The growth of ML is such that 82% of organizations demand machine learning skills. Although artificial intelligence (AI) and machine learning (ML) are often used interchangeably, they play distinct roles in enhancing efficiency in financial automation. Skepticism about AI and ML often stems from concern that these technologies will completely replace human decision-making, introducing new issues and pitfalls. In this article, we explore the difference between the two and the significant and hugely transformative application of these technologies to procure-to-pay (P2P) automation.

What is Artificial Intelligence, Machine Learning, and AutoML?

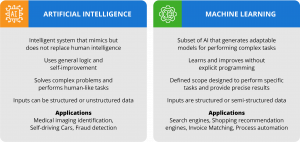

AI and ML have sparked widespread excitement, with estimates that they will drive $4.4 trillion in business value by 2025. AI is an umbrella term for software that mimics human cognition to perform complex tasks and learn from them. ML is a subset of AI that uses algorithms trained on structured data to generate adaptable models that make predictions and perform a variety of tasks.

The difference between AI and ML is clearest in their goals. The goal of ML is to allow machines to learn from data to produce accurate outputs that go beyond following rules. The goal of AI is to create intelligent systems that can process tasks like humans and offer valuable feedback. Through analyzing high volumes of data and problem-solving, AI algorithms can analyze medical images, assist with identifying disease characteristics, and even discover new antibiotics. Classic machine learning examples include search engines and shopping or content recommendation engines that learn about consumer preferences and provide suggestions. Netflix has famously proclaimed that their recommendation algorithms save them $1 billion per year.

AutoML takes ML a step further by automating time-consuming and iterative tasks involved in ML model development. It allows data scientists, analysts, and developers to build models efficiently at scale with continuous learning and improvement. In essence, the software learns from itself in real-time as more data and feedback are added, instead of using a static dataset.

Picture your Netflix recommendation system. It analyzes your viewing history and preferences, then recommends shows you might enjoy. Behind the scenes, AutoML helps in selecting the right algorithm and fine-tuning it to ensure the system keeps improving its recommendations.

How AI & ML should be used in Finance Automation

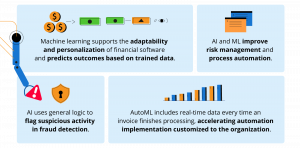

Half of all businesses have adopted AI in at least one business unit, with finance automation emerging as a prime target for AI implementation. AI and ML excel at improving risk management and process automation.

Organizations lose an estimated 5% of revenue to fraud each year, according to the 2022 Association of Certified Fraud Examiners Report. To combat fraud, AI uses general logic to flag suspicious activity. As the software establishes a baseline of “normal” organizational behavior, it can detect anomalies that require further review. The AI does not take action – instead, it alerts the business, which will make the final decision. After human review is completed, the decision informs the AI algorithm for future interpretations.

Nowhere is continuous learning more conspicuous than in machine learning. Machine learning supports the adaptability and personalization of financial software and predicts outcomes based on trained data. By handling and searching for patterns on large datasets, machine learning speeds up analysis and helps to automate repetitive, time-consuming processes.

However, non-AutoML uses relatively static training, based on a defined dataset. While non-AutoML may be updated periodically, AutoML includes real-time data every time an invoice finishes processing. Instead of relying on stale data, the engine learns immediately, accelerating automation implementation customized to the organization.

How SoftCo Applies AI and AutoML

SoftCo’s AI-powered platform is designed to process vast amounts of data, identify patterns quickly, and transcend the resource limitations of a human AP team. By integrating and analyzing data, AI reduces manual efforts and generates insights to improve AP decision-making. For example, AI drives fraud detection in SoftCo solutions, finding unusual patterns and alerting the business to make a final decision.

First, AI establishes a baseline of normal vendor behavior based on previous invoices, up to real-time. Then, if projected outcomes do not meet expectations, the system raises the issue. Let’s say a vendor typically submits one invoice per month for $1,000 each. If the vendor suddenly sends 10 invoices billing $5,000 each within a 24-hour period, SoftCo SmartAI will flag the suspicious behavior and present it to the AP team for review. High volumes of invoices can be processed without compromising fraud detection.

SoftCo AutoML ‘learns’ based on 250+ patterns, including tolerance, aggregation, and confidence match criteria, and applies this automation to all matching models to maximize invoice matching results. Once invoice matching is completed, the results and feedback are recorded and immediately incorporated into the AutoML algorithms. The optimum coding and routing of invoices are also determined by AutoML based on continuously learned patterns. The results are exceptional.

For example, a common processing issue with AP teams is different units of measure (UOM), such as if a customer buys one box that contains 12 widgets and is invoiced for 12 widgets instead of one box. Using SoftCo’s Machine Learning AutoML, the matching engine analyzes data from previous invoice processing for a particular vendor to see which match type was most successful. If the matching engine cannot match one box with 12 widgets, it may switch over to aggregate matching to match the total invoice amount. The matching engine can try millions of possible combinations within milliseconds to find the best possible outcome before sending it to the AP team, who can approve or reject a match. With more data points, the quality of the algorithms is constantly improving, along with the straight through processing rates.

With SoftCo’s AutoML platform, a remarkable 90% straight-through processing rate for PO invoices is achieved, while non-PO invoices are processed on average 89% faster. Book a demo with us to see AI and AutoML in SoftCo10.6 generate immediate results and start transforming your P2P efficiency today.