In the business world, time is money. This is quite literal for those who work in the accounting realms. If you manage the accounts payable for your company or organization, you are dealing with money all the time. The longer a bill sits in your department, the longer your suppliers get restless and the longer your accounts are skewed.

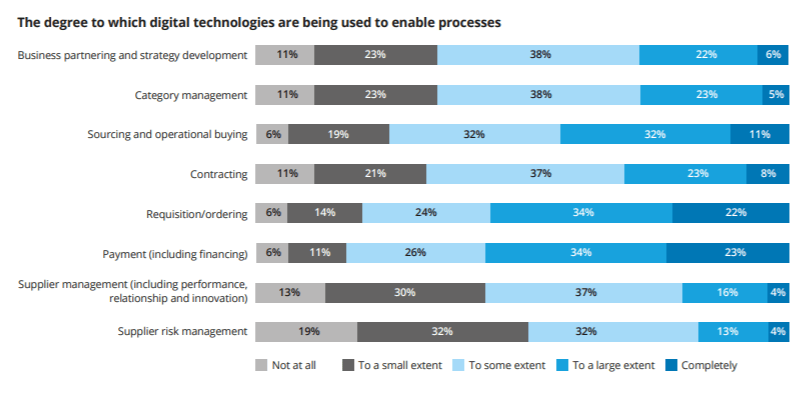

However, with so many invoices to consider, what is a diligent employee to do? The answer lies in procure-to-pay automation. According to Deloitte’s Global Chief Procurement Officer Survey, technology is transforming the world of procure-to-pay, with payments impacted more so than any other process.

While there are a variety of different technologies that can improve many areas of your payments operations, the area that many companies are focusing on is the automation of their 2-way matching process.

What is 2-Way Matching?

2-way matching is an automated process that seeks to match a purchase order to an invoice. In essence, the system first confirms that an order was placed for a good or service. If this can be confirmed through evidence of a purchase order, then the system will verify that an invoice was sent. An invoice implies that the goods or services were rendered. At this point, the system has enough information to conclude that the transaction was successful. The system will then automatically route the invoice for approval before the payment is made to the supplier and the transaction is completed.

Which Documents Are Matched?

The key to successful 2-way matching is the verification of two particular documents.

Purchase Order

The first key document is the purchase order. A purchase order is issued by your company or organization. The purchase order must specify what is being ordered. This confirms that your company requested the product or service and prevents payments for erroneous shipments.

Invoice

The second required document comes from the supplier. The supplier must provide an invoice that details the services provided and the amount due. This document is collected by the system to confirm that the goods or services were, in fact, rendered. This provides the system with two critical pieces of information. First, that the order is legitimate. Second, that the order was fulfilled. With this information, the system can successfully automate the vast majority of payment orders your company must facilitate.

In order for the matching process to be fully automated, however, it relies on an emerging technology known as Robotic Process Automation (RPA).

