Nearly two-thirds of CFOs surveyed said they need more AP process automation to improve efficiency. Legacy systems, manual processes, and increasing workloads are slowing down operations and growth.

How Do You Know If AP Automation Is Right for Your Business?

Without automation, your Accounts Payable team is either descending through frustration and burnout or ready to hit a panic button. Increasing invoice volumes, frequent manual errors, challenges in meeting regulatory compliance, and the high cost of manual invoice processing are just a few noticeable warning signs.

Highlighted below are common indicators that point to organizations needing to upgrade to AP automation, and we also detail how AP software turns the story around. To learn more about the power of AP automation, check out our complete AP Automation Guide.

10 Reasons to Upgrade to AP Automation

1. Long Invoice Processing Times

Manual invoice processing and approval workflows drain time and resources. Three-quarters of AP teams are also seeing an increasing volume of invoices, often leading to longer hours and increased burnout.

Processing times directly translate into employee hours and costs. The longer an invoice takes to get paid, the less likely you’ll be eligible for early payment discounts. Meanwhile, vendors hope to get paid as quickly as possible.

Adopting AP automation can reduce invoice resolution times by 80%, saving considerable time and money. Capita saw a 600% improvement in employee activity and increased form processing by 700% after integrating an AP automation solution.

2. Excess Time Spent on Vendor Inquiries

As invoices grow, so do vendor inquiries, which hamper productivity. 40% of AP professionals said they spend six or more hours each month responding to inquiries; some spend more than 20 hours per month.

Each query interrupts the workflow and takes away time from other tasks, especially if you have to dig along their files or folders to find data.

By automating AP, Grafton Ireland was able to reduce query resolution time by 75%, freeing up staff for more value-added activities.

3. Insufficient Automation

Many companies start on the path to adopting AP automation by using Optical Character Recognition (OCR) to capture data from invoices. They quickly find that OCR has limitations, especially when dealing with inaccurate or missing data. Duplicate invoices pass through without detection, and OCR does not handle posting an invoice to the ERP. OCR technology also cannot provide validation, invoice matching, ERP integration, or reporting. Without implementing advanced Smart Capture and Smart Matching engines that use artificial intelligence or Machine Learning(ML) technology, organizations may struggle to match invoices accurately without significant human intervention.

4. Rapid Company Growth

Organizations that are seeing rapid growth often lack the resources to handle the volume of payments required. With no way to scale efficiently, AP teams can struggle to keep up with the growing demand. This often results in data entry mistakes, lost or missing invoices, duplicate payments, and late payments.

Effective AP automation can improve workflow. For example, Smyths Toys was able to decrease approval times by 30% despite rapid growth from acquisitions.

5. Undergoing Tech Migration or Upgrades

If you are undergoing digital transformations like cloud migration or ERP upgrades, it’s time to consider upgrading your Accounts Payable processes. 90% of those responding to a Deloitte survey agree that the cloud — along with AI and analytics — works as a “force multiplier” for their digital strategy. Upgrading your AP tech stack complements the progress with automated workflows and payments.

Crown Agents Bank needed to streamline and automate its Accounts Payable and procurement processes as part of its digital transformation strategy and accommodate remote work. Adopting an end-to-end P2P solution integrated with the ERP system enabled Crown Agents Banks to capture invoices electronically and reduce the time for processing with 100% visibility over the procurement process.

6. Lack of Centralization

If no one is using a centralized platform, data silos can be prevalent in different departments or even within the same Accounts Payable team. Having a single source of truth improves efficiency.

Automating invoices and approval routing in a centralized system eliminates lost invoices and enables integration with ERP and accounting systems. AP software centralizes your invoice, approval, and payment processing, reducing costs by up to 80% and achieving 90% Straight-Through Processing.

7. History of Late Payments

Say goodbye to late payments with AP automation.

When you fail to make payments on time, you can damage your company’s reputation and your vendor relationships. More than half of companies in a survey by the Association for Financial Professionals (AFP) reported that speed of payment makes a difference in evaluating relationships amid pricing challenges.

You may also accrue late fees, which makes your invoices even more expensive to process. Late payments impact the overall company relationship.

While underlying significant growth, BulkBarn lacked control and visibility, resulting in budget overruns and an inability to pay vendors per terms. This resulted in late payment penalties, lost opportunities, and delays in store openings. By shifting manual P2P processes to AP automation, they gained 100% control and visibility over every store budget, eliminating overruns and ensuring all suppliers were paid within terms.

8. Need to Reduce Costs

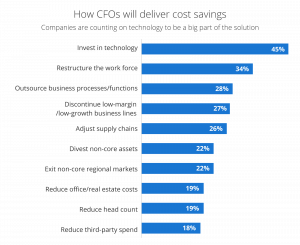

Source: CFO.com

If you’re looking to reduce costs, you’re not alone. CFOs report their top priorities right now are cost control within finance functions, prioritizing it above the broader organization and revenue generation. Delivering these cost controls requires rethinking processes. 45% of CFOs said investing in the right technology to streamline efficiency is at the top of their list.

The benefits from AP automation are clear. You can save nearly 90% of invoice processing costs going from a purely manual environment to a high automation environment.

Mobile top-up platform Ding reined in costs by automating their procure-to-pay process for 12,000 invoices annually, saving hundreds of hours of employee time and gaining complete control and visibility of their P2P process.

9. Lack of Security and Fraud Prevention

Nearly three-quarters of organizations report being the target of payment scams, resulting in more than $3.6 billion in losses due to fraud. Gartner suggests that reducing fraud requires going beyond the baseline levels of internal controls, focusing on vendor data integrity, real-time auditing, and insider fraud monitoring. Your main line of defense should not rely on your finance team playing detective.

Leveraging AP automation enables secure AP processing, eliminating much of the manual and human intervention where information can be manipulated for invoice fraud.

10. Bad Audit or Lack of Internal Controls

If internal analysis doesn’t find the source of your Accounts Payable nightmares, an external auditor might.

Many legacy systems and manual processes lack the controls necessary to remain compliant. Worse case, auditors might even find errors that have a significant financial impact. AP automation allows you to take control of your AP processes, creates clear audit trails, and sustainably improves your control environment for the long haul.

The Time for AP Automation is Now

If you don’t have an efficient AP process, it’s time to find a robust and reliable Accounts Payable automation solution. Best-in-class AP automation software, powered by artificial intelligence and machine learning can overcome challenges, streamline your workflow, improve your efficiency, and save you time and money.