Invoice errors are quietly costing businesses millions — and most don’t even realize it. A staggering 61% of late invoice payments in the U.S. are caused by simple invoicing errors. These mistakes delay approvals, damage vendor relationships, and create unnecessary friction in finance teams.

But the real cost is financial. Companies still using manual or semi-manual invoice processes spend an average of $6.20 per invoice. In contrast, those leveraging advanced invoice automation solutions and broader professional services automation (PSA) platforms pay just $1.83 per invoice, delivering more than a 70% reduction in cost. At scale, this operational efficiency unlocks massive savings and positions accounts payable (AP) as a strategic growth enabler through streamlined financial workflows and improved resource management.

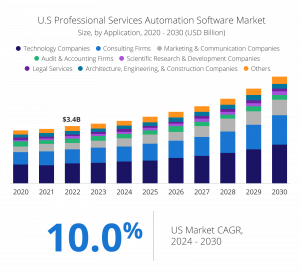

According to a report by Market Research Intellect, the invoice automation software market was valued at $2.87 billion in 2023 and is expected to reach $8.91 billion by 2031, growing at a 14.26% CAGR from 2024 to 2031. This surge reflects a broader industry shift toward cloud-based automation, real-time financial visibility, and end-to-end digital transformation across back-office operations.

How Invoice Automation Works in 2025

Invoice automation in 2025 works through an advanced end-to-end digital workflow that processes vendor bills from receipt to payment. Modern systems utilize artificial intelligence, machine learning, and advanced optical character recognition (OCR) to eliminate manual processing completely.

Documents arrive through digital channels or as scanned paper copies during invoice capture. AI-powered OCR technology converts these documents into machine-readable text with accuracy rates reaching the high 90% range (Capterra). The system extracts essential data including invoice numbers, dates, amounts, vendor details, and line items.

Natural Language Processing (NLP) is a vital component that understands invoice content whatever the format variations. The software understands vendor-specific terminology and categorizes expenses. It flags any discrepancies or missing information to prevent errors (PwC).

Automated validation happens through:

- Cross-checking extracted data against predefined rules

- Verifying vendor details against master databases

- Detecting duplicate invoices and anomalies

- Conducting two-way or three-way matching with purchase orders and receipts

The system routes invoices through approval workflows based on business rules. Machine learning algorithms identify stakeholders for approvals and send immediate alerts. The software automatically approves invoices that meet validation criteria (Gartner).

Approved invoices get automatically mapped to corresponding fields in accounting systems. This integration provides immediate visibility into processing status and enables automated data transfer that eliminates manual entry errors (Forbes).

AI learns continuously from handling exceptions and adapts to new invoice formats. The system applies predictive analytics to historical payment data that helps businesses forecast future expenses and optimize payment schedules (PwC).

By 2025, over 60% of finance professionals expect full accounts payable invoice automation, with AI reducing human errors by up to 40% (Gartner).

6 Hidden Features in Modern Invoice Automation Software

Modern AP invoice automation platforms offer more than simple processing. These platforms come with powerful features that can boost your accounts payable operations, yet many businesses overlook them. These hidden capabilities provide exceptional value.

- Intelligent Data Enrichment and Validation

Advanced systems now verify and improve invoice data quality before it reaches your financial systems. This approach gives you better control over ERP/AP workflows and ends up saving time and money while reducing financial risks (PwC). 30% or more of invoices contain discrepancies even in top companies, which makes this feature crucial. - Adaptive Workflow Intelligence

AI algorithms in modern platforms learn from your approval patterns continuously. These intelligent workflows adjust when processes change or team members take vacation time, which keeps operations running smoothly (Gartner). The software spots patterns in your approval processes and makes automatic adjustments without manual input. - Customizable Tolerance Controls

Premium invoice automation software lets you set tolerance thresholds so invoices with minor differences can move through workflows automatically (Capterra). To name just one example, you might allow automatic approval of an invoice that’s 3% above the purchase order amount if it meets your preset materiality threshold. This eliminates unnecessary reviews. - Early Payment Discount Detection

