Legacy accounts payable (AP) systems in aviation are like trying to fly a modern jet with outdated controls — they slow down operations, create inefficiencies, and expose airlines to fraud risk. As PwC’s 2025 Aviation Outlook highlights, digital reinvention is no longer optional: airlines must modernize their finance systems to stay competitive in an industry facing rising costs, complex supplier networks, and mounting regulatory pressure.

Yet most finance functions are still behind the curve. According to IFOL’s 2025 research, 73% of finance teams across industries continue to rely on manual AP processes — a gap that becomes especially critical in aviation digital transformation, where resilience depends on fast, secure, and reliable supplier payments.

This blog explores how outdated AP processes are holding airlines back, the inefficiencies and fraud risks they create, and how AP automation is helping the aviation industry achieve broader digital transformation goals — improving compliance, resilience, and operational efficiency.

TL;DR

- Airlines running manual AP are taking on avoidable fraud risk, delays, and cost.

- Digital AP is becoming a core pillar of aviation finance transformation — not a “nice to have.”

- Automation tightens controls, accelerates approvals, and protects cash flow across complex supplier networks.

- Integrated AP + ERP gives airlines real-time visibility, faster month-end, and stronger compliance.

- The payoff: fewer grounded operations from payment bottlenecks, stronger supplier trust, and a more resilient finance function.

The Inefficiencies and Fraud Risks of Legacy AP Systems

Outdated finance systems are holding back aviation’s digital transformation. Manual, paper-heavy processes not only slow down operations but also expose airlines to growing fraud risk. In an industry where margins are tight and resilience is critical; these outdated systems create vulnerabilities airlines can no longer afford.

Inefficiencies in Aviation AP

Traditional AP processes in aviation remain heavily manual — from paper-based invoicing to manual data entry and approvals. These workflows are slow, error-prone, and resource-intensive.

- Delays and backlogs: According to IFOL, 63% of finance teams spend more than 10 hours each week on invoice processing, with manual systems taking up to twice as long as automated ones. For airlines managing thousands of supplier invoices each month, these delays cascade into late payments.

Source: IFOL Accounts Payable Automation Trends 2025

- Supplier strain: Payment delays don’t just inconvenience finance teams; they disrupt critical supplier relationships, from fuel providers to MRO shops.

- Cost of inefficiency: 66% of finance teams still manually key invoice data into ERP systems, creating unnecessary bottlenecks and increasing error risk.

The result? Slower payments, strained vendor trust, and lost opportunities to optimize cash flow. For airlines navigating tight margins and complex supply chains, such inefficiencies directly undermine aviation resilience.

Fraud Risks in Legacy Systems

Inefficiency is only half the problem. Manual AP processes also open the door to fraud — a growing risk as payment fraud becomes more sophisticated and cyber-enabled.

- Weak controls: Paper trails and siloed approvals lack the real-time monitoring needed to spot irregularities.

- Invoice fraud exposure: IFOL reports that 27% of organizations have seen vendor relationships damaged by AP inefficiencies, with fraud and disputes among the leading causes.

- Financial losses: According to IATA, fraud already costs the airline industry billions each year — equivalent to around 5% of total revenue. Outdated systems leave airlines especially exposed, making it easier for false vendors, duplicate invoices, or cyber-enabled payment diversion schemes to slip through.

Stronger controls are no longer optional. Without automation, airlines remain exposed to both internal errors and external fraud attempts — risks that directly threaten financial stability and operational continuity.

For airlines balancing razor-thin margins and complex supplier networks, these vulnerabilities are unsustainable. The answer lies in AP automation — replacing outdated processes with digital workflows that strengthen controls, accelerate payments, and embed resilience at the heart of aviation’s financial systems.

The Impact of AP Automation on Aviation’s Digital Transformation

AP automation in aviation is more than a back-office upgrade — it is a catalyst for digital transformation. By digitizing payables and integrating with finance systems, airlines not only eliminate inefficiencies but also strengthen compliance, resilience, and supplier trust.

