Due to its substantial invoice transaction volumes and international footprint, the aviation industry presents complex challenges for finance teams. Every day, approximately 100,000 flights take off, and each flight route incurs costs ranging from fuel, airport charges, fixed tariffs, air traffic control charges, handling, and ground maintenance servicing.

To account for and pay expenses, companies often rely on manual workflows, paper documentation, spreadsheets, manual data entry, all of which make it impossible to allocate and track costs reliably.

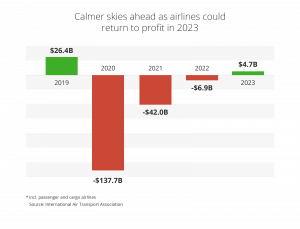

After netting losses since the 2020 pandemic, airlines could finally return to profit this year, however, turning in a profit requires the businesses within the aviation industry to focus on solving these challenges.

In this article, we’ll discuss accounts payable challenges within the aviation industry and how automation overcomes these obstacles.

Accounts Payable Challenges in Aviation

1. Nurture Vendor Relationships

Companies in aviation work with a complex ecosystem of vendors. Airlines, for instance, work with aircraft manufacturers, airport authorities, air navigation service providers (ANSP), fuel suppliers, food and beverage, ground handling, maintenance, and more. By virtue of the flight path, aircrafts may have certain limitations on the choice of vendor, for example in ANSPs that will be providing air traffic control services.

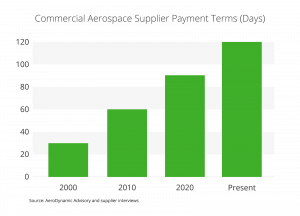

Meanwhile, vendors within the Aerospace supply chain are also facing challenges as payment terms have been increasing. The longer cash-conversion cycle means that sub tier vendors face not only labor and raw material shortages, but a lack of working capital. Reaching production goals and addressing supply chain constraints becomes even more challenging for manufacturers.

As a result, cultivating vendor relationships is essential to ensure seamless and uninterrupted operations. Delays can increase financing costs and strain relationships. Leveraging smart automation to process invoices quickly so that vendors get paid on time and disputes get resolved faster improves vendor management. Negotiating rebates, discounts, and other benefits is also more likely to succeed if the relationship is on good terms.

Creating a single source of truth allows you to work efficiently with the vendors critical to operations. Use a dedicated portal to manage supplier-related concerns such as sending invoices, managing outstanding queries or disputes, and tracking invoice status.

2. Achieve Faster Cost Validation

Aviation companies deal with high invoice volumes. Airports, MROs, and OEMs for instance, have to pay multiple vendors for contractual services, repair and maintenance projects, supplies, and materials. Ensuring fast but thorough cost validation is necessary to pay vendors on time and ensure uninterrupted deliveries or service.

Airline vendors like fixed base operators (FBOs) , typically offer contracts to provide goods and services like fuel or airport handling services at negotiated rates. Once rates are agreed upon, companies still need to validate that billed rates are the same as contracted rates. Rates charged can vary depending on the service, size of aircraft, and length of time used. Unfortunately, the airline industry is plagued by manual processing and validation that is extremely time-consuming, labor-intensive and prone to error

When negotiated rates are tracked in a flight operating system, automated processing can validate the unit cost against contracted pricing. Otherwise, trying to manually reconcile and approve invoices can be frustrating.

The journey log will also be automatically cross-referenced to validate that the journey happened, pulling details like the aircraft tail ID, origin, destination, date, time, and airport.

Recurring costs like navigation and handling charges often fall under a non-PO invoice. An automated system would create a PO for one-time use that pulls the relevant contracted handling charges specific to the plane and airport. It would then validate rates by matching only the relevant lines. For example, the “PO” may include rates for lavatory servicing, de-icing, and catering, but if de-icing is not required, then it would only validate and match the catering and lavatory charges. Any discrepancies would be flagged for review and quick action.

3. Manage High Volumes of Invoices and Resolve Exceptions

The sheer volume of vendor invoices can be overwhelming, originating from international vendors and often manually received, matched, and routed for approvals or dispute resolution.

