Fallout from the pandemic and a Russia-Ukraine war has threatened already constrained supply chains, prompting soaring inflation and central bank monetary tightening. Economists caution that the US and Europe are facing increasing risks of sliding into recession.

The World Bank has forecast global growth to decelerate from 5.7% in 2021 to 2.9% in 2022, with the rising possibility of stagflation – a combination of lower growth and rising costs. The trend is expected to persist at least through 2024 as fiscal and monetary stimuli are also withdrawn.

Both the US and European central banks have embarked on interest rate hike cycles designed to remove liquidity and tighten financial conditions. Tighter financial conditions spell higher cost of capital and lower demand, forcing organizations to recalibrate.

Given this outlook, the near-term instinct may be to cut or delay investments. In reality, the approach to cost savings requires a more nuanced approach, and finance leaders are looking to AP automation solutions to weather the storm. More than ever, now is the time to fast-track AP automation to accelerate gains in productivity and cost savings.

Diminishing pricing power

Recessions are often accompanied by a pullback in spending from customers. If demand is relatively elastic, then elevated prices may dampen customer interest. Companies lose pricing power as demand for their products and services decreases. This puts pressure on revenue and, ultimately, the bottom line.

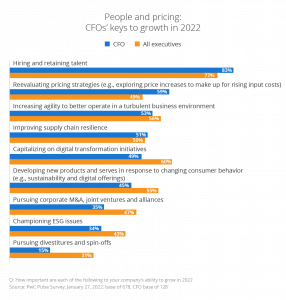

Pent-up demand and insufficient supply have allowed many companies to elevate prices.. According to PWC, 59% of CFOs see reevaluating pricing strategies (e.g., exploring price increases to make up for rising input costs) as a key to growth. Hiking prices could offset rising costs of capital, labor, and input costs however, and this strategy is at risk given signs of an economic slowdown.

Organizations looking to sustain growth have to look elsewhere for cost savings, especially as inflation persists.

Combat rising costs

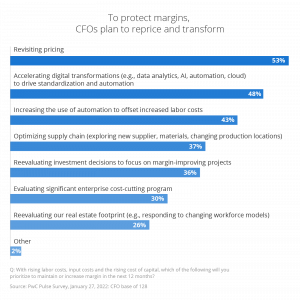

While global inflation may moderate in 2023, inflation is expected to remain above forecasts in most economies. Costs of hiring and retaining talent have been surging since the pandemic in a tight labor market. A recent PWC study shows that CFOs are not optimistic about a reduction in talent shortages.. As a result, 43% of CFOs intend to accelerate automation to offset wage inflation.

Increased expenses may cause organizations to re-evaluate or delay spending on larger projects. However, CFOs view digital investments through a different lens, and rightfully so.

In an inflationary environment, automation allows companies to gain a competitive advantage by decreasing business costs. Companies leading the digital race are three times more likely to achieve above-industry revenue and margin growth.

Pursuing digital initiatives has a long-term deflationary effect, especially in procurement.

- AP automation results in cost savings in a number of ways, including:

- Eliminating manual time-consuming tasks

- Reducing errors to eliminate multiple audits

- Speeding up invoice processing time for improved vendor relations

- Enabling early payment discounts which can offset costs

- Delivering touchless invoice processing which removes the opportunity for fraud

Rather than causing companies to scale back on innovation, inflation can drive digital initiatives to reduce costs even with tight margins. By leveraging technology, procurement teams can take a holistic approach to cost reduction across the entire business operation.

Improve Spend Management

The pressure to yield cost savings is relentless. Chief procurement officers are often tasked with delivering yearly cost reductions of 3% or more, according to Deloitte. Doing so requires understanding tradeoffs and transforming what, and how, procurement makes purchases.

Typically, organizations have developed rigorous processes for managing direct spend on input costs that directly contribute to profitability. However, indirect spending on items like operations or IT tend to be less visible, with decision-making spread throughout the organization. Management of indirect spend tends to be overlooked and requires a cohesive policy and systems to drive compliance.

Separating indirect spend and adding accountability can help organizations tackle maverick spending. This requires using technology to ensure full visibility of procurement, which also improves efficiency within accounts payable. An automation solution that offers complete visibility over procurement fuels better forecasts and decision making.

Maximizing Talent

CFOs are under pressure to find and keep top talent, and automating accounts payable makes your company more attractive to new and existing employees. With AP automation in place, you can offer a modern, streamlined working environment that will save staff time and frustration. Otherwise, you risk losing staff to competition that uses leading solutions. By keeping your AP staff, you retain company culture, vendor relationships, and the knowledge base.

As business scales and volumes increase, you don’t need to hire additional AP resources.

Automating accounts payable is an investment in your company’s future, and it’s one that will pay off for years to come.

Build Supply Chain Resilience

Another growth lever for organizations is improving supply chain resilience, which the majority of CFOs hope to focus on. The last few years have been littered with supply shocks, beginning with lockdowns from the pandemic, accelerating with the Russia-Ukraine war, and exacerbated by ongoing Covid lockdowns in China.

Optimizing supply chains by exploring new suppliers, improving supplier management, and collaborating with vendors can all move the needle. For instance, vendor onboarding supported by technology consolidates compliance documents and financial information in one place. A centralized system allows procurement to issue purchase orders and vendors to submit invoices. Complete visibility supports better vendor relations.

Scaling Up Digital Transformation

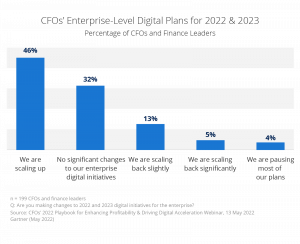

A Gartner survey reveals that despite existing market conditions, 46% of CFOs plan to scale up digital plans.3. Automation streamlines transactional activities to free up employees for value-added work. Making strategic investments now also positions organizations to grab market share as less competitive companies falter.

Conclusion

Despite threats of an impending recession, AP automation should not take a back seat. Smarter AP technology is the key to achieving growth in uncertain times and unlocking efficiencies in business operations, which results in lower labor, production, and delivery costs, higher productivity, and complete visibility.

Investing in AP automation shifts the game plan from defense to offense. Now is the time to push through with automation to achieve deflationary effects and support growth.