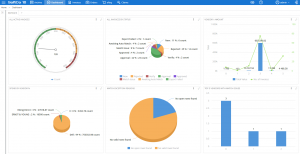

It is also important that this system is as easy to use as their consumer-based applications, as they want to be able to monitor the status of invoices, and continuously track progress through the use of KPIs and reports.

For many organizations, this is not the reality. Currently, many finance professionals either complete different tasks for procurement, invoicing, vendor management, document archiving, and financial reporting using manual processes. In some cases, organizations use stand-alone systems for each individual task.

What results is the inconvenience of having to log on to different applications in order to complete these tasks or to monitor progress. The consequence of having multiple platforms to manage different tasks ultimately comes down to a lack of visibility over processes.

Gaining a Single View

There are solutions for these issues: you have the choice to automate financial processes using either ERP modules or third-party solutions. However, it is important to consider some common issues with automating processes by deploying ERP modules or traditional third-party automation solutions, which include:

- Managing multiple systems that are poorly integrated, and multiple vendors for different processes, such as procurement, e-invoicing, vendor management, document archiving, and analytics

- Having poor usability due to a clunky user experience, which leads to a huge training requirement and ultimately, low user adoption

- Using rigid systems that cannot be easily configured to meet the specific requirements of an organization

What to Look for in a Solution?

When choosing a best practice automation solution for the purpose of combining many different modules, you should look for the following features:

- The automation solution should have a single point of integration with all existing ERP/finance systems to include real-time, bi-directional data transfers and full, seamless integration.

- It should feature a simple, easy-to-use user experience, so that tasks can be completed quickly, without the need for extensive on-boarding and training for users.

- It should have one log-in and one intuitive interface is extremely important to give one view over all processes.

- The automation solution should be easily configurable as the needs of the business change.

The Definitive Solution

SoftCo is a single, powerful platform that supports multiple, fully-integrated modules: Capture, Workflow, Archive, Analytics, and Integration. These modules are incorporated in SoftCo’s innovative solutions in the areas of procure-to-pay (P2P), accounts payable (AP), accounts receivable (AR), and enterprise content management (ECM).

SoftCo is a single platform that supports various deployment methods, modules, and solutions. Unlike current legacy systems where finance teams must log on to the multiple different systems and manually join the dots themselves to get the visibility they need for decision making and reporting, SoftCo presents all necessary information in one view.

SoftCo was specifically designed to allow finance professionals to use one single platform for all areas of procurement and finance, whether it’s P2P, AP, AR, or document management and archiving. To read more about SoftCo and how it can be used to combine multiple modules on a single platform, click here.