Digitizing the Payables Process

Manual, paper-heavy workflows slow airlines down. AP automation replaces these with digital invoicing, automated approvals, and electronic payments.

- Faster cycles: Automated invoicing reduces processing times from weeks to days, accelerating payments to critical suppliers like fuel providers and MRO shops. Accenture forecasts global MRO spending to rise 14% in 2025, meaning delays in payables can directly translate into grounded aircraft and extended turnaround times.

- Accuracy & transparency: Digital approvals remove manual errors while ensuring full auditability and accountability across every step of the process.

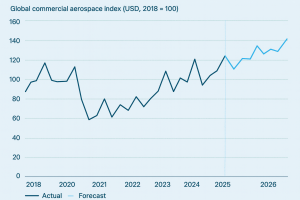

- Cash flow protection: With global aerospace revenues projected to grow 12% in 2025, airlines that digitize back-office finance functions like AP will be better positioned to protect cash flow, meet supplier expectations, and withstand margin pressures.

Source: Accenture Commercial Aerospace Insight Report 2025

This is where AP automation becomes a driver of aviation digital transformation, ensuring financial processes keep pace with the industry’s operational demands

According to IFOL’s 2025 report, AP teams with high levels of automation complete invoice processing in as little as two days, compared with more than five for manual or partly automated teams. That speed doesn’t just reduce costs — it strengthens supplier trust and keeps critical inputs moving across aviation’s fragile supply chains.

Integrating with ERP and Finance Systems

The true value of AP automation emerges when it is fully integrated with ERP and finance systems. For airlines, this creates seamless data flows, real-time visibility, and a stronger foundation for decision-making.

- Real-time insight: Integration gives finance teams instant visibility into liabilities, enabling sharper forecasting and tighter cash management — essential as MRO capacity constraints and cost pressures continue to escalate.

- Operational consistency: Connected systems eliminate duplication, improve accuracy, and strengthen enterprise-wide reporting.

- Strategic alignment: Embedding AP automation within ERP moves airlines beyond transactional processing into proactive financial leadership — freeing capacity, improving oversight, and aligning finance with digital transformation goals.

For aviation, AP automation integrated with ERP isn’t just about paying invoices faster — it’s about building the agility and resilience needed to navigate rising costs, supply chain disruption, regulatory pressure and the broader demands of aviation digital transformation.

Want to dig deeper into the cost side? See how airlines are cutting spend with AP automation without cutting corners in this blog.

Improving Security and Operational Resilience

Enhancing security and resilience is a critical component of aviation’s digital transformation. In an industry where compliance, transparency, and reliability are non-negotiable, AP automation in aviation provides airlines with the tools to meet regulatory demands while embedding long-term resilience.

If you want to see how airlines are managing rising geopolitical risk with smarter AP automation, explore our blog on how finance teams are buckling under global pressures — and what can help.

Enhancing Compliance and Audit Trails

Compliance with financial and regulatory standards is imperative in aviation. Automated AP systems deliver detailed audit trails, real-time monitoring, and secure data storage that together create transparency and accountability.

- Automated reporting: Airlines can demonstrate compliance quickly and accurately, reducing audit preparation time.

- Real-time tracking: Instant visibility into transactions lowers regulatory risk and improves governance.

- Secure data storage: Strengthens integrity and protects against tampering or loss.

These capabilities don’t just help airlines pass audits — they reinforce stakeholder trust. Stronger digital controls are becoming a foundation of sustainable aviation finance, particularly as regulatory scrutiny continues to intensify.

Building Operational Resilience

Operational resilience in aviation requires more than operational efficiency; it demands financial reliability. AP automation reduces vulnerabilities created by legacy systems and provides the visibility needed to manage disruption. Key advantages include:

- Continuity: Suppliers are paid on time, even during disruption.

- Risk management: Stronger internal controls reduce exposure to fraud and errors.

