Accounts Payable teams often struggle through a daily grind of invoices and requests, bogged down by manual tasks. Manual processes or low-level automation trigger delays in payments, high error rates, and a lack of informed insights. As a result, the competitive field to solve AP issues is growing, along with adoption levels.

AP Invoice Automation (APIA) solutions are designed to streamline workflows from capturing to approval and payment of invoices. Gartner forecasts that the spend on the APIA and supplier e-invoicing software markets will be nearly $1.75 billion through 2026, up from approximately $925 million in 2021, at a compound annual growth rate (CAGR) of 14%.

It’s easy to see why when you consider the significant benefits of AP automation, including:

- 90% cost reduction

- 90% lower approval time

- 70% fewer supplier queries

Sourcing AP invoice automation software to increase efficiency is no longer a luxury, but how do you pick an effective solution in the crowded market? In this blog we examine some of the advice that Gartner outlined in their recent Market Guide

AP Invoice Automation Landscape

At first glance, the AP invoice automation market seems to be littered with providers and spoiled for choice. Distinguishing available AP automation solutions is challenging, and many begin to look similar.

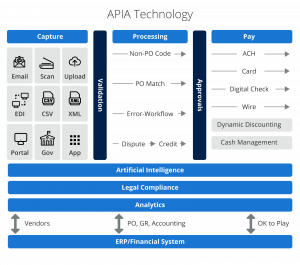

However, many vendors often only address needs partially and may originate from adjacent markets like procurement, ERP systems, RPA, intelligent document processing, or content management. A standalone APIA solution addresses needs ranging from data capture, invoice matching, coding, and approvals to payments.

Not all of these features may be available. At the lowest end of automation, digitizing data is often the first step. Enhancing data capture with AI is the most commonly observed type of automation, and an estimated 75% of solutions carry this feature.

If you take a closer look, the functionalities of APIA solutions that extend into advanced features like artificial intelligence and machine learning(AI/ML) can be somewhat limited. According to Gartner, less than 10-20% of the market offers features like:

- Smart workflows to continuously learn and adjust approval workflows (15% of the market)

- Intelligent computer vision and Natural language processing (NLP) supported data capture (10% of the market)

- Non-PO or fuzzy invoice matching where invoices don’t sync with POs or have missing or incomplete data (20% of the market)

- Supplier identification that can differentiate between vendors without confusion, for example, in related suppliers (15% of the market)

- Price auditing or surcharge handling (5% of the market)

- Dynamic discounting programs that find appropriate suppliers (10% of the market)

These technologies rely on sophisticated AI/ML tools, and 92% of executives surveyed agree their workflows will need to be digitized and leverage AI automation by 2025.

Addressing Invoice Processing Needs

Demand for Touchless Processing

About half of finance leaders say workflow execution management is their top goal, enabling greater productivity and transparency. AP automation fulfils this role, enabling 90% Touchless Processing to eliminate the majority of the manual work. Especially amidst financial constraints and labor challenges, automating workflow demonstrably reduces time and costs.

Increasing Government Regulations

Government regulations continue to push toward digitization, requiring organizations to employ digital invoice processing for compliance such as:

- Continuous Transaction Controls (CTC) in LATAM, India, Italy, China

- Mandatory B2B e-invoicing in Belgium in 2026

- New clearance models in France in 2026, where government agencies must approve invoices before they are sent to the recipient

- Post-audits in the EU, where invoices are audited after being sent

At the same time, cross-border invoices and payments continue to grow — exceeding $150 trillion —making compliance with multiple laws and regulations more challenging.

Evaluate Performance

Calculating current performance metrics is an essential first step in evaluating the potential for automation. As per Gartner,” Calculate the current invoice capture-to-OK-to-pay cycle time and the current touchless processing rate. If capture-to-OK-to-pay is more than seven days, and/or touchless rates are less than 50%, there is a good opportunity for automation.” .

Identify Specific Criteria

Dig into the specifics of your existing invoice volumes, geographic distribution, PO vs non-PO invoices, and bottlenecks. The size of your business and invoice complexity influence processing needs, which can include varying levels of intelligent data capture, account coding, or compliance support required. Enterprises may need complex smart coding with multilingual support, ML-supported matching, and real-time integrations.

Factor in your existing technology, especially surrounding accounting, procurement, and payments, while aligning your objectives with key stakeholders. To smooth the transition to effective workflows, find APIA providers who can support training and adoption seamlessly.

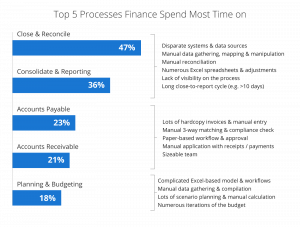

As one of the top 5 processes finance teams spend the most time on, accounts payable bottlenecks spill over into other accounting processes like closing and reconciliation or consolidating and reporting. Advanced analytical capabilities using real-time data also boost strategic decision-making. These are all considerations that influence your AP invoice automation vendor selection.

Finding the Best AP Invoice Automation Solution

Building a business case should be straightforward and based on clear benefits. For instance, procurement leaders value the improved vendor relationships from an automated invoice process. You’ll improve working capital management, reduce late payments, reduce fraud and error, comply with company controls and regulatory policy, and maximize resources and time.

Shortlist AP invoice automation vendors based on their fit with your operations and strategy. Confirm that an invoice automation solution can deliver the capabilities and integrations you need. For best results, put a prospective solution to the test.

Using a sample of your actual invoices, even on short notice, an effective APIA provider should be able to demonstrate results. This will give you hard data and insights into processing. Gartner recommends “Pressure-test a vendor’s ability to provide end-to-end automation by providing a sample of invoices to run a proof of concept before signing a contract. “

As the APIA market accelerates and solutions mature, organizations have an opportunity to dramatically transform efficiency and visibility. By thoroughly evaluating current challenges, setting future vision, and selecting the right automation partner for your needs, companies can reduce costs, improve cycle times, minimize risk, and scale operations. To learn more about the evolving APIA market, download the for Account Payable Invoice Automation Market.

Gartner, Market Guide for Accounts Payable Invoice Automation Solutions, Micky Keck, Balaji Abbabatulla, and 1 more, 7 August 2023

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.