For those UK companies with a December year-end, first submissions under the new payment practice and reporting obligations introduced by the Department of Business, Energy and Industrial Strategy (BEIS) will fall due in July 2018. The enhanced reporting requirements have been put in place in response to concerns expressed by UK policy-makers about the financial burdens that thousands of smaller suppliers face due to late payment of their invoices, and will force larger organizations to report publicly on their payment policies, practices and performance.

The regulation applies to any company or LLP that meets any two of the following three parameters: £36m annual revenue, £18m balance sheet total, and 250+ employees.

The information required is extensive and the reports will be made available to the public on a government website – the implication being that the risk of reputational damage will be enough to keep larger companies in check when it comes to paying their suppliers. The detail that must be reported is broadly as follows:

- Statistics

The average number of days taken to make payments to suppliers from date of receipt. The percentage of payments made within 30 days, 60 days, or longer. The percentage of payments which were not paid within agreed terms.

- Narrative

The company’s standard payment terms and processes for resolving payment disputes. This includes information on standard contract length and time for payment of invoices.

- Statements

The company must state whether suppliers are offered e-invoicing, if supply-chain finance is made available, if the company charges suppliers to remain on its supplier list, and if the company is a member of any payment code.

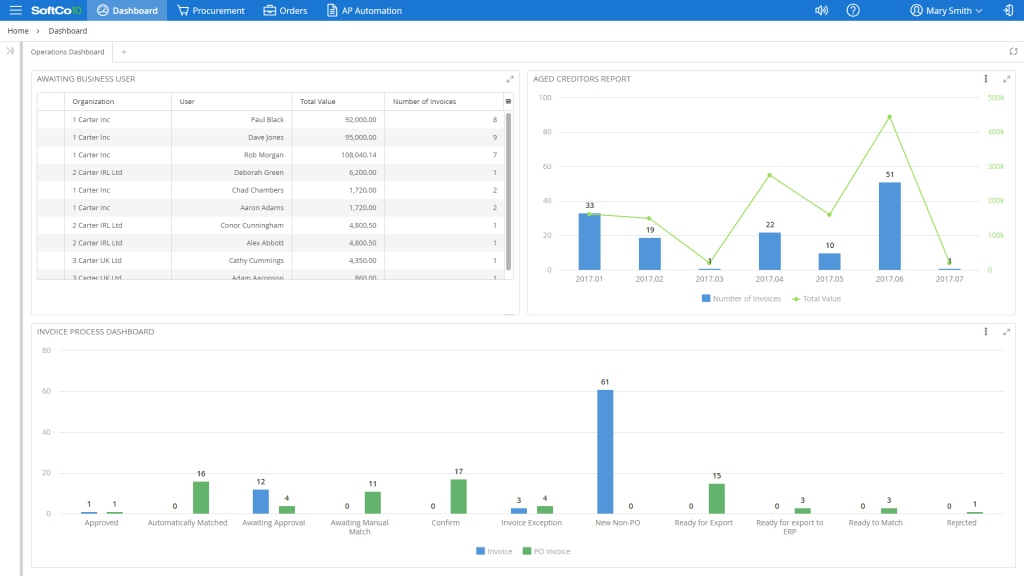

KPMG is advising companies to be well-prepared ahead of their first obligatory filing. In an August 2017 report, KPMG suggested that an automated solution will be required in most cases to ensure compliance; “Managing processes effectively by using a service provider’s automated solution can address the complexities of implementation while keeping on top of regulatory changes.”

The leading consulting firm also suggests that the impetus to improve procure-to-pay processes presents a working capital opportunity; “Changes to a purchase-to-pay cycle to improve payment performance can have a significant impact on operational working capital needs. KPMG typically identifies between 10-15% of gross working capital.”

Finally, KPMG reiterates the potential reputational damage of a negative report as the payment conduct of larger businesses is likely to draw significant media attention. Furthermore, board members will be held accountable with company directors open to personal legal liability of reporting is found to be incomplete or inaccurate.

Garret Pearse, Senior Procure-to-Pay Consultant at SoftCo, addressed the issue at a recent financial process automation event and highlighted that end-to-end automation solutions were already available in the market that would not only bring payment cycle times well within acceptable limits, but also generate the relevant reports required by regulators.

“Companies with a December fiscal year-end still have 6 months in which to get their house in order and avoid airing their dirty laundry in public. We have seen UK companies like Argos, for example, reduce average payment time from 3 weeks down to just 3 days – those are the kind of statistics that enhance rather than damage a company’s reputation,” said Pearse.

To find out more about SoftCo’s procure-to-pay solutions, visit our solution overview page here. To request an appointment with one of our experienced consultants to discuss your procure-to-pay process, email us at enquiry@softco.com or call us on +44 (121) 288 0768.