Financial departments are increasingly integrating with artificial intelligence (AI) as it becomes pivotal in transforming financial processes. AI enhances existing functions like accounts payable and receivable while strengthening fraud detection and compliance. Its potential to boost operational efficiency and drive strategic innovation is vast.

AI in Finance: A Comprehensive Guide for Finance Leaders, provides insights into these advancements, exploring market trends, adoption barriers, and real-world success stories. It provides a structured roadmap for effectively integrating AI into financial systems to drive innovation and maintain a competitive edge. Embrace finance automation with confidence and gain the expertise to lead your organization toward AI-driven excellence.

What CFOs Need to Know About AI in Finance

AI is transforming the finance sector with innovative solutions to longstanding challenges and redefining operations. By exploring foundational technologies like AI, machine learning, and automation, financial leaders can gain a clear understanding of these tools’ unique roles. This transformation demonstrates AI’s impact on financial functions, featuring advancements through examples of rule-based processes and intelligent automation. Equipped with this knowledge, financial leaders can leverage AI’s potential to optimize performance and achieve strategic outcomes in their operations.

What is AI, Machine Learning, and Automation in Finance?

Artificial Intelligence (AI) encompasses the development of systems that replicate human-like cognitive abilities to solve complex problems. These systems utilize sophisticated algorithms to interpret vast datasets, facilitating enhanced data analysis and process automation.

AI systems are characterized by several key functionalities:

- Engages in high-level cognitive functions such as decision-making, reasoning, and learning adaptively to optimize outcomes.

- Analyzes data by identifying intricate patterns and trends, providing actionable insights and foresight.

- Continuously refines its capabilities through adaptive feedback loops, enhancing precision and effectiveness over time.

Machine Learning (ML), an essential component of AI, involves creating systems that can learn and adapt based on data inputs. It leverages diverse algorithms to process and analyze data, thereby continually refining its models to increase predictive accuracy and effectiveness. Over time, these systems can identify patterns, make informed decisions, and provide actionable insights without explicit programming.

Machine Learning systems offer distinct advantages:

- Employs sophisticated algorithms that evolve with new data, enhancing system performance and capabilities.

- Continuously updates its model parameters and decision-making processes to improve accuracy and predictive power.

- Facilitates a wide range of applications, including complex financial forecasting, detailed trend analysis, and decision support across various domains.

Automation involves the use of advanced technologies to perform processes and operations with minimal human intervention, significantly boosting productivity and operational efficiency. It is a critical component in optimizing performance by leveraging intelligent systems to manage tasks.

Automation provides several key benefits in optimizing finance operations:

- Elevates efficiency by automating routine and complex tasks, freeing up human resources for more strategic decision-making.

- Enhances workflows by integrating processes that seamlessly adapt to business needs, thus saving time and valuable resources.

- Ensures uniform performance outputs by minimizing human error and maintaining high accuracy standards.

In finance, AI systems start by analyzing extensive datasets to forecast market trends, using deep learning techniques for initial predictions. Machine Learning refines these predictions by learning from new data, enhancing accuracy through advanced modelling. Automation executes trades in real-time, optimizing timing and efficiency.

Together, this integrated approach improves decision-making, reduces human error, and maximizes returns — showcasing the transformative power of AI, ML, and automation in unison.

When to Use Rule-Based Automation vs AI in AP

Rule-based automation and AI represent two distinct approaches to process automation, each with unique capabilities. Rule-based automation relies on predefined human-set rules, offering structure and predictability but lacking flexibility. It’s ideal for consistent, repetitive tasks like routine data entry or basic workflow management.

Conversely, AI, including machine learning, analyzes large data sets, learns, and makes decisions based on patterns and insights. Unlike rule-based systems, AI adapts to new situations without needing reprogramming, enabling it to tackle complex scenarios and deliver advanced analytical outputs.

The primary differences between these technologies are highlighted in the table below:

| Aspect | Rule-Based Automation | AI Intelligence |

|---|---|---|

| Approach | Follows predefined rules | Learns and adapts from data |

| Flexibility | Limited, requires manual updates | High, adapts to new data and conditions |

| Complexity | Handles simple, repetitive tasks | Capable of complex decision-making |

| Scalability | Difficult to scale for variability | Scales with data growth and complexity |

| Application | Routine tasks (e.g., data entry) | Complex analysis (e.g., fraud detection) |

Both rule-based automation and AI offer valuable tools in the realm of finance, but understanding their differences is crucial for leveraging them effectively in different scenarios.

How AI Revolutionizes Financial Processes for Enhanced Efficiency

AI is revolutionizing financial operations by improving efficiency, accuracy, and cost-effectiveness across key processes. This technology is reshaping the management of accounts payable, accounts receivable, fraud detection, and compliance. By leveraging AI, financial institutions can expedite complex workflows, maintain compliance with evolving regulations, and safeguard against security threats, thereby promoting a more agile and resilient financial ecosystem.

How AI is Enhancing Accounts Payable Operations

In accounts payable, AI is enabling a new level of efficiency and strategic capability. Leveraging cutting-edge AI technologies, businesses can automate key functions, refine accuracy, and elevate the overall quality of financial management.

- Automated Invoice Processing: AI employs optical character recognition (OCR) and machine learning to automatically extract, validate, and capture invoice data from various formats, reducing manual data entry, accelerating processing, and minimizing errors to ensure dependable financial reporting.

- Advanced Payment Matching: AI uses algorithms to reconcile invoices with purchase orders and contracts, swiftly identifying discrepancies. This improves accuracy, reduces the risk of overpayments, and strengthens cash flow management, thus fortifying supplier relationships with timely payments.

- Automated Invoice Coding: AI applies predictive analytics to suggest coding like cost centers and locations for invoices, reducing manual coding time and enhancing data consistency and precision, thereby improving the accuracy of financial documentation.

- Intelligent Workflows: AI-driven systems optimize approval workflows using adaptive learning, routing invoices based on invoice amount, historical data, and compliance. This speeds up approvals and allows finance teams to focus on strategic initiatives and decision-making.

What Ways Can AI Enhance Accounts Receivable Management?

AI optimizes accounts receivable by enhancing cash flow management and shortening collection times through analytics and automation.

