Regardless of a company’s size or industry sector, working capital is an important metric in assessing the long-term financial health of the business. While converting assets into cash quickly is crucial, managing the procure to pay cycle is also key to cash flow. In a 2021 PWC report, 65% of executives revealed that working capital management is the main objective of restructuring and change management activities.

The level of working capital available to an organization can be measured by comparing its current assets against current liabilities. This tells the business the short-term liquid assets remaining after short-term liabilities have been paid off.

The Covid-19 pandemic raised significant working capital challenges and uncertainty for organizations. Supply chain disruptions have been a major challenge, along with pent-up consumer demand and the collection of receivables.

Generally, companies will strive for a high level of working capital as it indicates a well-managed company with a greater potential for growth. While a high level of working capital may indicate improved liquidity, operational efficiency, and increased profits, it is equally important to ensure that much-needed funds required for growth are not trapped in working capital. The key to ensuring sufficient cash for operations without hindering growth initiatives lies with the proper management of working capital.

First, let’s look at the key benefits of effective working capital management. We will then delve into some of the working capital trends emerging from 2021 before highlighting 4 key tips for managing working capital.

Benefits of Positive Working Capital

Improved Liquidity

By obtaining a consistently high level of working capital, organizations ensure that adequate cash levels are available for any potential upcoming opportunities or unanticipated scenarios. It also gives organizations more flexibility over how they run their operations, which enables them to fulfill customer orders, expand, and invest in new products at a faster rate.

Operational Efficiency

Optimum use of working capital management evades any future hindrances in business operations. A ‘safety net’ is available to protect against lack of production or delays in payments received.

Increased Profits

A high level of working capital is only achieved when areas including Accounts Payable and Receivable are operating efficiently. In order for both departments to operate efficiently, they need to ensure that they pay their vendors as per the agreed terms, which leads to the capturing of early payment discounts and increasing the income of cash.

Achieving the Correct Level of Working Capital

In spite of the importance of consistently maintaining a high level of working capital, it is also important to understand that there is a level considered ‘too high.’

Having an extremely high level on an ongoing basis can indicate that there is more money within the organization than is needed – that cash is not being invested correctly or company growth is being neglected in favor of high liquidity.

The key is to consistently maintain positive working capital but avoid reaching too high a level that leads to waste and inefficiency.

Before undertaking strategic changes, it is worth taking stock of current working capital trends like low interest rates, mounting debt, and rising prices as we go into 2022.

The State of Working Capital in 2020

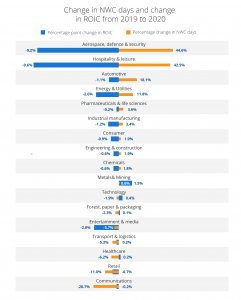

According to PWC’s Working Capital Report, only 7 out of 17 sectors have shown improvements in working capital between 2019 and 2020. Sectors that recorded the largest deterioration in net working capital like Aerospace, Defense, and Security and Hospitality & Leisure suffered significant shocks during the pandemic.

As vaccines became available, companies refocused efforts from recovery and survival to growth. However, business conditions remain unpredictable. Fears of another business disruption and unstable supply chains make it challenging to right-size working capital.

Many companies weathered through challenges during the pandemic while keeping a strong cash position due to readily available debt and government support. In fact, net debt reached a five year high in 2020.

The 2021 Hackett Group Working Capital Survey revealed that amid the uncertainty, companies surveyed reported a 40% increase in cash on hand to address risks and seize opportunities. Debt is responsible for much of this increase as year on year debt levels increased by 10%.

As government support winds down, companies have to keep a closer eye on liquidity and working capital efficiency. Proper management of working capital is critical to achieving growth that generates value and strengthening returns across sectors.

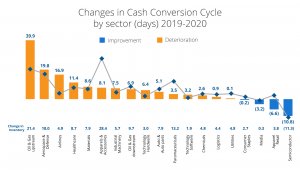

With the economic recovery in 2022, finance leaders and treasurers have to use excess cash reserves for debt repayment, capital investment, and other activities. With the deteriorating cash conversion cycle across most industries, companies have to improve working capital management to support growth initiatives.