- Agility: Real-time financial insight enables quicker responses to supply chain shocks.

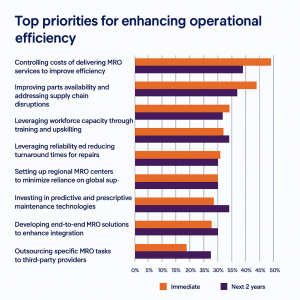

Accenture’s 2025 Commercial Aerospace report notes that leveraging digital tools and data to improve operational processes is among airlines’ top two-year priorities — and AP automation is a direct example of this principle in action, applying digital finance to strengthen both operational and financial resilience.

Source: Accenture Commercial Aerospace Insight Report 2025

Meeting Broader Digital Transformation Goals

AP automation also plays a central role in aviation’s wider digital journey. By eliminating inefficiencies and embedding stronger controls, it aligns finance with the strategic objectives of digital transformation:

- Efficiency: Streamlining processes and reducing costs.

- Agility: Enabling faster, data-driven decision-making.

- Reliability: Ensuring suppliers and partners deliver consistently, improving downstream service

Airlines that embed digital efficiency into finance functions are better positioned to capture growth while navigating ongoing supply chain volatility. By integrating compliance, resilience, and strategic alignment, AP automation becomes more than a back-office upgrade — it is a cornerstone of aviation’s broader transformation, enabling carriers to operate securely today while building the foundation for long-term competitiveness.

Conclusion: Securing Aviation’s Future Through AP Automation

The aviation industry is navigating one of its most complex periods: aircraft shortages, rising costs, and fragile supply chains continue to test resilience. Yet too many airlines remain weighed down by outdated AP systems that slow operations, expose them to fraud, and erode supplier trust.

AP automation in aviation delivers far more than efficiency — it embeds compliance, visibility, and financial reliability at the core of aviation digital transformation. By digitizing payables, integrating with finance systems, and embedding real-time controls, airlines can strengthen supplier relationships, protect operations from disruption, and build resilience where it matters most.

In aviation, resilience starts with finance. AP automation turns back-office vulnerability into strategic advantage — giving airlines the foundation to scale, adapt, and compete in a digital-first future.

Airlines that act now will streamline operations, rebuild supplier confidence, and secure long-term aviation resilience. Learn how SoftCo AP Automation for Aviation helps leading carriers modernize finance and build sustainable growth.

Frequently Asked Questions

Airline invoices are unusually complex — fuel uplift, airport handling, navigation fees, MRO events, and route-specific charges can vary flight-to-flight. Modern AP automation platforms extract and match these line items automatically, validate them against flight IDs or POs, and route exceptions back to operations for approval. This cuts manual reconciliation dramatically and reduces the risk of paying incorrectly coded charges.

Yes. Aviation-focused AP systems integrate directly with ERP and flight-ops data so every invoice can be tied to a specific tail number, flight ID, base, or route. This improves cost allocation accuracy, speeds up month-end close, and gives finance teams real-time visibility into route profitability — something manual AP can’t deliver.

Airlines rely on hundreds of suppliers across global stations — from ground handling to fuel to local maintenance providers. AP automation centralizes invoice capture, applies consistent approval rules across all locations, flags duplicate vendor records, and standardizes controls worldwide. The result is fewer regional bottlenecks, fewer disputes, and a consistent, audit-ready AP process across the network.

AOG delays often trace back to payment issues — an unpaid handling invoice, a disputed MRO bill, or a delayed fuel payment. AP automation accelerates approvals, ensures critical suppliers are paid on time, and provides real-time visibility into outstanding liabilities. By removing payment bottlenecks, finance teams reduce the risk of operational disruption linked directly to AP delays.

Airlines manage complex supplier networks — fuel, handling, MRO, navigation fees, ground ops, caterers — each producing thousands of invoices every month. Manual processes slow down payments, increase error rates, weaken compliance, and create avoidable operational disruptions.