The process can be very manual and time-consuming: bills, supplier invoices, loans, and other payables, can leave anyone struggling to keep up. Not only that, mismanagement can often lead to serious consequences across your business. We have identified five of the biggest challenges in the manual accounts payable process.

Challenges with Manual Accounts Payable Processes

1. Manual Data Entry Mistakes

No matter how reliable your workforce is, occasionally, there will be cases of human error. If you’re still relying on manual accounts payable processes, you may find that there are more errors in your data than you think. This can lead to underpaid or even overpaid invoices and a host of other problems that could lead to substantial financial trouble for your business down the road. Manual data entry also sucks down resources across your company that can be used for other tasks.

Accounts payable process automation uses scanning and other data entry tools to prevent you from sacrificing both time and money. Adding a technical layer to the process removes the need for someone to check over manual data entry and decreases the likelihood of mistakes.

2. Inability to Manage and Store Information

You go through a lot of data in the accounts payable department every day. There are invoices, bills, and a wide range of documents that need to be consulted again later. Manually storing and tracking these documents is challenging and overwhelming. How is all that vital information stored at your company? How do you access it when you need to look back at past information? In a Levvel Research survey, AP staff listed manual data entry and inefficient processes as two of the top accounts payable challenges.

If your business doesn’t have a solid information management system in place for your accounts payable data, you may find yourself struggling to put together simple reports or to double-check vital information. As a result, it may take both time and resources that you don’t have. Instead, your organization needs to digitize data management to ensure efficient and compliant document management. Enterprise Content Management (ECM) platforms enable organizations to index and categorize documents during the capture process so they are easily searchable.

3. Slow Approval Processing

Invoice approval is a necessary component of any AP process. Without it, invoices won’t get paid. Processes like this are designed to protect the company and help prevent theft and other potential problems. That process, however, shouldn’t be a long, slow, and frustrating one for both you and the companies you’re working with. Slow approval processing can lead to delays in invoice payments, which can, in turn, make it difficult to process future interactions with your suppliers. That said, there are a number of different steps that could offer a number of substantial advantages to your business, such as qualifying for early payment discounts:

- Automate invoice approval routing

- Email Approval

- Automate matching of invoices, purchase orders, and receipts

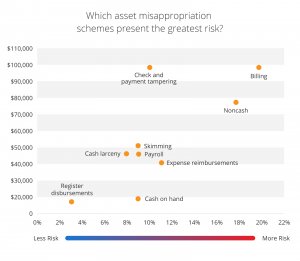

4. Vulnerability to Fraud

In a 2022 Global Fraud Study by the Association of Certified Fraud Examiners, fraudulent billing accounted for 20% of all fraud cases. Billing fraud is the most common form of asset misappropriation, with the highest median loss of $100,000 – making it one of the biggest accounts payable problems for many companies. Cases related to check and payment tampering have the same median loss of $100,000, but they only account for 10% of all reported fraud. From check tampering to invoices that don’t match the other expenses faced by your business, fraud is rampant in manual accounts payable processes.

This is another area where simplification is one of the most effective ways to protect your business. When there are fewer individuals working with your accounts, it’s easier for those who are involved to spot potential problems, rather than allowing fraud to fly under the radar. Creating a solid system of checks and balances so that no one individual can ever sign off on a particular invoice can also help catch fraud where it starts, rather than allowing it to go on indefinitely.

5. Lack of Visibility

When payments are issued by your organization, you need to be able to track their progress. When was the invoice issued? When was the payment made? Has it cleared the bank account of your supplier? If your organization is still using paper records, it can be incredibly difficult to track payments throughout the entire process. Not to mention increasing the difficulty of sharing that information with suppliers and other individuals.

Implementing a digital finance system, on the other hand, provides higher levels of visibility and allows you to easily track your payments throughout the entire process. Finance platforms give finance leaders full control and visibility over the entire AP process, which fuels better decision-making.

Conclusion

Dealing with the accounts payable problems associated with manual processes can feel like a nightmare. However, AP doesn’t have to be the most chaotic department in your business. By opting for automation, increasing visibility, and using solid digital systems, you can significantly improve your entire accounts payable department. This makes it easy to see exactly where those vital funds are going and how they’re being processed and managed.

Discover the ins and outs of AP automation by checking out our complete guide, tailored for both beginners and seasoned professionals.