As retail finance teams look toward 2025, they face a landscape marked by economic uncertainty, with anticipated challenges such as inflation, rising interest rates, and declining consumer spending placing pressure on financial strategies. These economic fluctuations demand proactive measures and innovative solutions to secure financial stability and growth. However, according to a recent global survey by IDC, only 23% of retail leaders believe that their finance function is “completely prepared” for such challenges.

To prepare for the economic uncertainties of 2025, forward-thinking retail finance leaders are leveraging strategies like cash flow management, cost-control initiatives, and investing in cutting-edge technologies, including AI and automation, to remain agile and competitive. This blog will explore both the economic challenges facing retailers in 2025 and the critical strategies, providing insights into how retail finance teams can effectively navigate these economic challenges and maintain their financial health amidst volatility.

What are the Top Economic Challenges for Retail Finance Teams?

Inflation and Rising Interest Rates

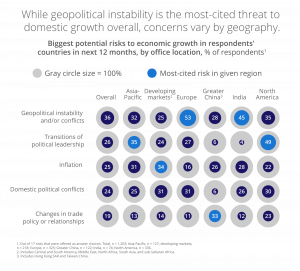

In 2025, retail finance teams must navigate the increasingly complex dynamics of inflation and interest rates, both of which are critical to their financial strategies. According to McKinsey, inflation ranks amongst the top 3 risks to economic growth in the next 12 months, along with geopolitical conflicts and transitions of political leadership.

Inflation continues to erode purchasing power, escalating costs and altering consumer spending behaviors more rapidly than before.

Interest rates are expected to remain volatile, affecting borrowing costs. As rates increase, financing operations becomes costlier for businesses, and as stated by Forbes, the “ripple effects” also extend into the broader economy, with consumers facing higher borrowing expenses. This scenario could pressure consumer spending and, consequently, retail sales.

The challenges of inflation and rising interest rates present a number of complexities for retailers heading into 2025. Here are the 5 biggest complexities they face in this area:

- Pressure on Profit Margins: As inflation elevates costs for goods, services, and labor, retail finance teams need to innovate to maintain margins. Implementing dynamic pricing and enhancing supply chain efficiency with advanced technology can help mitigate these pressures.

- Complex Budgeting and Forecasting: The volatility of inflation and interest rates necessitates advanced analytics and scenario planning for precise budgeting. Utilizing AI-driven tools enables flexible strategy adaptation under shifting conditions.

- Operational Expenses & Borrowing Costs: Inflation and rising interest rates can constrain cash flow and increase borrowing expenses. Real-time financial monitoring and agile cash flow management are crucial for sustaining liquidity and operational needs.

- Evolving Supply Chain Dynamics: Inflation complicates supply chain management, requiring improved vendor partnerships and sophisticated inventory systems. Investing in technology to enhance transparency and reduce disruptions is essential.

- Complex Investment Decisions: As capital costs rise, re-evaluating investment strategies becomes vital, necessitating thorough risk and return assessments to balance financing costs with potential gains.

The challenges posed by inflation and high interest rates are significant for retail finance teams. Successfully navigating these hurdles requires a combination of strategic foresight and adaptability.

By embracing technological advancements, enhancing financial planning, and maintaining robust vendor relationships, retailers can mitigate the adverse effects of these economic pressures and position themselves for sustained growth even in uncertain times.

Managing Declines in Consumer Spending

Facing a projected decline in consumer spending for 2025 presents significant challenges for retail finance teams. According to the Deloitte Global Retail Outlook, after a prolonged recovery, the trend suggests that consumers may have “hit their limits with price increases and budget stretching” as inflation persists and uncertainty amongst consumers remains high. This will likely mean a decrease in consumer expenditure in 2025, which will result in a decrease in retail sales, revenue, and profit margins.

As sales, revenue and profit margins take a hit, retailers are forced to deal with a number of challenges that require agility and innovation, including:

- Decreased Revenue Streams: Lower consumer spending impacts sales and reduces revenue, necessitating the exploration of alternative sources and innovative sales strategies.

- Inventory and Vendor Management Challenges: Reduced sales complicate excess stock management, leading to higher costs. Precise forecasting and renegotiating vendor contracts for better terms are essential.

- Pressure on Pricing Strategies: Balancing profitability with competitive pricing requires teams to adopt dynamic pricing models.

- Need for Consumer Insights: Understanding changing preferences through data analytics is crucial for personalized marketing and product offerings.

- Maintaining Liquidity: Declining sales make liquidity maintenance challenging, necessitating effective cash flow management for operational continuity.

These challenges underscore the importance of agility and strategic foresight for retail finance teams in 2025. By adopting a proactive approach, leveraging technological tools, and focusing on consumer engagement, they can navigate the complexities of a declining consumer spending environment and position their businesses for future success.

When it comes to navigating the economic challenges associated with inflation, increasing interest rates and declining consumer spending, retail finance teams must adopt innovative strategies. 3 particular strategies stand out:

- Effective Cash Flow Management

- Implementing Cost-Cutting Measures

- Leveraging AI and Automation

Let’s take a closer look at each of these strategies.

