In many cases, the accounts payable department does not get as much attention from the CEO as other areas of a business. Accounts Payable is generally not the first department that receives funding, and some companies may not even track accounts payable metrics. Despite that, AP teams have a major role to play in the operations of a business and in optimizing the levels of working capital available. Following the Covid-19 pandemic, the role of accounts payable teams has further grown in importance given persistent supply chain disruptions as organizations evaluate how they manage business risks.

The overall responsibilities of the accounts payable team, such as managing cash flow, reducing costs in the procure-to-pay cycle, and managing supply chain relations require significant attention. With such responsibilities in mind, here are 7 important accounts payable performance metrics that can be monitored to ensure that the department is running both efficiently and effectively.

7 Accounts Payable Metrics

1. Invoice Processing Time

According to research, the average processing time for invoices is 8.3 days, however, highly efficient teams that leverage the power of automation are able to process invoices three times faster.

Certainly, the size of the organization and how it is set up impacts processing time for invoices. Given that invoice approval is one of the biggest hold-ups during invoice processing, an effective automated invoice approval workflow speeds up the process and expedites payments to vendors. An additional benefit is allowing the department to take advantage of any early payment discounts, which are one of the biggest opportunities for reducing costs.

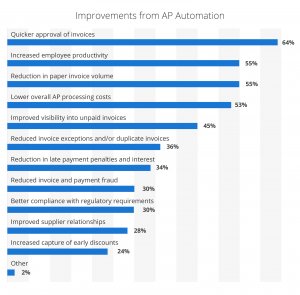

In fact, according to Research Consultants at Levvel Research, 64% of organizations named quicker approval of invoices as the number one benefit of AP automation.

2. The Cost to Process a Single Invoice

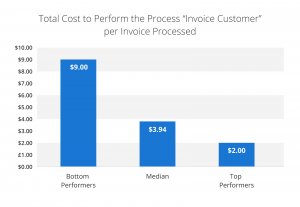

Processing invoices is an expensive procedure, and cutting down on operational costs is one way to reduce overall costs. According to Perry Wiggins, CFO, Secretary & Treasurer of APQC, “the bottom performers are spending $9 or more each time an invoice goes out. At the median are the organizations spending a little less than $4 to invoice a customer”.

These numbers are inclusive of salaries, copying, follow-up, routing, managerial and IT support. Of course, companies that process invoices manually have higher costs for invoice processing, and centralized and automated systems typically do better. Streamlining the processes cuts down on some of the most time-consuming tasks and lowers costs.

These numbers are inclusive of salaries, copying, follow-up, routing, managerial, and IT support. Of course, companies that process invoices manually have higher costs for invoice processing, and centralized and automated systems typically do better. In a similar study the Institute of Finance & Management (IFOM) concluded that in a purely manual environment the cost of processing a single invoice is $15.97 as compared to $1.77 for organizations who have high levels of automation in place. Streamlining the processes cuts down on some of the most time-consuming tasks and lowers costs.

3. Invoice Exception Rate

Managing exceptions is one of the biggest time-wasters when it comes to invoice processing. Every time an AP team member has to stop and track down missing information, like POs or addresses, it slows the entire process down and creates major bottlenecks.

Data tells us that invoice exceptions continue to be a major problem for the AP department, with the average invoice exception rate standing at 22.6%. Reducing or eliminating exceptions increases efficiency, reduces the stress on employees and management, delights vendors, and cuts overall processing costs. That’s why companies benefit from putting a solid procedure in place for invoice processing and ensuring that everyone is on board. When looking for an automation solution, make sure that you choose a partner who can tackle even the most complex of scenarios in order to reduce the number of exceptions.

4. Discounts Captured vs Offered

When an organization is running smoothly and an optimal AP system is in place, invoices are processed faster and you can save money by utilizing discounts offered. Early payment discounts are offered by vendors to keep their accounts receivable flowing, and they can be a source of good savings.

Tracking monetary amounts and numbers of missed discounts enables you to identify missed opportunities. An automated accounts payable system that tracks expiring discount windows helps to trigger timely payments. Additionally, using reason codes reveals how the department is falling short and where improvements need to be enacted.

5. Number of Supplier Enquiries, Discrepancies, and Disputes

Discrepancies and disputes with vendors slow down the department and tie up valuable time and resources. Lowering the number of discrepancies increases efficiency and gets vendors paid faster.

Eliminating human error is impossible, however, by automating the system and providing an avenue for electronic document transmission and a portal in which vendors can submit queries will reduce duplicate invoices, erroneous payments, missing information, and delivery errors.

6. Working Capital

Measuring AP metrics and effectively managing working capital ensures that organizations are always in a position to meet their short-term liabilities. Working capital is calculated by subtracting current liabilities from current assets, including assets such as available cash, short-term investments, and accounts receivable.

For a deeper dive, take a look at this blog post outlining tips for effectively managing working capital.

7. The Rate of Wrong Payments as a Percentage of Total Payment

Erroneous payments not only cost businesses money and time for correction, but they make the organization look amateurish and unprofessional. Keeping an eye on the rate of wrong payments as a percentage of total payment can be a good benchmark for identifying and correcting the causes of this type of error, thereby reducing the incidence in the future. Assigning and tracking error codes while also automating systems reduces the number of errors and the costs involved.

Future proof your Accounts Payable department

Though accounts payable often lags in automation, companies that do digitize their systems find significant cost savings in this department. Given the importance of managing working capital and operating costs, measuring the accounts payable metrics mentioned will make it easier to adjust your processes to accommodate issues that slow down your accounts payable function and cost your organization money.