Chief financial officer roles used to be tightly circumscribed. Typically a qualified accountant, the CFO’s task was to lead an organization’s finance function. Accounting, maintaining records, producing management information, financial reporting generally, statutory compliance and overseeing the treasury operation, these functions defined the limits of the CFO’s role.

However, in the medium past, this began to change with the growing role of IT. The finance function was a large producer and user of financial data and so it became imperative that the CFO gain a more thorough understanding of IT, its deployment and application; the job had become digital.

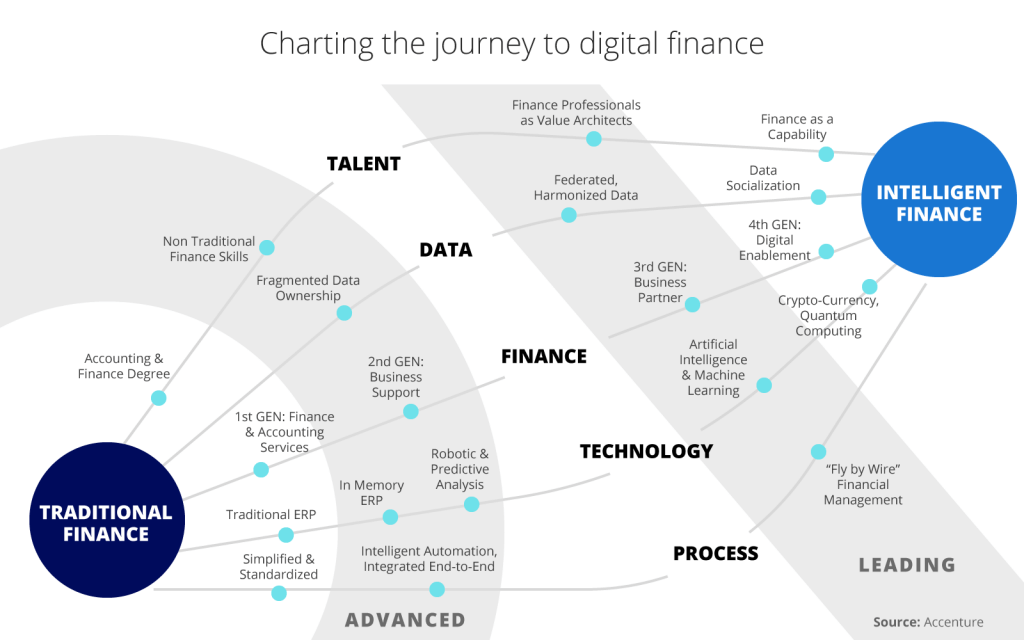

The introduction of the cloud, big data and digital currencies have contributed to a new era of financial management, processes and technologies. Digitizing the finance function has become vital in the face of the current challenges facing businesses but for CFOs, this offers scope for making a much wider strategic contribution across their organizations.

2020 Challenges for CFOs

Fast-forward to 2020, and particularly with the onset of Covid 19 the new challenges that CFOs now had to grapple with fell sharply into focus. Costs had to be closely monitored and controlled; managing often uncertain cash flows had become crucial. Quite suddenly, teams across the business, including those reporting to the CFO, now had to operate remotely. Many manual processes, particularly in the area of accounts payable now seemed outdated and supply chains suffered disruption. Furthermore, at the heart of all of these new realities, managing and maintaining the morale of staff became a prominent concern.

Meanwhile, across the wider world, digitization was happening everywhere. Big tech led the charge. New tech-based businesses in sectors such as FinTech, RegTech, InsureTec and many others were born digital; incumbent market leaders in traditional markets had to catch up if they were to keep pace with competition and address those 2020 challenges.

The Role of the CFO in Leading Digital Transformation

Some CFOs have taken the initiative, having recognized that establishing digital procedures and processes across their organization is vital to achieving greater control and efficiency. When faced with uncertainty and unpredictability, having instant access to data and being able to respond to change in real-time has become valuable.

In a piece of research entitled, “Value architects: digitally transforming finance for the intelligent enterprise,” Accenture Consulting found that some CFOs had been quick to seize the opportunity to play a bigger role in growing value in their organizations by driving digital transformation across the business as a whole, not just within their finance function. Accenture found that 81 percent of CFO’s “are focused on identifying and targeting areas of new value across the business as one of their key responsibilities.” Their research suggested that 77 percent of CFOs “believe it is in their remit to drive business-wide operational transformation.” In addition, 70 percent believe that the type of people they now need to hire needs to change because traditional finance qualifications and background may not give them the skills they need to lead digital transformation.

What can CFOs practically do to bring about such change to marry digital transformation with the challenges facing their organizations?

For CFOs, digitization begins at home in the finance function. As managing cash flow has become so vital, this means the accounts receivable and outgoing payments from the business gain immediate benefit from the instant controls and insights digitization can provide. Moreover, staff from the finance function who now work remotely need digital tools to operate efficiently and securely.

This has become particularly apparent in the area of accounts payable in recent months, with many CFOs coming to realize the necessity of automating AP processes such as capture, matching and approval, in order to facilitate remote working. The focus on digitization is increasing all of the time, with investment in AP Automation expected to reach over $3 billion by 2025.

With the cash flow related functions connected inextricably with sales and with disrupted supply chains, the CFO’s involvement in the wider digitization of the organization of the business becomes important. This is especially so in focusing the cost and value for money of investing in digitization. So key areas that call for CFO input are:

- Strategic vision on the need for digitization across the organization

- Working closely with IT and operational functions to coordinate the digitization process in line with the business-wide strategy

- Cost control, value for money and making cash available to invest in digitization

- Ensuring organization-wide compliance and spending policies and

- Overseeing this in the context of remote working where data and security can potentially be put at risk

Data and Analytics

CFOs and the finance function are typically accustomed to handling financial data and analyzing it in the context of preparing and providing management information. Consequently, they are well placed to play a wider role in data handling across the organization.

For example, at the strategic level, CFOs can guide other areas of the business in the choice of data that would be useful to generate from digital transformation. They can then prepare processes and procedures to collect and analyze such data with the aim of gaining business efficiencies and insight, managing risk and reporting on this to line management and the C-suite.

The CFO’s role is therefore central to digital transformation, both in setting the strategic compass and driving its adoption. As data management and analytics ultimately fall squarely in the CFO’s court it follows that the CFO should be the CEO’s key partner in the transformation of the business.

Focus on Talent

All told, the CFO’s role becomes much more enhanced with digital transformation, but there is one other crucial input. The CFO can only perform this much broader role if they have the personnel to help them do it. As mentioned in the Accenture report, CFOs now recognize a new set of skills required for the Finance function. This means that they have a vital input to make in the recruitment and deployment of talent with suitable skills to realize the organization’s digital transformation strategy. So not only has the CFO’s role evolved but also those of their key reports. Deloitte also acknowledge the fact that digitization places a responsibility on the CFO to evolve the finance workforce, through a mix of recruitment and training of existing staff.

Conclusion

Overall, the transformation of the finance function becomes the driver for the digital transformation of the organization as a whole. Considering the finance function’s traditional cash and risk management role in the organization, effectively controlling and optimizing its lifeblood, this is as logical as it is vital in preparing for the increasing prevalence of digital business. CFOs need to be prepared to lead the digital transformation of organizations as part of their evolving role.