- Advanced Predictive Analysis: AI accurately forecasts payment behaviors, enabling finance teams to anticipate cash flow patterns. By analyzing variables like historical trends, market conditions and client data, AI helps develop strategies that reduce risks and enhance liquidity.

- Comprehensive Credit Assessment: AI provides in-depth evaluations of customer creditworthiness by integrating diverse data sources, allowing for tailored credit limits and optimizing risk management while enhancing revenue opportunities.

- Intelligent Automated Reminders: AI sends personalized reminders to customers, improving workflows. By customizing communication based on history and preferences, AI boosts timely payments, reduces delinquency, and strengthens relationships.

How Does AI Improve Fraud Detection in Finance?

AI is pivotal in enhancing fraud detection, offering advanced solutions for secure transactions.

- Anomaly Detection: AI employs machine learning to monitor transaction patterns and detect fraud, analyzing large datasets to spot subtle anomalies in real-time, providing superior threat protection.

- Real-Time Alerts: AI delivers instant alerts for suspicious transactions, automating notifications to ensure timely action for fraud prevention.

- Behavioral Analysis: By examining user behavior with deep learning, AI profiles historical data to identify irregularities and predict potential fraud, thereby strengthening financial security.

What Are the Benefits of AI Solutions for Compliance?

AI optimizes compliance processes, helping organizations exceed regulatory standards with enhanced efficiency and accuracy.

- Advanced Regulatory Monitoring: AI utilizes algorithms to track and predict regulatory changes, dynamically updating compliance protocols to quickly adapt to global shifts.

- Automated Reporting: AI creates tailored reports that meet audit requirements, reducing manual labor. Advanced analytics ensure transparency and easy audits.

- Data Integrity Checks: AI uses machine learning to detect real-time inconsistencies, maintaining data consistency and compliance to protect against regulatory breaches.

What Are the Key Market Trends and Adoption Rates in AI for Finance?

The influence and importance of AI within the finance industry is constantly growing, with quick adoption being seen across all sectors. This section highlights market trends that underscore AI’s evolving influence, focusing on adoption rates and its transformative impact on financial operations. AI’s potential to streamline processes, enhance decision-making, and improve competitive advantage is driving significant uptake. The following subsections offer insights into adoption rates and strategies, real-world corporate examples, and barriers to AI integration. Understanding these factors enables financial leaders to fully harness AI for strategic growth and innovation.

Why Are AI Adoption Rates Rising in Finance?

Financial institutions now view AI as a crucial tool for enhancing operational efficiency, strategic innovation and market competitiveness. Here are some key insights and statistics on AI adoption in finance:

- Nearly 70% of financial executives are integrating AI solutions, showing growing confidence in AI’s capabilities, according to Forbes.

- A KPMG report highlights that 85% of companies in North America have either adopted AI or plan to do so soon.

- 70% of European companies report AI adoption or near-term plans to adopt, while 72% in Asia-Pacific and 63% in Latin America have similar adoption timelines.

- The top areas for AI adoption in finance are risk management (81%), financial reporting (74%), treasury management (68%), and tax functions (66%).

- A Gartner survey found the main AI use cases include intelligent process automation (44%), anomaly detection (39%), analytics (28%), and operational assistance (27%).

These statistics reflect AI’s expanding role in global finance, notably in North America, Europe, and Asia-Pacific, with significant benefits in areas like risk management and financial reporting.

What Are Examples of AI Transformations in Finance Across Different Industries?

Transformative AI implementations are reshaping finance across different sectors. This section highlights three case studies: Tesco in retail, Bosch in manufacturing, and Barclays in banking, demonstrating unique AI applications that optimize processes and achieve strategic objectives.

Case Study 1: Retail Industry – Tesco

Overview:

Tesco, a major European retailer, implemented AI to enhance its customer analytics and engagement strategies. By leveraging machine learning algorithms, Tesco aimed to provide personalized shopping experiences and optimize inventory management.

Implementation Details:

- Personalized Marketing:

- Applied machine learning to segment customers based on purchasing behavior and preferences.

- Developed dynamic promotional strategies, adjusting offers in real-time based on trends and demands.

- Integrated AI-driven recommendations across digital platforms to boost customer interactions.

- Inventory Optimization:

- Deployed AI models to analyze sales data to better forecast demand.

- Implemented real-time inventory tracking to maintain optimal stock levels.

- Enhanced procurement and supplier collaborations through AI insights.

Outcomes:

- Customer Satisfaction and Retention:

- Increased engagement and loyalty via personalized interactions and tailored rewards and promotions.

- Inventory Efficiency:

- Reduced costs with precise forecasting and stock management.

- Minimized waste, supporting sustainable practices and profitability.

Case Study 2: Manufacturing Industry – Bosch

Overview:

Bosch, a leading supplier of global technology and services, integrated AI into its production for operational efficiency and supply chain management.

Implementation Details:

- Optimized production schedules and managed inventory in real-time via AI.

- Utilized AI to analyse product quality data to prevent defects and enhance quality.

Outcomes:

- Improved operational efficiency, reduced waste, and saved costs.

- Enhanced product quality and customer satisfaction.

Case Study 3: Banking Industry – Barclays

Overview:

Barclays, a leading European bank, integrated AI to transform financial operations and risk management.

Implementation Details:

- Financial Risk Management:

- Deployed AI for data analysis and risk model precision.

- Implemented real-time analytics for risk identification and mitigation.

- Automated Transaction Analysis:

- Automated transaction pattern recognition and fraud detection with machine learning.

- Strengthened security and response times with AI-driven alerts.

Outcomes:

- Risk Prediction and Security:

- Increased prediction accuracy, reducing financial losses.

- Bolstered security, customer trust, and brand reliability.