JP Morgan’s Working Capital Index reports that a significant amount of liquidity is tied up in the supply chain. Improving working capital efficiency could unlock as much as $507 billion across S&P 1500 companies.

Similarly, the Hackett Group noted a total working capital opportunity of $1.2 trillion for US companies by collecting faster, holding less inventory, and paying suppliers slower. Of the companies surveyed, top performers were able to convert cash in 15.7 days compared to a typical company that requires 46.4 days.

With such working capital opportunities in mind, we have come up with a list of 4 tips for effectively managing your working capital during these economically challenging times.

Tips for Effectively Managing Working Capital

1. Manage Procurement and Inventory

Prudent inventory management is an important factor in making the most of your working capital. Excessive stocks can place a heavy burden on the cash resources of any business. On the other hand, insufficient stock can result in lost sales and damage to customer relations. When looking at inventory, it is important to monitor what you buy, just as much as what you sell. The key challenge for companies is to establish optimum stock levels and avoid driving up costs for physical storage and insurance as well as wasting stock if it is time-sensitive. This can be done by promoting better communication and forecasting between departments.

If stock levels are unknown, then it is difficult to manage the optimum level and the company risks experiencing a loss in sales, as a result of a shortfall in materials. Periodic inventory checks are useful in monitoring levels of different types of stock and alerting finance to any recurring overstock or understock issues.

It is extremely important to control what is purchased. Investment in procurement automation can greatly boost working capital. A centralized procurement process where each purchase requires authorization helps to prevent maverick spending by ensuring that procurement staff are only permitted to order approved products/services from preferred vendors.

2. Pay vendors on time

Enforcing payment discipline should be a key part of your payables process. Analysis of working capital levels shows that the biggest improvement comes from improved payables performance and reduced days payable outstanding (DPO). Extending DPO should no longer be considered a viable option, particularly with many vendors having been affected by the pandemic and therefore unlikely to offer the option.

Companies that pay on time develop better relationships with their vendors and are in a stronger position to negotiate better deals, payment terms, and discounts. It seems like a counter-intuitive way of maintaining a steady level of working capital, but if you keep your vendors happy, it could save you money in the long run when it comes to getting larger discounts for bulk buying, recurring orders, and maximizing the credit period.

3. Improve the receivables process

In order to shorten the receivables period, organizations need to have a good collections system in place. One important aspect of working capital is to send out invoices as soon as possible. Companies should reassess invoicing processes in order to eliminate inefficiencies that may be causing delays in sending invoices to your debtors. Such inefficiencies may include manual processing, lost invoices, and a high volume of invoices to manage.

Deloitte recommends using accounts receivable technology to deliver invoices electronically in order to speed up billing and collection and ultimately shorten the cash conversion cycle. It is also vital to ensure that invoices are accurate before they are sent to your debtors to avoid delays in payments. Maintaining an accurate debtor’s ledger ensures that you are on top of debtor collection dates and can send timely reminders to your customers regarding payment.

4. Manage debtors effectively

The best way to ensure you have enough working capital available is to make sure money is coming in on time. Reassessing your contracts and credit terms with debtors may be necessary to make sure you are not giving debtors too big a window to pay for goods and services, as this may be impacting negatively on your own company’s cash flow.

CFOs should review credit terms with company management to ensure that the level of credit offered to debtors is appropriate for your company’s cash flow needs. To reduce bad debts, implement more rigorous credit checks and ensure that effective credit control procedures are in place for chasing late-paying customers.

Conclusion

The Covid-19 pandemic has presented a number of working capital challenges for businesses across a range of industry sectors.

Going into 2022, the economic impact of the pandemic is fading but as seen in 2021, the strong and uneven rebound creates the main macro risk of high inflation. With prices rising quickly everywhere, businesses must look at new ways to finance working capital in order to maintain operations.

By focusing on inventory, payables, and receivables, organizations will be best placed to maintain adequate cash flow and maintain short-term commitments in the months ahead.

Working capital management is an accurate barometer for assessing the long-term financial health of a business and ensures that adequate cash flow is always maintained to meet its short-term commitments. On the road through economic recovery, managing working capital effectively remains a top priority for CFOs, now, more so than ever.

If you would like to learn more about how to manage your working capital, you can download our whitepaper here.