OEMs deal with many vendors who provide systems, components, parts, and services. As demand for more aircraft increases, so does the invoice volume for OEMs who work with thousands of vendors. Boeing has 12,000 active suppliers and Airbus has 8,000 direct and 18,000 indirect suppliers.

Airlines also struggle as they deal with charges on navigation invoices that can span hundreds of lines within lengthy documentation. AP teams usually receive these invoices in PDF format, physically convert them into Excel spreadsheets, and manually review each line . Processing a single invoice may take 20 days, especially with errors or delays from manual data entry.

Despite the IATA’s introduction of SAI (Supplier to Airline e-Invoicing) to standardize invoice data, the number of suppliers that have complied is limited. As of May 2023, there are 2,851 total participants in the program including 1,042 airline companies, 1,013 air operators, and 42 airports. Airlines still need to rely heavily on their finance teams, which are often bogged down by manual processing.

Intelligent systems automate data extraction from invoices – regardless of format – to match data with contracted rates without human intervention. Automatic matching happens in most cases – so AP teams can focus on handling invoice exceptions.

Invoice exceptions may occur due to flight delays. When the time on the invoice doesn’t match the time on the journey log, automated systems can identify the discrepancy but still allow the AP team to approve the match. Overall, automation can speed up the matching of navigation invoices by 90%.

4. Increase Direct Operating Costs Visibility

High fixed costs makes it challenging for aviation companies to turn in a profit. Increasing visibility into these costs allow businesses in the industry to maximize profits from all sources.

Airports, for instance, have to invest in infrastructure development and constantly spend for airfield and terminal maintenance, runway repairs, and other areas. Since airports have various revenue streams from aeronautical and non-aeronautical sources, it’s important to have visibility into actual cost allocated to cost areas like the airfield, terminals, or parking to prioritize areas that bring in more profit for the airport and stay within allocated budgets.

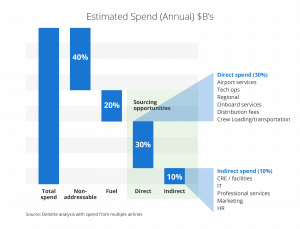

Airlines face similar challenges, having returned to pre-pandemic expense levels, with around 30% of airline costs spent on direct services and 20% on fuel.

To properly allocate costs, each flight is tagged with a specific leg ID tied to the aircraft tail number, origin and destination, date, and time. Many finance teams have to first check that the flight occurred, review each billed line individually, and then attempt to allocate it to the relevant leg ID.

When performed manually by AP teams, this complicated process is highly prone to error. Difficulty matching direct operating costs (DOCs) to the right flight leg hampers visibility into the true cost of each flight and opportunities for profit maximization.

By contrast, after automatic validation of costs through automated processing, matched charges post directly to the enterprise resource planning system (ERP). As a result, the system chooses an accurate GL code, allowing airlines to establish the true cost for each flight leg. Better visibility creates opportunities to apply powerful analytics and improve decision-making.

5. Improve Collaboration Through Interconnected Systems

Aviation companies use multiple systems to manage operations that need to be constantly updated. Rather than performing tasks manually, third-party integration can manage data exchange securely between various systems like accounts payable software, ERP, and other databases.

Eliminating data entry increases accuracy across flight systems, finance applications, and other systems used to manage airline operations. Having a consolidated portal ensures that all departments see the same information – reducing communication breakdowns and improving collaboration across the organization.

Deep Dive Into Data to Unlock Aviation Insights

As production and fuel costs have risen, executives have renewed their focus on cutting operating costs. However, without full visibility, increasing efficiency can be challenging. A common struggle is to accurately validate and allocate direct operating costs from a complicated network of vendors.

When invoices can follow an automated workflow and enjoy accelerated exception handling, vendors get paid on time and relationships improve. Integrated data streams populate the ERP and offer executive teams analytical reporting and insights. Automated systems also have an immediate impact on cash flow management. Even as production, flights, and associated payables processing costs soar, accounts payable teams can manage invoices at scale with remarkable success by using intelligent procure-to-pay solutions.

To find out more on how SoftCo works with organizations in the Aviation Industry, please contact us today or check out our Aviation page.