Irrespective of the type of business you have, one aspect central to your operations are contracts. Contracts form the backbone of the relationships that an organization has with its vendors, partners, and customers. Contracts, by their nature, are the main source of revenue and relationship building for an organization. It can unlock additional value to your business, but can also lead to unforeseen costs if not managed correctly. It may sound surprising but according to IACCM data “the average company ‘leaks’ over 9% of its revenues annually due to contracts-related issues”. However, contracts can also hold the key to unlocking additional cost savings.

Right now cost containment has become even more important as the IMF predicts a $9 trillion loss due to Covid-19. This four-minute blog will take you through four common mistakes made in Contract Management, their costly pitfalls, and what you can do to avoid them.

1. Inaccessibility of Contracts

With remote working now the norm, many companies have realized that critical contracts are inaccessible, locked away in closed offices, branches, or stored on owners’ desktops.

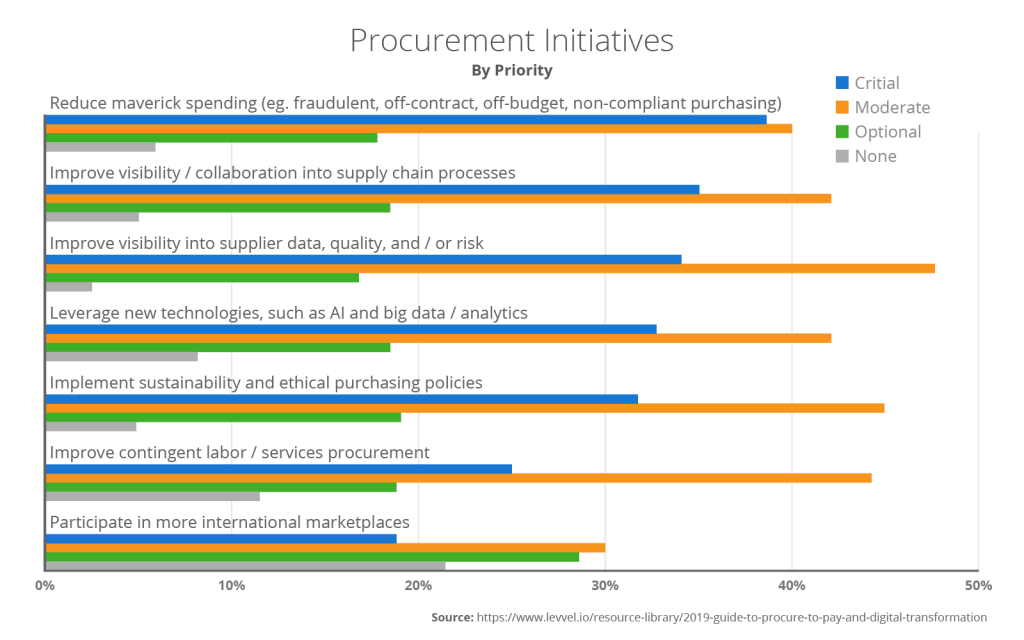

When organizations finally establish an overview of their contract portfolio, rogue or maverick spending is often uncovered as contracts that are disconnected from the main business come to light. In a 2019 Levvel survey, reducing maverick spending was a key initiative for companies to tackle, which highlights just how prevalent the problem is. Additionally, organizations may discover they are stuck with contracts they don’t need, all adding up to unnecessary costs to the business.

Reacting to changes in the supply chain and the market is even more critical given the current economic realities. The more time that is spent looking for contracts, the costlier it is for a company, as reactions to changes are naturally slower. By the time these companies have located their contracts, organizations that use an automated Contract Management solution have already viewed, assessed, and amended contracts to reflect changes in the market. Companies are therefore paying a high price due to the inaccessibility of their contracts.

(We recently wrote a blog about maverick spending – you can read it here.)

2. Automatic Contract Renewals

Automatic renewals or evergreen clauses in contracts can have serious financial implications for organizations. Auto-renewals are particularly prominent in manual processes, as businesses rely on spreadsheets instead of automatic alerts to remind them that a contract is coming up for renewal. These companies find that they are tied into previous terms and conditions when the contract auto-renews, which comes at a cost to the company, particularly as they could have secured better terms with vendors in the current environment.

