Having a well-managed accounts payable (AP) department is critical to the financial health of any business. With accounts payable responsible for processing invoices, ensuring payments are made on time and managing vendor relationships, the department has a direct impact on an organization’s ability to reduce costs and ensure compliance obligations are met.

According to The Hackett Group, cost reduction through automation ranks as the number one initiative on the finance transformation agenda in 2021. Central to the goal of reducing costs is the need to have strong risk management procedures in place and internal controls for better compliance.

Managing risk and compliance is at the heart of almost every procedure within the accounts payable process. Segregation of duties to reduce internal fraud, duplicate payments, anti-money laundering (AML) laws and validating vendor TAX/VAT data at the time of onboarding are just some of the challenges that accounts payable are faced with.

When accounts payable processes are carried out manually, full compliance is often difficult to achieve. Since the spread of Covid-19 led to wide-scale remote working, risk management and compliance have become even greater challenges for accounts payable. A lack of control and visibility, inadequate formal approval processes and retrieval issues around the storage of documents are only a few of the compliance-related issues that have become more prominent in today’s world.

Given the struggles that businesses have encountered during the pandemic, there is now a major focus on developing accounts payable processes to reduce risks and ensure compliance.

PYMNTS.com report that investment in AP automation will increase from $1.9 billion in 2019 to over $3 billion by 2024, with this trend clearly illustrating that organizations worldwide are realizing the need to quickly move away from manual environments.

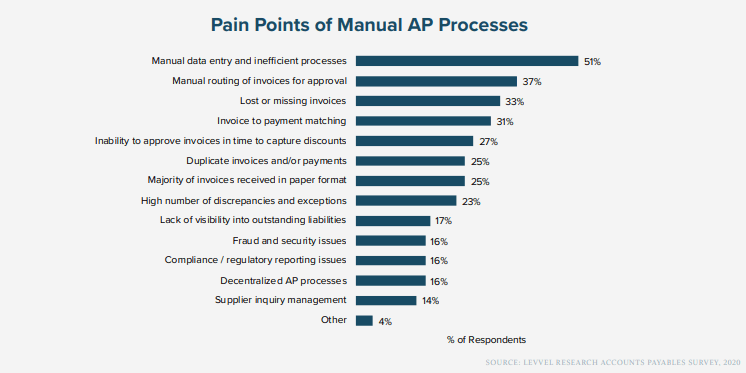

A series of research reports are now drawing attention to the risks associated with manual processes and suggesting ways to resolve them in 2021. Levvel’s Payables Insight Report published in April 2020 highlighted a number of “pain points of manual AP processes.” Amongst the most common pain points are:

- Lost or missing invoices

- Lack of visibility to outstanding liabilities

- Fraud and security issues

- Manual data entry and inefficient processes

- Manual routing of invoices for approval

- Matching invoices to payments

- Inability to approve invoices in time to capture discounts.

- Compliance/regulatory reporting issues

An Expense and Invoice Management survey conducted by Aberdeen Research in November 2020 also concluded that regulation and compliance are at the top of the list of financial management priorities, alongside data accuracy and tracking of company spend. They say that “…by automating steps in invoice management processes, companies can eliminate manual errors to enhance data quality and enable timely compliance to help them avoid regulatory and reporting issues.” (Aberdeen.com 2020)

These conclusions point squarely at the need to employ automation to ensure compliance and reduce risk in accounts payable.

What can AP automation do?

A system that automates the accounts payable process right from invoice capture, to matching, approval and query management, also encompassing both vendor management and analytics, will ensure that organizations reduce risk and maintain compliance in a number of different areas.

Capture

Research from Levvel among others has shown that e-invoicing is steadily increasing. Whether received in digital or still in paper form, data capture is the first step. Once the important elements of the invoice such as currency, amount, due date, vendor identity and purchase order reference are in the system then the data can be put to work.