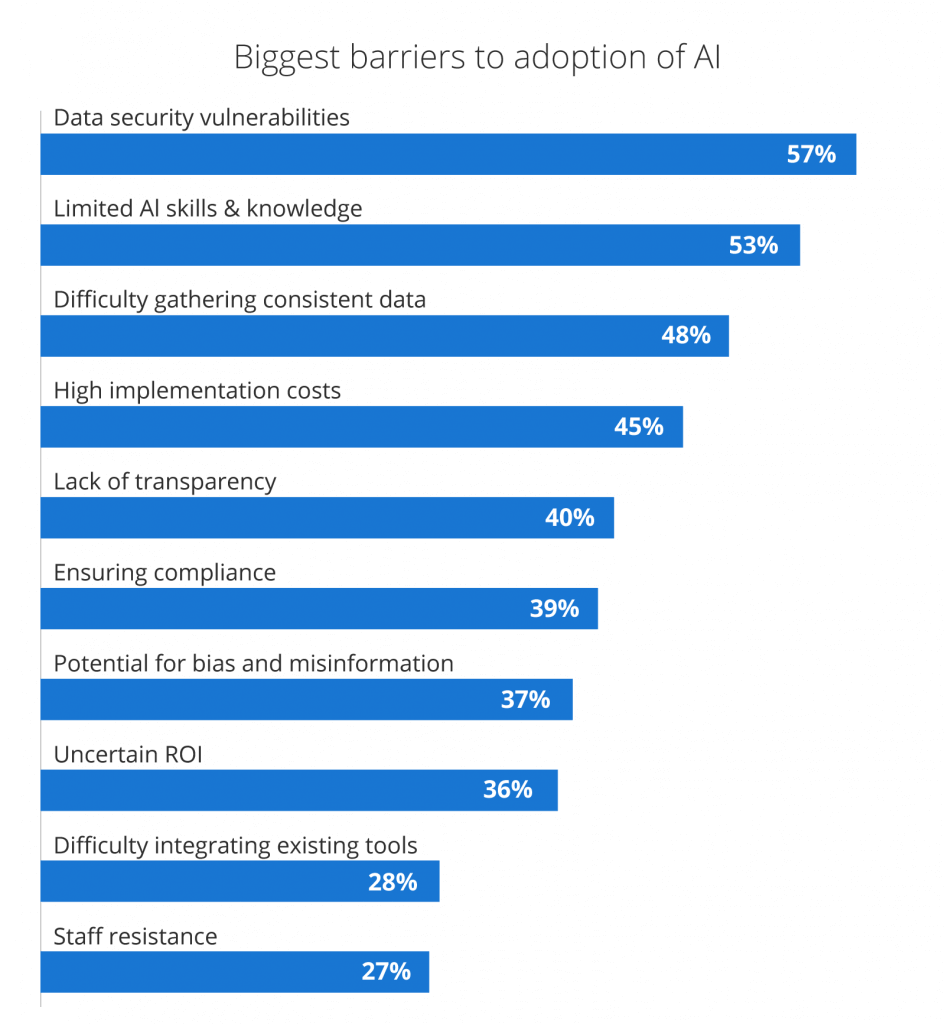

What Challenges Are Hindering AI Adoption in Finance?

While AI integration offers significant benefits, several barriers hinder its widespread adoption. According to KPMG’s Global AI in Finance Report, some of the main obstacles include data security vulnerabilities, limited skills and knowledge, cost, integration complexities, and change management challenges.

1. Cost:

High initial investment costs can be a hurdle. Organizations often delay AI adoption until they can forecast a clear ROI, requiring strategic cost management.

2. Integration:

Complex legacy systems complicate integration, necessitating fundamental updates to integrate AI solutions. Selecting scalable technologies is crucial.

3. Change Management:

Resistance to new technologies is common and can disrupt workflows. Overcoming this requires clear communication of AI’s benefits and fostering an innovative culture.

4. Data Security Vulnerabilities:

AI systems manage vast data, so strong security measures and regulatory compliance are critical to prevent breaches.

5. Limited Skills and Knowledge:

A lack of AI expertise can hinder adoption. Investing in employee training and development is essential.

Overcoming these challenges demands innovative strategies and meticulous planning. Strategies to tackle these barriers include upskilling staff, adopting AI incrementally, and forming cross-disciplinary AI teams. By concentrating on skill development and phased integration, organizations can effectively enhance their financial operations.

How AI is Transforming Accounts Payable Processes

AI is having a profound impact on the ways in which accounts payable process invoices accurately, optimize payment workflows, and ensure stringent compliance. This section explores the advancements AI brings to AP, the benefits organizations can anticipate, and provides real-world case studies of successful AP automation and compliance management.

What Are the Benefits of AI in Invoice Processing and Workflow Optimization?

The integration of AI into invoice processing automates routine tasks traditionally prone to human error. This innovation ensures that organizations can manage large volumes of invoices with greater precision and in less time, improving operational efficiency and reducing financial loss.

Here’s how AI enhances invoice processing:

- Automating Data Entry:

- AI systems automate the capture and processing of invoice data.

- Minimizes the need for manual input.

- Leads to faster data processing and reduces errors.

- Ensures data is consistently recorded, providing a reliable foundation for financial analysis.

- Workflow Optimization:

- AI streamlines the approval process by automatically routing invoices to appropriate personnel based on predefined rules.

- Accelerates approval times.

- Aligns the workflow with an organization’s strategic priorities.

- Reduces bottlenecks and promotes a smoother, more efficient processing experience.

- Compliance Checks:

- Ensures each invoice adheres to established policies and regulations.

- Facilitates rigorous compliance management.

- Automates checks to verify all necessary requirements are met before processing.

- Minimizes likelihood of compliance violations and enhances the organization’s ability to meet regulatory standards.

These advancements lead to a marked reduction in manual errors and a boost in overall efficiency.

What Are the Key Advantages of Touchless Invoice Processing?

Touchless invoice processing transforms financial operations by automating invoice handling from receipt to payment without human intervention. This approach streamlines processes, enhances efficiency, and offers significant advantages in productivity, accuracy, and cost reduction.

Let’s look at each of these advantages in more detail:

- Higher Productivity

- Accelerated Processes: AI rapidly speeds up invoice cycles, allowing management of larger transaction volumes.

- Reduced Manual Oversight: Automation minimizes human intervention, decreasing errors and ensuring data accuracy.

- Strategic Focus: Employees can shift from routine tasks to strategic initiatives that foster growth and innovation.

- Enhanced Agility: AI automation aids quick responses to market changes, optimizing business operations.

- Accuracy

- Fewer Errors: AI lowers data entry errors, providing precise datasets.