Companies can also unknowingly renew contracts with vendors who are underperforming or find themselves tied into contracts or services that they no longer require. If they attempt to terminate the contract, often they are penalized by costly cancellation fees.

3. Missing Deadlines

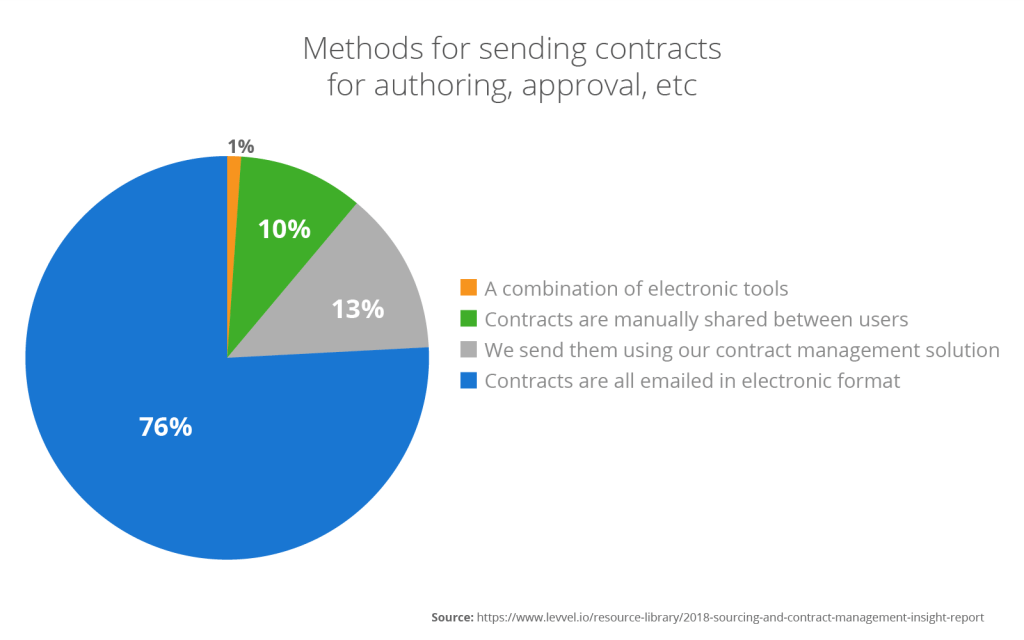

Email is the most common communication tool used in authoring, amending, and approving contracts, according to this recent Levvel study. Such a heavy dependency on email correspondence in Contract Management is dangerous as it can result in deadlines being missed and terms being unclear.

Issues rapidly arise for companies solely reliant on email with the sheer volume of revisions. It becomes all too easy for anyone within the organization to update the wrong version of the contract or leave out important agreed clauses.

When it comes time to make payments, often revised terms are not communicated to the finance team in a timely manner or are incorrect due to confusion caused by the number of revisions. As a consequence, overpayments are unknowingly made and installment deadlines are missed resulting in fines or loss of service. This is evident in this AP Association report where 78% of companies confessed that they missed payment deadlines and 58% of those companies were subsequently hit with late payment charges.

4. Failure to Comply

Every company has government, corporate, and contractual compliance to adhere to. Consequences for failure to comply can lead to fines, legal costs, and damage to vendor relationships. It’s an area that causes concern for companies, as 61% reported compliance as one of the top Contract Management challenges in this recent Levvel survey.

Organizations that rely on manual processes will find it difficult to monitor and report on how they are complying with Prompt Payment and Payment Practice requirements, which are a set of rules to help contractors and subcontractors to be paid in a timely manner. As payment terms will vary by country and state, organizations with multiple locations have the complexity of managing different payment deadlines. In a manual system, the finance team are reliant on extensive spreadsheets or calendar reminders to make payments on-time. The result of using such a poor process can be late fees, and if a vendor escalates the case, a company could be faced with significant legal expenses.

