Anyone working in finance has a deep understanding of purchase order invoice processing, but non-PO invoice processing introduces an alternate set of circumstances. The differences between them can produce significantly more work and subsequent problems, especially for companies not using accounts payable automation software for invoice processing. The preference for using one method over another may depend on a powerful concept that Martin Luther originated in his defense of the 1521 Diet of Worms. The choice seems to come down to “whose ox gets gored.” AP professionals and other employees within a company may see things differently. The adage predicts that preference depends on the self-interests of either group.

Starting with a Familiar Approach

Familiarity with the accounts payable function usually requires you to use the traditional method of processing a vendor’s purchase-order-based invoice. Standard procedure involves receiving and coding it for the general ledger, obtaining approvals, and posting it in the financial system as ready for payment. Professionals accept P.O. invoicing as a method that represents one of only two types of supplier invoices. The other classification uses expense invoices which initiates non-PO invoice processing.

Characteristics of P.O. Invoice Processing

A standard invoice includes a purchase order number and a description of the agreed-to terms for goods and services between buyers and vendors. When you receive an invoice, you match it against the P.O. Most companies use a 3-way invoice matching procedure to automate the process and verify the details. The typical P.O. invoice addresses the purchase of direct material and requires multiple approvals.

Getting Acquainted with an Unfamiliar Approach

You often hear about trying solutions “outside the box” as a novel way to approach tasks differently. While different approaches may produce a beneficial impact for some stakeholders, they may inconvenience others. Non-PO invoice processing offers such pros and cons.

Characteristics of Non-PO Invoice Processing

Without having a purchase order associated with it, a non-purchase order process becomes an expense invoice that allows for indirect purchases. By going outside the normal multiple-approval process, managers can obtain something that fills an urgent need through indirect spend, a category of spend which we discussed in this blog.

When progress cannot continue without specific items, managers may choose to get them outside of the normal process that purchase orders require. An office may need toner for a printer whose supply abruptly ran out, or facilities management may need a cleaner for an unexpected spill. Both contribute to a company’s products or services but only indirectly.

Considering the Differences

The differences between P.O. invoice processing and non-PO invoice processing can produce shortcuts and convenience for some people within an organization but painstaking and laborious work for others. In manual systems, the workload increases dramatically for processing non-PO invoices. The biggest difference between the two methods lies in the approval mechanism preceding the creation of the order. The typical process requires multiple approvals to create a purchase order. However, AP teams face a mountain of work that requires diligence to get the pertinent information.

Non-PO invoices contain no reference P.O and as such, non-PO invoice processing activity in a manual system needs clarification. AP professionals typically obtain required data by contacting the vendor and the person who requested a purchase before tagging it to the invoice.

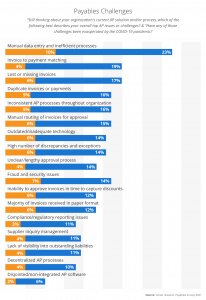

The slow pace of approval and payment of non-PO invoices in a manual system makes the process inferior, time-consuming, and frustrating for AP professionals. Manual data entry and invoice routing coupled with lost invoices and a high volume of invoice exceptions create obstacles that electronic systems avoid.

All told, the time required to verify the data and the level of difficulty of validating it contribute to reasons to automate invoice workflow.

According to Levvel Research, as mentioned, manual routing of invoices for approval and manual data entry rank as the biggest challenges in the AP process. However, invoices received in paper format, lost or missing invoices, and a high number of discrepancies and exceptions also feature. Many organizations spend thousands of dollars each year on damage control resulting from such issues.

Impact of AP Automation on non-PO invoice processing

Almost any change in business operations presents challenges, and the automation of AP processes from scratch may make some of them painfully apparent. A company may not have a well-functioning relationship with the information technology department, extending the time needed for adopting and implementing a new process. However, an all-new system lets a company design and customize the software by providing non-PO invoice processing capability without incorporating existing solutions, hardware, or problems.

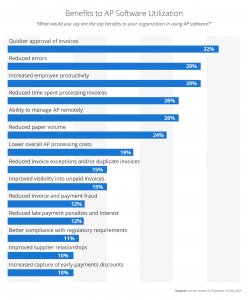

Automation may reduce labor costs by relieving the stress of non-PO invoice processing issues that require staff to track down missing paper invoices, leading to faster invoice approval and fewer errors, among other benefits.

With AP automation, recurring non-PO invoices, for things like rent and electricity, can be automatically approved by matching them to a payment plan in a contract. We’ve previously discussed the benefits of contract matching.

Additionally, pre-approved spend can be assigned for different categories of products, departments, or vendors. This removes the need for approval, allows teams to make purchases without raising a PO, and thus expedites the delivery and receipt of goods.

Even when approval is required for certain non-PO invoices, automated routing and approvals relieve the congestion that can bog down an AP department and improve efficiency within an organization. Real-time notifications for unapproved invoices further speeds up the approval of both PO and non-PO invoices.

Conclusion

When companies take the step to automate their invoice processing, the focus is mainly put on PO invoices, often due to greater familiarity in dealing with them. However, non-PO invoices often create more hassle in a manual world and therefore should not be ignored when it comes to automating. With the likes of contract matching, pre-approved spend, and approval workflows, organizations can remove the difficulties often encountered with non-PO invoice processing.