- Financial Credibility: Improved precision ensures credible financial reporting and informed decision-making.

- Consistent Monitoring: AI maintains high standards and prevents inaccuracies in financial processes.

- Cost Reduction

- Reducing Labor: AI decreases the need for manual labor, cutting expenses.

- Minimizing Errors: Fewer errors mean more reliable financial records and lower rectification costs.

- Optimizing Resources: Efficient processes free resources for strategic growth initiatives.

Adopting touchless invoice processing isn’t just an efficiency upgrade; it’s a strategic enhancement boosting financial agility and decision-making. By minimizing manual tasks, organizations refine current operations and enable financial tech innovation. These systems are vital for promoting data-driven decisions and optimizing resource allocation. To stay competitive, adopting such technology is essential, showcasing AI and automation’s role in modernizing financial methodologies and delivering key strategic benefits.

Why Companies Choose AP Automation: Case Studies Explored

In the journey towards financial transformation, real-world case studies of AP automation provide valuable insights. Companies like Logitech, Superdry, and Primark showcase successful AI-driven accounts payable processes. These organizations have utilized AI to streamline operations, elevate accuracy, and achieve significant cost savings. By exploring their experiences, we see how each enterprise tackled unique challenges and benefited from adopting AI in their financial workflows. These case studies highlight AI’s potential to revolutionize financial operations, offering a blueprint for other organizations seeking to innovate and optimize their systems.

Logitech

Overcoming Challenges

- Subjective invoice matching

- Ineffective ERP integration

- Poor visibility

AI-Powered Strategies

- Automated Data Capture: Reduced manual entry, ensuring accuracy.

- Intelligent Workflow Routing: Directed invoices dynamically, speeding approvals.

- Streamlined Invoice Handling: End-to-end automation improved cash flow.

- Real-Time Monitoring: Enabled proactive decisions with insights into AP metrics.

Impact

- 83% Straight-Through Processing: Drastically reduced manual intervention.

- No Increased Headcount: Handled more workload without expanding staff.

- 100% Control and Visibility: Eliminated process “black holes.”

- Enhanced Accuracy and Precision: Core processes aligned with audit standards.

- Improved Cash Flow Management: Ensured timely vendor payments and strengthened relations.

Superdry

Overcoming Challenges

- Manual handling

- Delayed processing

- Limited visibility

AI-Powered Strategies

- Automated Invoice Processing: Reduced manual efforts, improving speed and accuracy.

- Improved PO Utilization: Enhanced financial oversight with AI insights.

- Enhanced Supplier Communication: Streamlined interactions with AI-enabled channels.

Impact

- Increased Processing Efficiency: Elevation of touchless processing from 5% to 80%.

- Reduced Staffing Costs: Redeployed staff to strategic roles.

- Higher PO Compliance: Improved consistency and efficiency.

- Enhanced Team Perception: Recognized for high-value contributions.

- Improved Cash Flow Visibility: Enabled better financial planning.

Primark

Overcoming Challenges

Primark’s complex supply chain and manual systems hindered efficiency, requiring an automated AP solution.

AI-Powered Strategies

- Automated Invoice Processing: Reduced errors and accelerated processing times through a 98% match rate.

- Advanced Matching Capabilities: Improved accuracy and customs clearance, expediting the release of goods and reducing demurrage costs.

- Intelligent Workflow Management: Dynamic invoice routing expedited approvals and enhanced policy adherence.

Impact

- Accelerated Processing Speed: Managed invoices efficiently with fewer staff.

- Error Reduction: Reduced discrepancies in records.

- Enhanced Cost Efficiency: Lowered labor costs through automation.

- Advanced Data Management: Real-time insights improved decision-making.

- Strengthened Compliance: Ensured regulations adherence, improved logistics.

The case studies of Superdry, Logitech, and Primark underscore AI’s powerful impact on AP, showcasing how it streamlines processes, minimizes errors, and fortifies compliance. By embracing AI-driven innovation, these companies enhanced their operational efficiency and strategic agility. Their success illustrates that with thoughtful AI implementation, finance leaders can unlock significant opportunities and ensure their organization’s future success.

What Are the Best AI Strategies for Fraud Prevention and Risk Mitigation?

Fraud prevention and risk management in accounts payable are crucial due to their vulnerability, which can lead to financial losses, reputational damage, and regulatory penalties. Frequent transactions heighten these risks, potentially disrupting cash flow and harming supplier relationships. AI advancements significantly bolster fraud detection, identifying patterns and anomalies beyond human capability, reducing fraud potential. AI automates monitoring, enhances accuracy, and strengthens internal controls, mitigating financial risks and ensuring resilient operations within accounts payable.

This section explores AI’s transformative impact in three key areas:

- Enhancing security by identifying fraud patterns,

- Implementing AI-powered risk scoring for vendor management,

- Improving internal controls for regulatory compliance.

What You Need to Know About Recognizing Fraud Patterns and Anomalies

Identifying fraud patterns in accounts payable is essential for safeguarding financial integrity and maintaining trust. Accounts payable are often targets for fraud, leading to financial losses, disruptions, and reputational damage. Traditional detection methods often fall short due to the need for constant monitoring of vast transaction data.

AI’s role in fraud detection is critical, utilizing advanced capabilities such as:

- Sophisticated Pattern Recognition: Using machine learning to detect subtle fraud indicators in data beyond predefined rules.

- Real-Time Monitoring: Continuous surveillance detects anomalies instantly, ensuring swift responses.

- Predictive Analytics: Using historical data to foresee potential fraud risks, enabling proactive measures.

- Contextual Analysis: Identifying transaction nuances that might be overlooked by standard analytics.

- Dynamic Adaptation: Continuously improving detection capabilities by learning and adapting to new fraud tactics.

These functionalities empower organizations to significantly reduce fraud-related losses and bolster security.

What is AI-Powered Risk Scoring and Why is it Essential?

AI-powered risk scoring evaluates and ranks vendor risks precisely, safeguarding financial stability. By analyzing extensive vendor data, it enhances decision-making and vendor management.

Key benefits include:

- Comprehensive Data Analysis: Continuously evaluating data sets to identify vendor trends, ensuring timely risk assessments.

