As the company’s highest-ranking financial professional, CFOs play a vital role in maintaining a balance between financial stability and transformation. Turnover rates for CFOs are on the rise, up for the first time in three years with 52% of turnover due to retirement.

As companies recruit more executives to combat turnover, they often need to source new talent to fill the role. About 34% of CFOs are relatively new to the role with 1-5 years of experience, mostly without the support of formal onboarding to navigate the company . Uncertainty comes with the territory – being a CFO means facing unfamiliar situations and living up to high expectations from day one.

Incoming CFOs have to make their mark quickly, which makes their first 100 days crucial for setting the course of their tenure as the highest-ranking finance executive. Build credibility and find success during the transition period to your CFO position with these tips.

Top Priorities for CFOs

Executives find themselves pulled in different directions from day 1. Here are a few items to keep top of mind.

1. Nurture Vital Relationships

Relationship-building is a top priority for all incoming CFOs. Get to know your team and the key internal and external stakeholders to establish trust.

Creating lasting relationships with other executives, organizational department heads, and strategic investors is critical. Cultivating collaborative relationships and breaking down silos reduces roadblocks in implementing enterprise-wide strategy. Building relationships with other executives and aligning objectives also reduces friction and disagreements between departments.

2. Coordinate Strategic Objectives

87% of executives and managers outside of finance believe the finance team is now more important than before the pandemic. As the CFO role becomes more influential, finance leaders are spending significant time working with executives outside the finance function. Some of that time involves coordinating company-wide objectives.

Unfortunately, only 38% of senior executives are “very satisfied” with how key performance indicators and objectives of finance and operations align. Disagreements and different priorities in finance and operations can impair company performance and decision-making. Working with the rest of the executive leadership team to put everyone on the same page may be an ongoing challenge, but it’s important to keep an eye on the prize at the highest level.

3. Examine Current Systems

Rookie mistakes during your first 100 days create a lasting impact on your credibility as a CFO.

Make it a priority to map and understand the organization and industry processes as early as possible.

Finance leaders take charge of a company’s financial health, but they should also understand where financial data originates. As CFO, it’s imperative to look at existing processes such as:

- Software and systems used by finance teams

- Invoice payment practices

- Cash collection processes

- Payroll preparation and processing

- Vendor management

- Management reports preparation

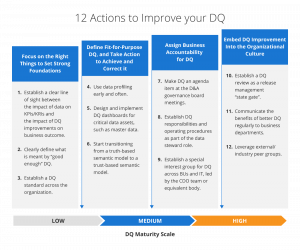

Getting a full picture of the different processes allows CFOs to gauge whether finance data is reliable, up-to-date, and complete. Using information based on poor data can cost organizations $12.9 million annually. Data quality directly affects decision-making, making it imperative for finance leaders to find and address processes that could compromise the accuracy of financial data.

4. Determine Areas Requiring Immediate Attention

CFOs often assume their post during a transition. During this time, there are likely to be several red flags that a finance executive needs to address. A lot of workflows may be problematic, but you need to prioritize.

One effective strategy is to create a triage system and classify tasks based on urgency and impact.

Negative cash flow, for instance, would always be high on the priority list. A broken accounts payable process where vendors don’t get paid for months due to delays in approval is also urgent. However, an invoicing system that requires the company to issue checks rather than making electronic payments would be a lower priority if there are no imminent problems with the existing process.

It’s not possible to fix all broken systems in 100 days, but you can deliver results by focusing on problems that require immediate attention.

5. Assess Overall Financial Health

CFOs aim to drive profitable growth and help CEOs deliver expected financial performance. Meeting regulatory requirements, ensuring the credibility and availability of management reports, passing internal and external audits, and monitoring performance are some of the heaviest responsibilities of the finance leader.

As the finance leader, the CFO should understand revenue drivers and what the company needs to do to achieve income targets in less time while reducing risks and expenses. These areas help CFOs gain a deeper understanding of a company’s financial situation:

- Cash flow Statements

- Income Statements

- Balance Sheets

- Accounting procedures

- Audit findings

Aside from historical reports based on actual performance, CFOs should also evaluate forecasts and budgets.

6. Develop a Strategic Plan for the Finance Function

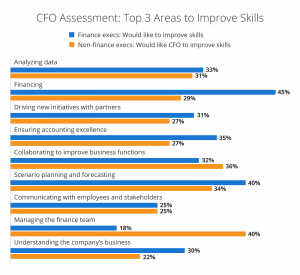

As the head of finance, CFOs should have a vision for the finance function. Non-finance executives see managing the finance team as one of the most critical areas for CFOs to focus on. Working on a framework to chart the course of the finance team can include the following:

- Hiring key personnel for specific areas to drive growth

- Identify key performance indicators and markers

- Establish policies and procedures

- Scenario planning and forecasting

- Considering automation

In many companies, digital transformation falls under the CFO’s domain. In fact, 53% of CFOs plan to invest in technology such as cloud solutions, AI, data analytics, and automation to accelerate digital transformation and address business challenges in critical processes like Accounts Payable. Transitioning out of manual or paper-based invoicing processes by automating accounts payable could make an immediate impact on cutting costs and improving operational efficiency.

Sitting at the CFO’s desk brings unique opportunities and challenges. As the executive who goes between the management and its investors, CFOs face pressure from external and internal stakeholders.

Careful planning and speed execution are critical during the first 100 days. But it’s equally vital for finance leaders to focus on initiatives to usher process transformations that deliver positive ROI while proving their ability to lead organizational change.