Airlines operate on some of the slimmest margins in business, with fuel, maintenance, and airport fees consuming most of their operating budgets. The International Air Transport Association (IATA) projects a 3.7% profit margin for the industry in 2025, an improvement from 3.4% in 2024, but still low compared to other industries. In this high-cost environment, every efficiency gained directly impacts profitability. Yet many carriers still rely on manual invoice processing, leaving them vulnerable to errors, duplicate payments, compliance risks, and missed early-payment discounts.

That’s where airline AP automation comes in. By automating accounts payable workflows, airlines can streamline invoice approvals, improve accuracy, and gain real-time visibility into spend. The result? Significant cost savings, stronger margins, and greater financial resilience in a highly competitive aviation industry. In this post, we’ll explore why invoice automation for airlines is no longer just a nice-to-have, but an essential strategy for protecting profitability and long-term growth.

Top Cost Challenges in the Airline Industry (Fuel, Maintenance, and Airport Fees)

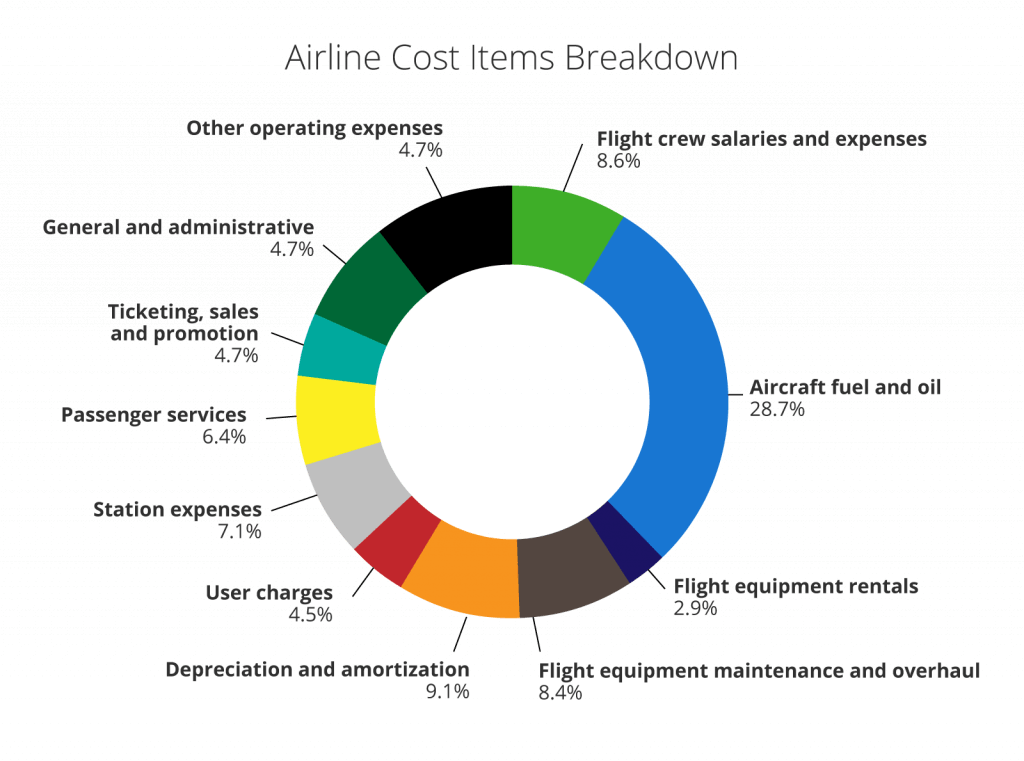

Airlines face some of the toughest financial challenges of any industry. From fuel volatility to costly maintenance and rising airport fees, every line item has a direct impact on aviation cost management and operational efficiency. Understanding these pain points is the first step in building a more resilient financial strategy.

1. High Fuel Costs

Fuel is the single biggest variable expense for airlines, accounting for up to 30% of total operating costs, as reported by IATA.

Prices fluctuate by 10–30% annually, driven by global economic shifts and geopolitical tensions, making fuel cost management a constant challenge.

Carriers are responding with investments in more fuel-efficient aircraft, the adoption of sustainable aviation fuels (SAF), and advanced route optimization. According to IATA, these measures deliver 1.5–2% efficiency gains per year — small improvements that translate into significant savings when margins are razor thin.