- Dynamic Risk Assessment: Predictive analytics flag potential risks proactively.

- Enhanced Vendor Selection: Streamlining partner selection with comprehensive risk profiles.

- Automated Monitoring and Alerts: Real-time systems update risk scores, enabling immediate action for risk management.

- Regulatory Compliance: Ensuring adherence to regulations with up-to-date risk evaluations and supporting documentation.

Integrating AI-powered risk scoring secures a resilient vendor management system, enhancing financial stability and efficiency.

Why Strengthening Internal Controls with AI Matters for Compliance

Robust internal controls and compliance in accounts payable are essential for maintaining financial integrity. However, staying updated on regulatory changes can be challenging. AI provides transformative enhancements for internal controls and compliance.

AI achieves this by:

- Audit Automation: Conducting detailed audits to ensure records comply with policies and standards, improving audit reliability.

- Dynamic Regulatory Adaptation: Continuously updating processes to reflect current regulatory requirements.

- Risk Management: Identifying compliance risks proactively with pattern analysis, providing early warnings.

- Transaction Monitoring: Enabling real-time monitoring to detect compliance breaches or discrepancies.

- Enhanced Data Accuracy: Ensuring reliable financial records through automated validation processes.

These measures significantly mitigate operational risks, enhancing organizational credibility with partners and regulators.

What Role Does AI Play in Financial Forecasting?

AI is driving change in the field of financial forecasting by enhancing accuracy and providing actionable insights within the accounts payable process. It significantly improves cash flow predictions and scenario planning, ensuring operations are predictive and adaptive. AI’s role in real-time data analysis empowers swift and informed decision-making in response to market changes. Large enterprises have seen tangible benefits from AI-driven forecasting, leading to improved operational efficiency and strategic agility, heralding a new era in financial management.

How AI Enhances Cash Flow Predictions and Management

Effective cash flow management is crucial for financial stability and seamless operations. AI enhances cash flow predictions by simplifying forecasting and adding precision through advanced analytics and real-time data processing:

- Historical Data Analysis: AI examines past data to uncover patterns and trends, providing insights into cash flow dynamics. This enables leaders to forecast and plan future states by identifying recurring influences on cash flows.

- Scenario Planning and Simulation: AI supports scenario planning by simulating various financial situations and their effects on cash flow. This allows leaders to prepare for different outcomes, aiding in strong contingency planning.

- Real-Time Data Integration: AI uses real-time financial data to keep forecasts updated. By integrating sources like sales and trends, it offers a full view, enabling agile decision-making and market adaptation.

- Predictive Analytics for Variances: AI detects cash flow variances by analyzing payment behaviors and supply chain elements. This helps in proactively adjusting strategies to sustain liquidity and stability.

- Sentiment Analysis: AI assesses qualitative data, such as market news, to detect economic changes affecting cash flows. Combining quantitative and qualitative insights leads to more detailed and informed forecasting.

Why is Real-Time Data Analysis Crucial for Financial Decision-Making?

Real-time data analysis powered by AI is vital for maintaining decision-making agility. AI processes vast data volumes, enabling finance teams to swiftly make informed decisions. This helps businesses navigate market changes, optimize operations, and drive strategies.

- Immediate Insights: AI analyzes datasets in real time, delivering rapid insights and allowing proactive action by identifying trends and anomalies.

- Enhanced Forecasting Precision: AI employs advanced algorithms to minimize forecasting errors, optimizing resource allocation and enabling strategic adjustments.

- Resource Optimization: Continuous data assessment enhances resource allocation, spotlighting investment opportunities and boosting efficiency.

- Dynamic Risk Management: AI uses real-time data to identify risks and opportunities, enabling swift mitigation for resilience.

- Strategic Planning: Embedding AI insights into planning crafts robust strategies aligned with real-time data, ensuring competitiveness.

Why AI-Driven Forecasting is Transforming Industries: Real-World Examples

In exploring AI in financial forecasting, advanced analytics and machine learning have proven to be transformative, significantly boosting decision-making accuracy and timeliness. These technologies offer deeper insights into market trends, optimize resource allocation, and enhance risk management. Below are three notable case studies demonstrating these capabilities: AI-driven demand forecasting, AI-enabled cash flow forecasting, and AI-powered financial and risk forecasting. These examples highlight AI’s transformative impact, reinforcing the benefits discussed earlier.

- Retail Industry: AI-Driven Demand Forecasting

Organization: Carrefour (France)

Solution Provider: Forts

Challenge: Carrefour, a leading global retailer, experienced inconsistent demand across stores, particularly during promotions and seasonal shifts, causing stockouts and surplus inventory.

Solution: Carrefour adopted Forts’ AI-powered demand forecasting solution, which leveraged historical sales, price fluctuations, and promotions to refine demand predictions.

Outcome: This AI implementation reduced stockouts by 20%, enhanced inventory management, elevated customer satisfaction, and lowered costs. - Manufacturing Industry: AI-Enabled Cash Flow Forecasting

Organization: Meridian Adhesives Group (USA)

Solution Provider: Armanino

Challenge: Managing cash flow across various countries with different currencies and banking systems proved challenging for Meridian.

Solution: Meridian collaborated with Armanino to deploy an AI-powered cash flow forecasting model, offering real-time insights into cash positions and financial data integration.

Outcome: The AI-based model improved cash flow management and liquidity forecasting, aiding in their expansion and acquisition goals. - Construction Industry: AI-Powered Financial and Risk Forecasting

Organization: Skanska (Sweden)

Solution Provider: Prophix

Challenge: Skanska required precise financial performance and risk forecasting for projects with complex budgets and variable material costs.

Solution: Skanska implemented Prophix’s AI-powered financial management system, utilizing predictive analytics for insights into project costs, revenue, and cash flow.

Outcome: This AI-driven system minimized financial risks, optimized budgets, and improved cash flow management for major construction projects.

AI is revolutionizing financial forecasting in industries like retail, manufacturing, and construction by enhancing demand anticipation, optimizing inventory, refining cash flow management, and boosting risk assessment. These improvements lead to better decision-making and increase operational efficiency. By integrating AI-driven forecasting with accounts payable processes, organizations further enhance accuracy and liquidity management, enabling swift, data-driven decisions. This integration results in a more adaptable and resilient financial framework, crucial for navigating today’s complex market landscape.