Smart invoice automation systems spot opportunities to save money through early payment discounts and schedule payments to capture these savings (Forbes). This feature changes accounts payable from a cost center into a potential profit source. - Real-Time Collaborative Dashboards

Unified control dashboards in modern AP automation software show all incoming invoices and provide better visibility throughout your organization (PwC). These shared hubs help make analytical decisions earlier and route invoices to the right business units quickly. - Predictive Analytics and Fraud Detection

Machine learning algorithms analyze thousands of transactions to spot unusual patterns that might indicate fraud (Gartner). Therefore, companies can take steps to stop invalid invoices before they enter financial systems. This creates a resilient audit trail for all activities (PwC).

How These Features Impact Your AP Workflow

Advanced invoice automation features improve operations in your accounts payable department. Companies using automation spend 58% less time processing invoices (Forbes). This change has transformed how AP teams handle their daily work.

The financial benefits go beyond efficiency gains. Companies with invoice automation software cut AP processing costs by 50% and reduce processing time by 75%. This change turns accounts payable from a cost center into a valuable strategic asset. Automated data entry and workflows help teams capture more information and get live insights. Better decisions follow naturally across the organization.

Vendor relationships grow stronger too. Quick approvals and clear communication lead to timely payments. Your business can then negotiate better terms and build lasting partnerships with key suppliers.

Automated invoice processing spots early payment discount opportunities, which helps manage cash flow better. This automation helps businesses speed up payment cycles, remove bottlenecks, and keep suppliers happy.

The biggest advantage might be freeing AP staff from repetitive tasks. Companies cut manual AP work by up to 60%. To name just one example, a leading edtech company reduced their AP team by 40% while keeping high efficiency after automation. Your AP team can now focus on activities that drive business growth instead of pushing paper.

Conclusion

Automated invoice processing offers a valuable chance for businesses as they move into 2025. Our research shows companies that adopt these technologies see real benefits in many areas. They cut processing costs by nearly 70%, reduce processing time by 75%, and lower errors by up to 90%. These improvements directly boost the bottom line.

Modern invoice automation’s power lies in features that many businesses miss. Smart data enrichment, efficient workflows, and live analytics turn simple automation into a competitive edge. AP departments can move from being cost centers to becoming value creators.

The financial effects go beyond just saving time and money. Companies with automated invoice systems get more early payment discounts and build better vendor relationships. Their finance teams can work on projects that stimulate growth instead of dealing with paperwork.

These advanced features help companies handle common invoice processing problems better. The system can spot fraud, adjust approval workflows, and track everything in real-time. This level of security and control makes manual systems obsolete.

Companies that don’t adopt these technologies will fall behind their competitors. The market will reach $8.9 billion by 2031, which shows how important this trend has become. Advanced invoice automation isn’t just nice to have anymore – it’s crucial for businesses that want to stay competitive in 2025 and beyond.

Ready to see how invoice automation can transform your AP process? Discover the hidden features in action and learn how SoftCo can help you reduce costs, eliminate errors, and scale with confidence.

Frequently Asked Questions

Invoice automation significantly reduces processing costs, cuts processing time by up to 75%, and minimizes errors by up to 90%. It also improves cash flow management, strengthens vendor relationships, and frees up AP staff to focus on more strategic tasks.

AI plays a crucial role in invoice automation by powering optical character recognition (OCR) technology, natural language processing for understanding invoice content, and machine learning algorithms for continuous improvement and fraud detection.

Intelligent data enrichment is a feature that verifies, enhances, and improves invoice data quality before it enters financial systems. This proactive approach creates better control over ERP/AP workflows, saving time and money while reducing financial risk.

Invoice automation improves vendor relationships by enabling timely payments and enhancing transparency. This streamlined process allows businesses to negotiate better terms and build stronger partnerships with critical suppliers.

Organizations using invoice automation software report a 50% reduction in AP processing costs. Additionally, it enables businesses to capture more early payment discounts, transforming accounts payable from a cost center into a potential profit center.