The capture of invoice data also highlights the importance of a secure, central repository for storage of documentation in general, which provides significant benefits. Invoices can be digitally fingerprinted to ensure authenticity and avoid duplication. Documents such as contracts can be managed throughout their lifecycle. This includes those that contain GDPR sensitive information where customer consent is required for storage and use. These can be earmarked for deletion when they have fulfilled their purpose and, importantly, evidence of appropriate compliance is available when required.

Matching

Automated matching of an invoice to a PO and GRN reduces the risk of fraud, duplication of payments and human error. All of which help to reduce costs. By reducing human interaction in the process an individual is denied the opportunity to manipulate data that could result in a fraudulent payment. Additionally, if vital information is missing from an invoice or mirrors that of an invoice already passed through, an automated system will reject the invoice for query.

Approval

A fully automated approval process brings increased compliance in a number of ways. Firstly, there is the segregation of duties, whereby someone who has raised a PO cannot be involved in the approval process of the invoice relating to the PO, thus removing the possibility of internal fraud. Additionally, approval matrices ensure that appropriate levels of approval can be applied to large transactions. Multiple verifiers and approvers can be added to the process, with signoff from each required before the invoice is made available for payment. Daily reminders sent to those involved also ensure that payments are made quicker, further adding to the level of compliance within the accounts payable process.

Vendor Management

Vendor management plays a key role in an organization’s ability to manage risk and achieve compliance. From the outset, thorough due diligence must take place before an agreement is entered into. When an accounts payable system is integrated with a supplier management portal, organizations can ensure that a vendor is fully validated and that there are no financial or compliance risks before they are uploaded to the vendor master file. VAT/TAX and TIN details must be uploaded to the vendor management portal along with PO and invoice submission preferences. All data thereafter can be maintained by vendors, via a secure approval process to ensure compliance is maintained and risk reduced throughout the working relationship. The accounts payable system then takes a feed of vendor master data from the ERP, ensuring a fully optimized accounts payable process.

Cash flow and payments

Once the invoice has gone through the approval process it can be passed forward for payment at the appropriate time. This may be on the due date or it may be earlier than an original due date if an early payment discount is applicable. In either case, the accounts payable process feeds into the wider cash flow management of the business. Knowing when payments will need to be made as well as when payments will be received, allows for the provision of accurate forecasting, tight treasury management and, hopefully, lowers the funding costs of the business.

The link between the payment itself, the accounts payable process and accounting lends itself to enterprise resource planning (ERP) system integration. Integration of the AP and ERP system will ensure real-time handover of approved invoices, facilitating quicker payments.

Audit and analytics

The entire accounts payable automation process from beginning to end provides rapidly available and transparent audit trails. Having access to complete audit trails enables organizations to stay on top of internal compliance, in terms of assessing where human error or, worse still, internal fraud took place.

Drawing upon the same data, it is easy to match actual spend to projections and budgets. KPI measures can be applied and any failures to match up will be clear to see. Comparison of vendor prices, their overall terms of business and efficiency can be extrapolated from the system. It is straightforward to examine where further economies of scale in purchasing can be achieved. Furthermore, for a business that operates across borders and regions, an enterprise-wide automated accounts payable process extends and tightens purchasing controls further and reaches into all corners of the operation.

An automated accounts payable system will also provide insights into the throughput of AP staff and the responsiveness of approvers, which can have a direct impact on an organization’s ability to pay vendors on time and avail of early payment discounts. Analytics also enables organizations to comply with Payment Practices and Performance reporting obligations, providing the information required to seamlessly compile and submit such reports, analyze and address the reasons for poor payment performance.

Conclusion

The risk and compliance challenges inherent in manual accounts payable processes are significantly greater when compared with what well-wrought automated AP systems can offer. Fire-fighting the consequences of Covid lockdowns and the move to remote working is now less of a priority. Consequently, businesses can turn their attention to resolving the AP issues that have come to light by embracing AP automation but at the same time they can gain scale and analytics benefits that will add further value at the margin as their recovery gathers pace.