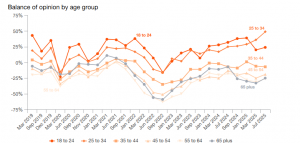

Consumer sentiment has now improved beyond the long-run average, a positive turn after three successive quarters of decline. This uplift is undoubtedly encouraging news for retail, consumer, and leisure sector operators. However, the improvements in consumer confidence are unevenly distributed across demographics. Only the 25–34-year-old demographic and the most affluent socioeconomic group report feeling more optimistic compared to last year. Understanding this widening gap is crucial for businesses seeking to navigate and thrive in the consumer market over the coming months.

Rising Sentiment Amidst Persistent Economic Challenges

The latest PwC consumer sentiment survey reveals net consumer confidence measured as the difference between individuals who believe they will be better off financially next year versus those expecting to be worse off has risen from -12 to -5. Although this marks the highest point in 2025, it paints an incomplete picture. Optimism is primarily concentrated among younger adults (aged 25–34) and higher-income households. Contrastingly, every other demographic has experienced deteriorating sentiment compared to the same period last year.

Source: PwC Consumer Sentiment Index

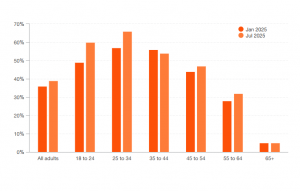

Historically, household finances had shown consistent improvement since 2022; however, this trend stalled in early 2024, with current financial circumstances deteriorating even beyond immediate post-election levels. Once again, the 25–34 age group (41%) exhibits stronger-than-average financial stability, while under-25s and those over 45 have faced increased financial pressure. Both groups are in a better financial position than the UK average, while other demographics appear to be falling behind.

The widening polarisation identified in PwC’s Spring consumer sentiment survey has continued. Concerns around inflation and job security have notably deepened, especially among young and lower socioeconomic groups.

Mixed sentiment across consumer segments

Previous surveys showed polarisation between the most optimistic and pessimistic demographic groups narrowing, but this trend reversed last quarter, potentially indicating tougher times ahead. Key demographic insights include:

- The 25–34-year-old group remains optimistic, benefiting from policy measures such as National Insurance rate cuts, National Living Wage increases, and stable job prospects.

- Many in this group face fewer financial burdens, such as mortgages and family-related expenses.

- Older demographics and lower-income groups grapple with inflation, job uncertainty, and worsening household finances.

The financial gap between age groups is also shifting:

- 25–34-year-olds (41%) and those aged 65+ (44%) now have comparable financial health.

- Traditionally stronger retirees now see younger adults catching up due to beneficial policies.

- Both demographics remain above the national average financially, while others fall behind.

Economic Concerns Influencing Consumer Spending

Economic stability, inflation, and employment prospects continue to shape consumer spending decisions in 2025. Job insecurity particularly affects younger consumers, amplifying anxieties around career stability. Inflationary pressures have heightened universally, prompting cautious financial management and selective spending.

Source: PwC Consumer Sentiment Index

Spending Intentions Stabilise but with Continued Caution

After previous declines, spending intentions are stabilising. Grocery spending, driven by anticipated ongoing inflation, is expected to increase over the next year. Conversely, consumer interest in big-ticket items like furniture and household appliances has softened, indicating cautious financial decision-making.

Younger consumers (under 35) show greater willingness to allocate discretionary funds, prioritising essentials but also demonstrating interest in fashion, beauty, technology, and leisure activities. This presents targeted opportunities for retail and hospitality sectors seeking to offset subdued spending from older groups.

Implications for Retail Operators: A Mixed Picture

Overall consumer sentiment surpassing the long-term average signals cautious optimism. Yet, beneath the surface, a fragmented picture emerges, with financial improvements largely limited to young adults and affluent consumers. Other demographics remain less financially secure.

Despite economic uncertainties, retail and hospitality sectors had a relatively strong start to 2025. Rising sentiment among select demographics might signal potential future improvement if optimism broadens. Nonetheless, caution remains essential, given persistent inflation, job insecurity, and careful spending behaviours.

Looking ahead, close monitoring of demographic divergence is critical. Businesses must remain agile, strategically tailoring their offerings to diverse consumer financial realities and priorities. If consumer confidence continues to grow and economic conditions stabilise further, the retail and hospitality sectors may witness strengthened consumer spending momentum.

Strategic Opportunities with SoftCo

In this environment of economic uncertainty and cautious consumer spending, businesses can benefit significantly from automation solutions. SoftCo’s procure-to-pay, and AP automation solutions deliver crucial cost control, financial efficiency, and enhanced spending visibility, enabling businesses to navigate challenging economic conditions confidently. Embracing automation can strategically position companies to mitigate risks and drive financial performance amidst evolving consumer dynamics.

Frequently Asked Questions

Consumer confidence has improved and is now above the long-run average, driven mainly by 25–34-year-olds and affluent groups.

The 25–34 age group and higher-income households show the most optimism and financial stability.

Inflation, job security, and economic uncertainty remain top concerns across most groups.

Grocery and essential spending are increasing, while big-ticket purchases are declining due to caution.

It helps retail and hospitality businesses understand shifting consumer behaviours and tailor strategies accordingly.