(To learn more about the Prompt Payment Act, read our blog here)

How to Avoid Costly Mistakes in Contract Management

To avoid these costly mistakes, companies need an automated Contract Management solution which stores all contracts on one compliant, cloud platform, making them readily accessible for review and analysis even while working remotely. It will prevent maverick spending with approval routes and it will clearly identify contract owners which ensures accountability.

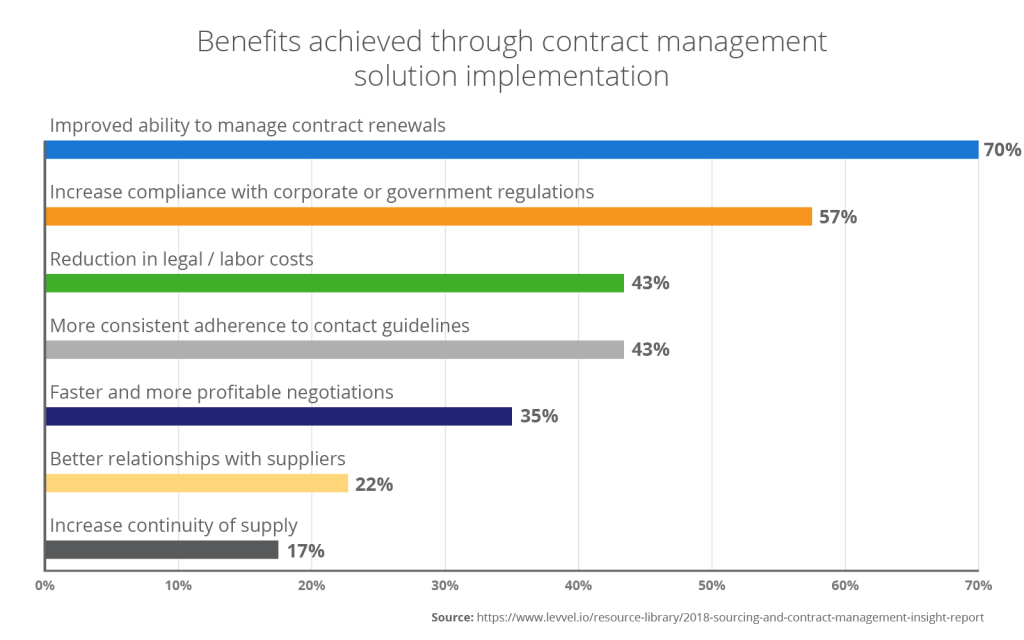

Auto-renewals won’t catch organizations by surprise. Customized alerts can be established to warn companies of an impending auto-renewal, giving the contract owner plenty of time to renegotiate terms or cancel the contract if necessary. A Levvel survey showed just how powerful a Contract Management solution is, as 70% of organizations saw an improvement in contract renewals after implementation.

The key to keeping costs down in Contract Management is having the ability to rapidly review contracts, make revisions, and get them approved centrally, whilst having complete visibility into timelines and payment deadlines. A Contract Management Solution provides businesses with these capabilities and it’s no surprise that 43% of organizations saw an improvement to consistent adherence to contact guidelines after automation.

Finance teams benefit from features such as self-billing options that trigger the payment process even if vendors don’t issue an invoice, and tolerance deviations that alert users to an invoice that goes over a set limit. These measures stop contract leakages such as overpayment or late payment and keep companies compliant to their SLAs. In fact, a separate Levvel report showed 78% of organizations saw an improvement in compliance with corporate or government regulations after implementing a Contract Management solution. This can be attributed to the increased visibility into contract terms and the assignment of contract owners who are responsible for keeping contracts up-to-date.

In these challenging times, companies are working tirelessly to enhance cash-flow and cost containment. As the outlook for the year remains uncertain, companies should take time now to investigate their Contract Management processes to determine if they’re falling into any of these costly pitfalls. Organizations should then evaluate how an automated solution could solve their issues and provide cost-saving benefits. To learn more about Contract Management, follow this link.