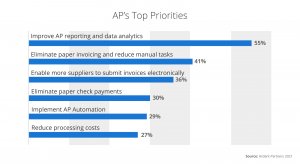

By now, most businesses have successfully prioritized the digitization of client-facing and revenue-generating technologies. The next phase of growth comes from internal automation of functions that promotes cost saving and strategic planning.

In this Blog, we’ll discuss why automating AP is a key priority for businesses in 2022.

Facilitate Company Growth

Viewing AP as a strategic asset allows companies to successfully manage cash, the lifeline of every organization. Business leaders intuitively understand the importance of cash flow in fueling business expansion.

As companies grow, simply hiring more people on the AP team to deal with repetitive tasks is highly inefficient. With automation, costs can be reduced by much as 80%. Removing menial tasks in AP also leads to a more accurate and cost-effective team. Rather than focusing primarily on transactional tasks, AP teams free up time to contribute to value-added decision making.

Support Hybrid Workplaces

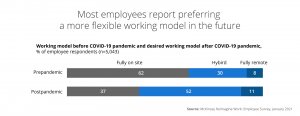

The future of work is already here. By 2022, Gartner estimates that hybrid workers (employees working outside of the office at least one day a week) or fully remote workers will make up 31% of the global workforce. The U.S. is set to lead this trend with 53% of its labor force working partially or fully remote.

Employees prefer flexible work arrangements, and given widespread staff shortages, flexibility remains an important incentive for talent retention. However, remote work exposes accounts payable challenges, like over-reliance on manual processing, the vulnerability for longer processing times, data security issues and the increased risk of fraud.

Automating invoice processing and approvals with a cloud-based solution means that it doesn’t matter where your team is located. Going into an office isn’t necessary as invoices do not need to be printed or managers physically chased for approvals and queries. Your finance team can have 24/7 access and 100% control and visibility over the invoice processing cycle anytime, anywhere.

Address Demand for Speed

According to the IDC, the adoption of cloud-based software (vs on-premises or other software) is expected to increase to 49.5% in 2022 from 34.1% in 2017. Cloud-based solutions make it easier to automate AP as there is no need to invest in hardware or onsite IT maintenance, which also results in faster implementation times.

Regardless of industry, cloud-based AP solutions speed up invoice processing, reduce reliance on IT, and support the demand for instant information.

Reduce Reliance on Manual Processes

Invoice exception management remains one of the top frustrations of AP teams. 73% of invoice exceptions are linked to invoice discrepancies, which may require manually tracking down missing information. The impact of exceptions compounds, causing delays in processing times, increased costs, and late payment risks.

Heading off errors before they have a chance to cause bottlenecks provides the first line of defense. Automation reduces errors from manual data entry and employs robotic process automation for invoice matching. Automated processes can substantially reduce overall exceptions and processing times.

Centralize Data Analysis

Data insights proved to be a crucial tool for business leaders to manage risk and business continuity during the pandemic. About 88 percent of finance professionals see data and intelligence as critical pieces of the AP process. However, data analytics are only as good as the quality of available data.

Expense visibility is a key feature of AP automation. A central repository for information avoids data silos and inconsistent data that could affect the quality of decision making. With real-time data, finance leaders can upgrade processes and make informed decisions faster and more accurately.

Lower Processing Costs

While businesses are still dealing with pandemic-related supply chain bottlenecks, supplier relationships have become even more critical. Late payments are generally bad news and can exacerbate fragile supply chains. On the other hand, prompt payments help avoid late payment penalties that siphon up cash intended for other bills and investments.

Rapid payments could even add to your bottom line. Strong vendor relations allow your business to take advantage of a steady flow of supplies and discount opportunities. A UK study estimated that UK corporates miss out on £6.7 billion in early payment discounts, and one in six companies lose out because of outdated software. AP automation accelerates the processing cycle so that companies can save money and strengthen supplier relationships.

Industry benchmarks offer a glimpse into achievable milestones for those who choose to automate. Among best in class AP performers, the cost to process a single invoice drops from $10.95 to $2.25, and time spent decreases from 11.9 days to 3.3 days. Most importantly, accomplishing process efficiency related to invoice receipt, approvals, and payment scheduling translates to straight-through processing rates of 67%, versus 21% for underperformers.

Keep Pace with Competition

Every crisis reveals glaring vulnerabilities and opportunities to improve performance. According to a McKinsey Global executive survey, the pandemic prompted companies to accelerate the digitization of customer and supply chain interactions, as well as internal operations, by three to four years. Some of these solutions were temporary, but cost and process efficiency generate the incentive to invest in changes that stick.

With competition revving up amidst an economic recovery, innovative and cost-efficient firms are bound to see the highest ROI. Companies expect intelligent automation to increase revenues by 15% and decrease costs by 24%.

Revenue generation and cost savings are only a part of the puzzle. Automation boosts speed, accuracy, and visibility while driving sustainable results. Companies embracing automation are poised to scale better and leverage recovery demand, while ensuring business continuity and growth.

How To Automate AP

SoftCo provides end-to-end AP automation to enterprise customers, delivering industry-leading 80% straight-thru processing rates. Schedule a demo to transform your accounts payable department today.