3 Key Strategies for Navigating Economic Challenges in 2025

Emphasizing robust cash flow management, implementing strategic cost-cutting measures, and leveraging advanced technologies like AI and automation are key pillars in ensuring financial resilience. By embracing these approaches, retailers can maintain agility and competitiveness in a fluctuating economic landscape. Let’s take a look at each of these strategies in detail:

1. Effective Cash Flow Management

Effective cash flow management is crucial for retail finance teams, especially during economic uncertainty marked by inflation, rising interest rates, and declining consumer spending. Monitoring and forecasting cash flow is essential to anticipate potential shortfalls and make informed financial decisions under such pressures.

Key strategies include optimizing accounts receivable and payable processes for timely collections and payments. Retail finance teams currently undertaking manual processes should invest in invoice automation solutions to streamline these processes.

Negotiating better payment terms with vendors can also enhance cash flow flexibility, which is vital during periods of low revenue. The opportunities for this greatly improve when retailers use automation, as vendors receive payments quick, thus enhancing relations.

Maintaining a cash reserve offers a financial cushion, while utilizing financial software provides real-time cash flow insights for accurate decision-making. These practices help maintain liquidity, reduce financial risk, and ensure sustained growth amidst challenging economic conditions.

2. Implementing Cost-Cutting Measures

Amid economic challenges, retailers need to adopt effective cost-cutting strategies to maintain profitability and stability. By performing audits and risk & return assessments to pinpoint inefficiencies, businesses can balance financing costs and better allocate financial resources. Here are the top five measures:

- Streamline Supply Chains: Optimize logistics and negotiate favorable vendor terms to reduce shipping costs and enhance inventory turnover.

- Embrace Outsourcing: Outsource non-core functions such as IT, customer service, or payroll to specialists for increased efficiency at lower costs.

- Enhance Energy Efficiency: Invest in energy-efficient systems and management software to track and reduce utility bills.

- Adopt a Flexible Workforce: Utilize part-time or temporary workers during peak seasons and cross-train employees to manage labor costs effectively.

- Optimize Marketing Spend: Focus on digital marketing for targeted campaigns with measurable results, using data analytics to maximize ROI.

By implementing these strategies, retailers can sustain competitiveness and financial health in the challenging economic environment of 2025.

3. Leveraging AI and Automation

Retail technology holds the potential to navigate the numerous economic challenges to ensure retailers remain resilient and competitive amidst turbulent times and set them up for future growth. According to PwC, global spend on retail technology is forecast to grow 10% each year between 2024 and 2028.

Leveraging technologies like AI and automation can significantly enhance the efficiency and effectiveness of retail finance operations, helping retailers to implement strategies in a number of areas, including:

- Budgeting

- Forecasting

- Dynamic pricing

- Consumer behavior

- Inventory management

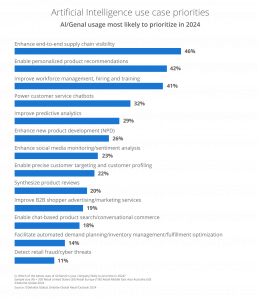

This is reflected in the Deloitte Global Retail Outlook with personalized product recommendations, predictive analytics and automated demand planning/inventory management all named amongst the top AI use case priorities for retailers that can help navigate economic uncertainty.

Implementing invoice automation solutions allows retailers to optimize back-end accounts payable workflows, minimize manual errors, and speed up payment cycles. Automating routine tasks like data entry, invoice processing, and financial reporting provides finance teams with these key advantages:

- Faster payments to vendors facilitating better cash flow management

- Enhanced vendor relations and negotiating power for early payment discounts

- Additional time for staff to focus on strategic activities that drive growth

AI-powered analytics enable retail finance leaders to forecast trends, manage risks, and optimize financial planning with greater accuracy. Machine learning algorithms can analyze vast amounts of data to identify patterns and predict consumer behavior, allowing businesses to apply dynamic pricing and tailor marketing and product offerings and improve customer engagement.

Moreover, automation tools can enhance compliance and audit processes by ensuring accuracy and maintaining comprehensive records. Implementing these technologies not only cuts costs but also improves overall operational resilience.

Embracing AI and automation empowers retail finance teams to remain agile and competitive, equipping them with the tools needed to navigate economic uncertainty and capitalize on emerging opportunities.

The Role of AP Automation in Navigating Economic Challenges

Investing in AP automation is a critical step for retailers aiming to navigate the economic challenges of 2025 effectively. SoftCo provides powerful automation solutions tailored to enhance the efficiency of retail finance operations. With extensive experience partnering with leading retail brands like Superdry, Primark, and Logitech, SoftCo delivers proven tools that drive measurable results.

SoftCoP2P for Retail transforms procurement and accounts payable processes by reducing manual intervention, minimizing errors, and accelerating transaction times. This investment in automation not only optimizes current workflows but also lays the groundwork for long-term operational resilience.

By automating key tasks such as invoice processing and compliance checks, SoftCo’s solutions free up resources, enabling retail finance teams to prioritize strategic initiatives that drive growth. Advanced analytics powered by AI and machine learning uncover spending patterns and highlight cost-saving opportunities—essential for managing inflation, rising interest rates, and other economic pressures.

Furthermore, investing in AP automation ensures compliance with financial regulations, accurate record maintenance, and seamless audits, all of which bolster operational efficiency and governance. This strategic investment empowers retailers to maintain agility and strengthen their competitive edge. With features like insightful reporting and optimized cash flow management, SoftCoP2P equips retail finance teams with the tools they need to thrive in a rapidly evolving economic landscape.