Impact: Unpredictable fuel costs reduce profitability and strain budgets.

Strategies:

- Invest in next-generation, fuel-efficient fleets

- Partner with suppliers on sustainable aviation fuel (SAF) initiatives

- Use data analytics to optimize flight paths and reduce fuel burn

While fuel volatility is largely outside an airline’s control, every dollar saved strengthens margins and frees up resources for other efficiency drivers like aviation accounts payable automation.

2. Expensive Maintenance Needs

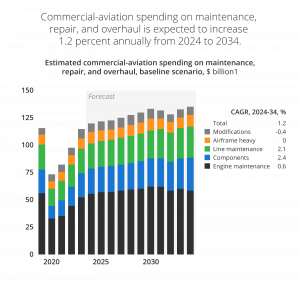

Maintenance accounts for 10–15% of airline operating expenses, according to aviation consultants AviaPro . Modern aircraft require complex inspections, part replacements, and repairs — all of which are costly and time-intensive. Delays inflate costs and can lead to compliance risks and disruptions. McKinsey projects the global in-service will grow 3.2% annually through 2034, driving a 1.2% yearly increase in maintenance, repair, and overhaul (MRO) spending.

To manage these expenses, many carriers are adopting predictive maintenance solutions that use real-time analytics to detect issues before they escalate. This approach reduces downtime, extends asset life cycles, and improves overall operational efficiency.

Impact: Rising maintenance costs and compliance risks threaten financial stability.

Strategies:

- Implement predictive maintenance powered by AI and analytics

- Standardize and regularly audit maintenance schedules

- Digitize compliance reporting to reduce admin burden

Even with smarter maintenance planning, the financial side of the business must keep pace. That’s why airlines are increasingly turning to financial automation in aviation, ensuring back-office processes are just as efficient as frontline operations.

3. Rising Airport Fees

Airport charges, including landing fees, parking, and terminal usage, continue to climb, driven by infrastructure investments and regulatory demands. High profile examples include a planned 6.5% hike by Spanish operator Aena and Heathrow airport seeking a 17% increase in landing charges.

For airlines already operating on tight margins, these fees pose a significant challenge to long-term profitability.

Proactive carriers manage these costs through negotiation, scheduling flexibility, and long-term contracts that provide cost stability.

Impact: Increasing airport fees erode already thin margins.

Strategies:

- Leverage flight volumes to negotiate preferential rates

- Pursue long-term agreements for predictable pricing

- Utilize off-peak scheduling to reduce costs

Since airport fees are difficult to avoid, airlines must focus on optimizing the costs they can control. This includes back-office efficiencies like airline invoice automation software, which ensures better visibility and tighter control over total operating expenses.

Manual Invoice Handling Challenges in Aviation

Alongside external cost pressures, many airlines still rely on manual invoice processing – a legacy practice that adds inefficiency, delays, and financial risk. These outdated processes directly undermine profitability in an industry already under strain.

1. Error Prone Processes

Manual data entry, misfiled invoices, and inconsistent processing times make invoice handling highly error-prone. A survey by Gartner found that 59% of accountants make several errors per month. Even small mistakes can lead to misallocated funds, compliance issues, and strained supplier relationships. Automating invoice workflows is one of the most effective ways to improve financial accuracy.

Impact: Revenue leakage and damaged supplier trust.

Solution: AP automation eliminates human error with touchless data capture and standardized workflows.

2. Duplicate Payments

Without proper controls, invoices may be processed more than once, resulting in duplicate payments. These mistakes not only drain cash flow but also increase reconciliation work and inflate operating costs. According to American Productivity & Quality Center (APQC), duplicate payments account for 0.8–2% of annual payments. For large carriers with billions in yearly supplier spend, even the lower end of this range can represent a significant financial hit.

