Why is AI automation important in 2025?

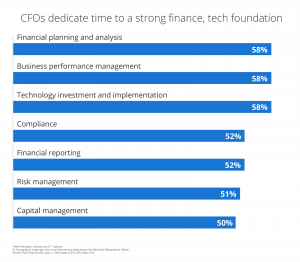

In today’s fast-moving finance environment, traditional tools simply aren’t keeping up. Organizations are overwhelmed by rising invoice volumes, increasingly complex compliance needs, and mounting pressure to do more with fewer resources. That’s why the shift from rule-based to AI-powered accounts payable (AP) automation is now mission-critical. Finance leaders are responding accordingly — PwC’s CFO Pulse Survey found that 58% of CFOs are dedicating more time to technology investment and implementation, with AI playing a central role in that transformation. Another 52% identified hiring talent with the right skills as a top priority, underscoring the human capital needed to support this evolution.

What Is Rule-Based AP Automation?

Rule-based automation is built on pre-set logic. Think of it like a flowchart: if an invoice is under €500, send it to the team lead; if not, escalate to finance. These systems are dependable for straightforward, repetitive workflows.

But the moment something falls outside the rules — like a mismatched PO or a new supplier format — the system breaks. Someone in accounts has to jump in, investigate, and manually process the invoice. That’s fine when it’s one or two. But what about 1,000 a day?

Rule-based systems are limited in their ability to handle exceptions, variations, or learn from history. That makes them rigid and expensive to scale.

What’s the difference between rule-based and AI automation?

Rule-based and AI automation both aim to streamline accounts payable — but how they do it (and what they can handle) is fundamentally different.

Rule-Based Automation is structured and predictable. It follows strict “if-this-then-that” logic, making it best suited for repetitive, low-variation tasks. However, it struggles when invoices deviate from expected patterns, such as non-PO invoices or new supplier formats. Every exception often requires manual intervention, which slows down processing and increases errors.

AI Automation, on the other hand, is dynamic. It uses machine learning to adapt, predict, and self-correct. AI can process a wide range of invoice types, flag anomalies, auto-code GLs, and even learn approval behaviours over time. It’s especially powerful in complex, high-volume environments where formats and workflows are constantly evolving.

What are the benefits of switching to AI for AP?

Organizations that have shifted to AI-driven automation are seeing transformational results:

- The Finnish Government implemented AI-powered AP across 70+ departments and now saves €15 million annually, achieving 90% touchless processing.

- Chanelle Pharma went from manual entry and no spend control to full automation with 100% visibility.

These aren’t just process improvements — they’re strategic wins. AP teams shift from data entry to data insights, enabling better cash flow management, vendor relationships, and financial forecasting.

When should I replace rule-based automation?

AI-based automation is ideal if your business deals with:

- Large volumes of invoices from diverse vendors

- A high number of exceptions and non-PO invoices

- Global operations with multi-currency or tax compliance needs

- Month-end bottlenecks or scaling issues in AP workflows

- Limited resources but rising transaction loads

If any of these sound familiar, rule-based systems likely won’t cut it anymore. AI provides the adaptability and intelligence needed to stay competitive.

How does AI improve finance team performance?

The shift from rule-based to AI-powered AP isn’t just a technology upgrade — it’s a mindset shift. Instead of reacting to invoices, exceptions, and approvals, your finance team can get ahead of them.

Automation is no longer about removing people. It’s about elevating their work — allowing them to focus on analysis, strategy, and control.

And in a world where every minute — and every euro — counts, that shift can make all the difference.

Ready to move beyond rules?

See how AI-powered AP automation can transform your finance team — from reactive processing to proactive control.

Frequently Asked Questions

It’s rigid — if an invoice doesn’t follow a defined rule, it usually requires manual intervention.

AI learns from past transactions. It identifies patterns, predicts outcomes, and adapts in real time — even if the format or logic changes.

Yes. By reducing manual work, speeding up approvals, and catching errors early, AI cuts labour and compliance costs significantly.

Yes. By reducing manual work, speeding up approvals, and catching errors early, AI cuts labour and compliance costs significantly.

Leading platforms include advanced encryption, audit trails, and user permissions to meet enterprise-grade security standards.