What is the Role of AI in Compliance and Regulatory Reporting?

AI is simplifying the challenges of compliance and regulatory reporting by addressing complex demands with advanced solutions. By automating processes for adherence to regulations like IFRS, GAAP, and SOX, AI ensures precise, timely compliance. Automated audit trails and AI-powered reporting tools increase transparency and accountability, while intelligent compliance monitoring minimizes financial risks by detecting irregularities and maintaining regulatory adherence. These advancements highlight AI’s essential role in reshaping compliance strategies.

How AI Simplifies Compliance

AI simplifies compliance with complex regulations such as IFRS, GAAP, and SOX. By automating repetitive tasks and improving data accuracy, AI reduces the burden of compliance, allowing organizations to meet strict regulatory requirements efficiently and cost-effectively.

AI simplifies compliance by:

- Streamlining Processes: Automates workflows, reducing the need for manual checks and enabling efficient regulatory compliance.

- Ensuring Accuracy: Minimizes human errors with precise data validation, meeting regulatory accuracy demands.

These advantages not only enhance efficiency but also lower compliance costs.

What Are Automated Audit Trails and Why Are AI-Enabled Reporting Tools Essential?

Automated audit trails and AI-powered reporting tools are ensuring compliance with stringent standards. Providing real-time insights, these technologies streamline complex processes, reduce errors, and ensure compliance with evolving regulations, thus maintaining transparency and integrity in financial reporting.

- Complete Audit Trails: Logs every transaction automatically for traceability and auditability.

- Accurate Reporting: Ensures reliable data for audits, reducing discrepancies.

- Data Consistency: Maintains data uniformity across reports and systems, boosting confidence in data integrity.

- Real-Time Monitoring: Continuously updates compliance strategies in response to regulatory changes.

- Enhanced Accountability: Increases oversight with comprehensive record-keeping and reduced errors.

These tools significantly improve transparency and accountability in financial reporting.

What is the Role of Compliance Monitoring in Reducing Financial Risk?

AI enhances financial risk management through precise compliance monitoring. Advanced algorithms consistently scan for regulatory inconsistencies, enhancing an organization’s ability to prevent errors and mitigate risks. This intelligent monitoring not only upholds regulatory adherence but also reduces financial penalties and reputational risks.

- Identifying Irregularities: Uses analytics to detect and flag unusual activities indicating potential compliance violations.

- Ensuring Adherence: Continuously updates understanding of regulatory frameworks to stay compliant with evolving requirements.

- Proactive Alerts: Provides real-time notifications of potential compliance issues for swift intervention and correction.

These AI-driven measures are crucial in safeguarding against financial penalties and protecting the organization’s reputation.

Why Integrate AI-Powered AP Solutions with ERP Systems?

Integrating AI-powered AP solutions with Enterprise Resource Planning (ERP) systems provides significant advantages for finance teams by streamlining financial operations and enhancing strategic decision-making through improved data processing and insights. This integration achieves unmatched efficiency, fuels innovation, and offers a competitive edge.

AI-powered AP solutions automate complex tasks, such as invoice processing, data validation, and error detection, reducing manual intervention and increasing operational efficiency. This leads to optimized cash flow management and enhanced financial reporting accuracy.

These solutions also offer predictive analytics within ERP environments, delivering insights into payment trends and enabling proactive management for better decision-making. The adaptability and scalability of AI solutions ensure long-term sustainability and cost-effectiveness, making them crucial for future-focused finance teams.

By focusing on strategic considerations and technological advancements during integration, organizations can ensure a smooth transition, allowing them to harness AI’s full potential and fully capitalize on the benefits of AI-enabled AP solutions within ERP systems.

What to Know About Integrating AI-Powered AP Solutions with SAP, Oracle, and NetSuite

Integrating AI-powered AP solutions within ERP systems such as SAP, Oracle, and NetSuite can greatly advance operational capabilities by seamlessly incorporating invoice processing with comprehensive financial management tools. This integration facilitates enhanced data consistency and enables real-time insights, which are crucial for improving decision-making processes and increasing overall profitability. To achieve a successful integration, it’s important to prioritize certain key considerations:

- Data Compatibility: Implement robust data mapping techniques to ensure seamless integration of invoice and payment data across systems. This includes maintaining data integrity and preventing silos, which facilitates smooth and continuous data sharing.

- System Updates: Conduct thorough analysis and testing to regularly update ERP systems, ensuring that they fully support the latest AI functionalities. This compatibility is crucial for leveraging enhancements and improving overall performance.

- User Training and Development: Develop comprehensive training programs to equip staff with the necessary skills for effectively utilizing AI tools. This fosters a culture of continuous learning and enhances the capability of employees to operate within the AI-enhanced ERP environment.

- Customization and Scalability: Design bespoke AI solutions tailored to specific accounts payable workflows within SAP, Oracle, and NetSuite. This ensures seamless integration into existing processes and accommodates future business expansion and changes.

- Vendor Collaboration: Engage in proactive collaboration with ERP vendors to leverage their expertise. Their insights and support are vital for smoothing the adoption process and ensuring successful implementation, particularly in the tailoring of AI applications to meet unique business needs.

These strategies are essential to ensuring a smooth and efficient integration of AI-powered AP solutions, thereby maximizing their impact and value within ERP systems.

Why Are APIs and Cloud-Based AP Solutions Crucial for Integration?

Integrating AI-powered AP solutions with ERP systems like SAP, Oracle, and NetSuite is most effective when using cloud-based platforms. These platforms not only support seamless data transfer but also optimize processes, allowing organizations to fully leverage AI capabilities. Application Programming Interfaces (APIs) are also crucial, as they facilitate flawless data interaction, ensuring smooth integration.

Cloud-based AP solutions alongside APIs offer substantial benefits that strengthen financial systems:

- Seamless Integration: APIs enable real-time data exchange between systems, ensuring that cloud-based AP solutions integrate smoothly with ERP environments, minimizing disruption and maintaining data flow cohesion.