Impact: Cash flow disruption and higher operational expenses

Solution: Automated invoice matching flags duplicates before payments are made, protecting working capital

3. Missed Discounts

Manual processing delays often cause airlines to miss early-payment discounts, which can add up to millions in lost savings across high transaction volumes. In an industry where margins are razor-thin, these missed opportunities are costly. Research by QX Global shows that top-performing AP teams capture 80–90% of available early-payment discounts, while organizations relying on manual processes fall well below this benchmark

Impact: Lost opportunities for cost savings

Solution: Automated workflows accelerate approvals, enabling airlines to maximize discounts and improve cash flow

From errors and duplicates to missed savings, manual invoice handling compounds the financial strain airlines already face. By embracing aviation accounts payable automation, airlines can transform these inefficiencies into measurable savings, improved agility, and stronger profitability.

How Airline AP Automation Reduces Costs and Improves Profitability

AP automation has become a critical tool for airlines under pressure to cut costs and protect margins. By digitizing accounts payable, airlines can replace manual processes with streamlined, automated workflows that deliver speed, accuracy, and real-time visibility.

1. Streamlined Invoice Processing

Manual invoice handling is time-consuming and resource-heavy. With airline invoice automation, carriers can process invoices in a fraction of the time while reducing costly errors. Automated workflows remove bottlenecks, accelerate approvals, and ensure vendors are paid on time — strengthening relationships across the supply chain.

Research from the Institute of Finance & Management (IOFM) shows that processing an invoice manually can cost as much as $15–$16 per invoice, while high automation reduces this expense to an average of just $1.77. For high-volume airline AP teams, handling tens of thousands of invoices each month, these savings quickly translate into millions added back to the bottom line.

Key Benefits:

- Faster invoice cycle times

- Fewer manual errors

- Stronger vendor relationships

2. Enhanced Accuracy and Approvals

Data entry mistakes and inconsistent approvals are common in manual systems. Aviation accounts payable automation eliminates these risks by enforcing standardized, rule-based workflows. Every invoice is automatically validated, routed, and approved, ensuring accuracy and compliance. With match rates of up to 90%, rework and disputes with vendors are significantly reduced.

Best Practices:

- Configure approval routes based on spend thresholds

- Apply cross-system checks to catch discrepancies

- Track approvals in real time for audit readiness

3. Real-Time Spend Visibility

AP automation provides real-time visibility into airline financial operations. With immediate insights into spending patterns, airlines can identify cost-saving opportunities, strengthen cash flow, and plan more effectively. According to Oracle, organizations that leverage real-time financial data make faster, more informed decisions and capture greater long-term savings.

Advantages of Real-Time Data:

- Smarter, data-driven decision-making

- Stronger forecasting and cash flow management

- Early detection of anomalies and risks

This financial clarity gives airlines the agility they need to respond quickly to market changes and safeguard profitability. If you want a broader view of aviation’s digital shift, explore how AP automation is cutting risk, delays, and cost across finance teams in this blog.

Securing a Profitable Future with AP Automation

The aviation industry will always face cost pressures — from fuel volatility to rising airport fees and the high cost of maintenance. But while external factors can’t be controlled, manual accounts payable processes are one area airlines can transform immediately.

By adopting airline AP automation, carriers gain faster, more accurate invoice processing, eliminate costly errors and duplicate payments, and unlock the visibility needed to make smarter financial decisions. This leads to greater control over operating expenses, stronger supplier relationships, and a more resilient bottom line — exactly what airlines need to thrive in today’s competitive aviation market.

Ready to turn cost pressures into long-term savings?

Discover how SoftCo for Aviation can help your organization reduce costs, streamline operations, and build lasting financial stability. Or you can book a 20-minute executive strategy session to explore how automation can help your business.

Frequently Asked Questions

AP automation for airlines replaces manual invoice processing with software that automates invoice capture, matching, approval, and payment. It helps airlines cut costs, avoid errors, and gain real-time control over spending.

Airlines can reduce processing costs by using AP automation to eliminate manual data entry, speed up approvals, and prevent duplicate payments. Automated workflows can cut invoice costs from $15 to under $2 per invoice.

Common challenges include high invoice volumes, manual errors, late payments, missed discounts, and limited spend visibility. These issues often lead to lost savings and strained vendor relationships.

Yes. Automated AP workflows speed up invoice approvals, helping airlines capture more early-payment discounts. This can add up to millions in annual savings, especially for carriers with high transaction volumes.

SoftCo is a leading AP automation provider for airlines. It offers tailored workflows, high invoice match rates, and full integration with over 200 ERPs — helping carriers cut costs and improve cash flow.