- Enhanced Scalability: Cloud platforms provide dynamic scalability, allowing businesses to adjust computing resources to manage varying data volumes and invoice processing demands effectively.

- Cost Efficiency: With cloud infrastructures, the need for extensive on-premises hardware is reduced. Pay-as-you-go pricing models help optimize cost management.

- Security and Compliance: Modern cloud platforms and APIs come equipped with robust security measures and compliance tools, ensuring data protection and adherence to industry standards.

- Agility and Innovation: Cloud-based platforms facilitate rapid deployment of AP solutions, fostering innovation through quick prototyping and iteration, enabling businesses to swiftly adapt to market changes.

By utilizing cloud-based AP solutions and leveraging the power of APIs, financial leaders can drive innovation and maintain competitiveness in a dynamic business environment.

What Are the Best Ways to Overcome Integration Challenges and Ensure Data Accuracy?

Integrating AI-powered AP solutions into ERP systems presents various challenges, including system incompatibilities, ensuring data accuracy, and managing extensive data loads. APIs and cloud-based platforms simplify this process by enhancing data flow and cohesion. Addressing these challenges is essential for unlocking AI’s potential in financial operations.

To manage these issues and ensure data accuracy, businesses can take strategic actions:

- Conduct Pilot Tests: Start with small pilot projects to test AP solution compatibility in the current ERP environment. This helps identify issues early, refine strategies, and demonstrate benefits, easing larger rollouts.

- Ensure Data Integrity: Establish robust data governance, prioritize accuracy, consistency, and security across systems with standard procedures, audits, and validation tools to eliminate errors.

- Collaborate with Vendors: Partner with AP and ERP specialists for insights, technical support, and tailored solutions, aligning with business needs for smoother implementation.

- Invest in System Upgrades: Regularly update ERP systems to ensure compatibility with evolving AI technologies, enhancing invoice processing performance and decision-making.

- Provide Comprehensive Training: Offer workshops, webinars, and online courses to equip employees with necessary AP automation skills, ensuring effective operation and fostering growth.

These strategies facilitate successful integration of AI-powered AP solutions and allow businesses to harness their full potential in financial systems.

Why is Change Management Essential for Adopting AI in Finance Teams?

Change management guides organizations and finance teams in transitioning to AI, which is crucial for maintaining competitiveness and enhancing efficiency. Challenges like resistance and job displacement fears need addressing. Integrating AI successfully means aligning teams with transformative goals, shifting from manual tasks to strategic roles, and employing effective training practices. This section outlines strategies for smooth AI integration.

The Importance of Aligning Finance Teams with AI-Driven Transformation

Aligning finance teams with AI transformation is vital to maximizing AI’s potential. This requires understanding technological advancements and incorporating them into daily operations. Success hinges on clear communication, active participation, and continuous education. To foster a culture, open to AI, consider the following:

- Communicating Benefits and Vision: Define and communicate the strategic goals and benefits of AI adoption to gain team buy-in and enthusiasm.

- Involving Stakeholders: Engage stakeholders at all levels to promote an inclusive transformation and gather valuable insights.

- Providing Tailored Training: Offer programs suited to diverse skill levels, focusing on improving roles and creating growth opportunities.

- Fostering Collaboration: Encourage sharing of AI knowledge to ensure widespread understanding and adoption.

- Setting Clear Metrics: Establish measurable goals for AI integration tied to business objectives for data-driven decision-making.

Implementing these strategies will help teams align with AI transformation, fostering innovation and growth.

How to Address Fears of AI Replacing Jobs

Addressing job displacement fears is essential for smooth AI adoption in finance. As AI automates tasks, roles shift toward strategic responsibilities. Emphasizing human creativity is key.

- Collaborative Integration: Highlight AI as a tool to enhance human roles and emphasize its support in making impactful decisions.

- Skill Development Opportunities: Present AI as a growth opportunity, encouraging skill expansion in data analysis and AI management.

- Career Advancement Strategies: Communicate new roles emerging from AI integration, offering enhanced engagement and responsibility.

- Open Dialogues: Create channels for concerns and discussions to demystify AI and share benefits.

- Success Stories and Mentorship: Share examples of role transitions and connect employees with mentors to facilitate adaptation.

These strategies help nurture a positive view of AI, preparing finance teams to leverage it fully.

What are the Best Practices for Training and Upskilling in AI?

Redefining roles is vital to balance technology with human skills. Training and upskilling staff are essential as AI reshapes finance. Implementing best practices ensures they can leverage AI effectively.

- Offering Workshops: Run interactive, real-world-focused workshops to build confidence in using AI tools.

- Encouraging Education: Promote lifelong learning through formal courses, certifications, and conferences to boost adaptability.

- Utilizing Online Resources: Use digital platforms for flexible, on-demand training to integrate learning into schedules.

- Creating AI Champions: Train AI champions to mentor peers and lead initiatives for knowledge sharing.

- Blended Learning Approach: Use varied methods like e-learning and peer learning to engage different learning styles.

- Aligning with Real Applications: Link training to actual job tasks for immediate application of new skills.

By embedding these strategies, organizations prepare finance teams to work with AI, promoting innovation and maintaining a competitive edge.

What is the Future of AI in Finance?

As we have seen, AI integration in finance is transforming the sector, providing pioneering advancements for forward-thinking organizations. Finance teams need to adopt innovation proactively to preserve their competitive standing in this fast-paced environment. AI will influence every aspect of the financial sector, improving decision-making, strategic planning, and supporting sustainability efforts.

What Are the Emerging AI Trends in Finance?

Technologies like generative AI and predictive analytics are revolutionizing creativity and decision-making, automating tasks, and improving accuracy. Blockchain-AI integration enhances data security. ESG reporting boosts transparency, aiding sustainability goals. Investing in resources and training is crucial for preparing for an AI-first financial future.

What is Generative AI? Exploring Its Impact on Creativity and Efficiency

Generative AI is reshaping finance by optimizing processes and creating new content, from financial models to customer solutions.

- Creativity Enhancement: Generative AI autonomously creates complex financial scenarios, enhancing innovation by simulating numerous potential outcomes. According to KPMG, 83% of respondents use it for financial planning, offering new insights into risk and opportunities.

- Operational Efficiency: Automating the production of financial reports, generative AI reduces time and resources needed for tasks, allowing a focus on strategic initiatives. This streamlines operations, cutting production time by up to 30%.

- Market Growth: With a projected market size of $1.3 trillion by 2032, generative AI is essential for managing complex data and sustaining a competitive edge.

What Makes Predictive Analytics Critical for Finance?

- Improved Forecasting: Leveraging real-time data, predictive analytics enhances forecast accuracy by 20%, enabling efficient resource allocation and strategic adjustments.

- Risk Management: It identifies risks early, reducing incidents by up to 15% and enhancing risk mitigation, enabling companies to maintain stability.

- Investment Returns: With up to 250% ROI, it supports precise investment strategies, improving decision-making and portfolio performance.

What Are the Benefits of Integrating Blockchain with AI?

- Enhanced Security: Combining blockchain with AI provides end-to-end encryption, reducing fraud susceptibility by 40%.

- Data Integrity: Immutable blockchain records, coupled with AI analysis, ensure accurate and consistent transaction data, aiding compliance.

- Adoption Rates: With a projected market growth from $445 million in 2023 to $3 billion by 2033, blockchain-AI solutions are crucial for fraud prevention, compliance, and efficient data management.

These trends drive finance towards a future defined by increased efficiency, security, and innovation.

How is AI Impacting ESG Reporting?

AI is becoming vital in Environmental, Social, and Governance (ESG) reporting, providing essential support for sustainability initiatives. As organizations focus more on sustainable practices, the need for accurate ESG data grows. AI’s expanding role is key in streamlining processes and improving data analytics accuracy. By automating complex tasks and offering deeper insights, AI helps companies enhance their ESG strategies and sustainability performance. AI contributes to ESG reporting by:

- Automating Data Collection: AI systems efficiently gather and process vast ESG data, reducing the time and resources required while improving data consistency and comprehensiveness.

- Enhancing Data Accuracy: Advanced algorithms improve data precision and reliability by minimizing human errors, providing actionable insights to inform decision-making.

- Real-Time Monitoring and Reporting: AI tracks ESG metrics continuously, providing real-time updates to quickly identify areas needing attention and efficiently adjust operations to meet ESG targets.

- Predictive Analytics and Forecasting: AI-powered predictive analytics help businesses anticipate ESG-related risks and opportunities, aiding scenario planning and proactive sustainability enhancements.

- Improving Transparency and Accountability: AI ensures clear, data-driven insights into ESG practices, fostering accountability and building stakeholder trust.

- Supporting Regulatory Compliance: AI adapts to evolving ESG regulations, ensuring compliance with local and global standards and enhancing reputation by reducing the risk of penalties.

These AI capabilities are transforming ESG reporting from a compliance requirement into a strategic advantage, paving the way for a sustainable future.

How to Prepare for an AI-first Financial Future

AI is becoming integral to the financial sector, not just as a tool but as a vital component of future advancements. Preparing for an AI-driven financial ecosystem requires strategic foresight and a willingness to embrace change. Here are key strategies to effectively transition into this future:

- Invest in Talent and Skills Development:

- Cultivate AI literacy and skills within your organization through continuous learning and training opportunities.

- Form cross-functional AI teams combining technical and financial expertise to drive innovation.

- Build a Data-Driven Culture:

- Promote data as a strategic asset, ensuring secure, scalable infrastructure and data-driven decision-making.

- Maintain data integrity and compliance through robust governance policies.

- Leverage AI for Strategic Insights:

- Use AI’s predictive analytics for deep insights into market trends and risks to guide strategic planning.

- Employ AI tools for financial scenario simulations to enhance adaptability.

- Enhance Cybersecurity Measures:

- Strengthen protocols using AI-driven solutions to counter cyber threats with real-time responses.

- Perform regular security audits to stay resilient against risks.

- Drive Innovation with AI and Emerging Technologies:

- Integrate AI with other technologies like blockchain and IoT to explore new business models.

- Stay agile and informed on technological advancements to align with strategic objectives.

- Commit to Ethical AI Practices:

- Implement ethical guidelines for AI use, ensuring fairness and accountability in decisions.

- Engage stakeholders in discussions of AI’s ethical implications to build trust and inclusivity.

By preparing for an AI-first future, financial leaders can enhance their competitive edge and foster a more innovative, efficient, and sustainable financial system.

Key Takeaways

AI is playing a significant role in reshaping the finance sector by integrating core concepts with advanced applications. Finance leaders can navigate AI’s impact, utilizing elements like machine learning and automation, while distinguishing between rule-based and AI-driven systems. Major advancements have been achieved in areas such as accounts payable, fraud detection, and compliance, supported by real-world examples.

Despite facing challenges like high costs and integration complexities, strategic solutions are essential. Emerging trends like generative AI, predictive analytics, and blockchain convergence underscore AI’s transformative potential. AI’s growing role in ESG reporting and cybersecurity highlights the need for strategic adaptability for an AI-first future. With this insight, finance leaders are positioned to harness AI for competitive advantage in the digital era.

Key takeaways from this AI in Finance guide include:

- Integrate Foundational AI Concepts: Differentiate between rule-based and AI-driven approaches using machine learning and automation.

- Enhance Financial Processes Efficiently: Apply AI in areas such as accounts payable to streamline operations and reduce errors.

- Adopt AI for Fraud Detection and Compliance: Utilize AI for robust fraud prevention and compliance management.

- Navigate Adoption Barriers: Plan strategically to address costs and integration challenges while fostering change management.

- Optimize Forecasting and Risk Management: Use AI-driven analytics to refine forecasting and align strategies with data insights.

- Embrace Emerging AI Trends: Explore generative AI and blockchain convergence to drive innovation.

- Leverage AI for ESG Initiatives: Enhance ESG reporting with AI to improve data accuracy and sustainability.

- Prepare for an AI-First Future: Focus on skill development and strategic planning for AI-centric operations.

Financial departments are increasingly integrating with artificial intelligence (AI) as it becomes pivotal in transforming financial processes. AI enhances existing functions like accounts payable and receivable while strengthening fraud detection and compliance. Its potential to boost operational efficiency and drive strategic innovation is vast.