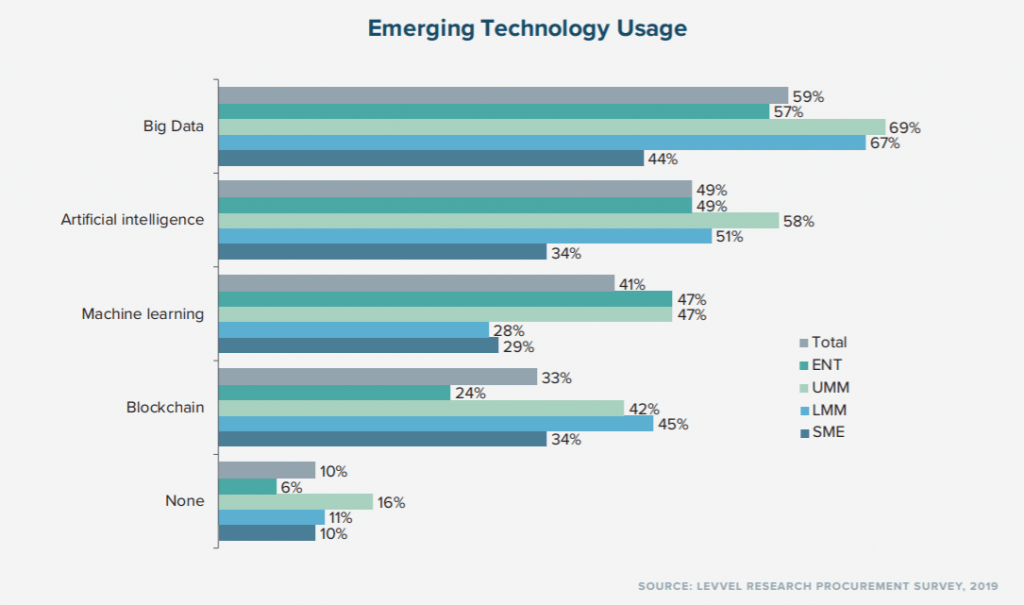

According to Levvel’s Guide to Procure-to-Pay & Digital Transformation Big Data, Artificial Intelligence and Machine Learning rank as the top emerging technologies in procure-to-pay.

RPA, however, acts as the perfect bridge towards eventual AI integration. It is the single emerging technology that is foundational to effecting digital transformation in P2P, with its ability to take on repetitive, rules-based tasks and processes, namely invoice matching. In a recent blog, we discussed the impact that RPA is having on AP.

Over time, AI can learn such processes that RPA manages and both improve them and flag any issues as they arise.

How Does it Compare to 3-Way Matching?

As advanced as 2-way matching can seem, it is actually a simplified version of 3-way matching. In 3-way matching, the automated process also uses an invoice and a purchase order. However, there is an additional level of verification. The system also matches a goods receipt note (GRN). This confirms that your company has a record of receiving the item. This extra level of protection was added in order to limit unnecessary payments. However, the extra security creates some additional complications that have made some companies look for an alternative.

Where 2-Way Matching is Preferable?

GRN Blockers

There are some companies that benefit from using a simplified 2-way matching process. This is because 3-way matching can create an excessive demand for verification that slows down the process. When you use 3-way matching, you are creating goods receipt blockers. This is problematic because there are many modern exchanges that do not transmit specific goods. Instead, the purchase is for services. Many suppliers do not provide a receipt for a service, which means the invoice lays stagnant in the system until someone intervenes. This keeps your accounts from being balanced and frustrates your suppliers.

Direct Shipping

Moreover, consider cases of direct shipping. Direct shipping moves products directly from the supplier to you. This dramatically reduces shipment time because of an agreement between your company and the supplier. However, this process is muddied when additional paperwork is required. To maintain a fast supply of goods, it is important to keep payments moving out at a good rate. With 2-way matches, this is possible.

Licencing Costs

A 2-way match reduces the licensing costs that can be associated with 3-way matching. Because 3-way matching requires an extra layer of verification, there must be more licensing involved. In many cases, this extra verification is simply unnecessary. Therefore, the costs are also unnecessary, and your company is throwing away money. Some experts suggest that common sense should prevail. The Pareto Principle may be applicable. This concept delineates that 80 percent of your expenses are tied up in 20 percent of your purchases. Therefore, you may only want additional verification on that scant 20 percent. The rest of your purchases are only slowed down by 3-way matching.

Other Benefits of 2-Way Invoice Matching

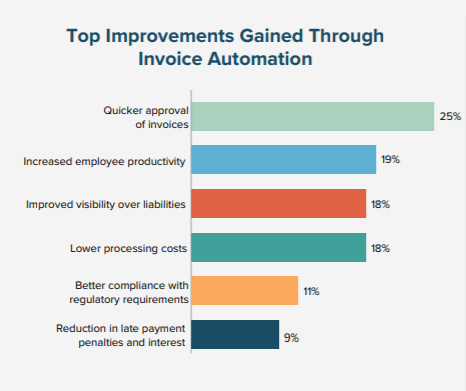

According to Levvel Research, quicker approval of invoices and increased employee productivity rank as the top two benefits experienced from a switch to invoice automation. While these benefits can be seen within both 2-way and 3-way matching processes, they are particularly noticeable in the former.

Increased Employee Productivity

Ultimately, 2-way matching is simply less labor intensive than 3-way. Compared to companies without a procure-to-pay solution, 2-way matching reduces the human toll of paying invoices. Moreover, it improves your accuracy in payment. Human error is a huge problem. An automated system makes far fewer mistakes. This means you reduce incorrect payments while also balancing your accounts faster.

The main burden of 3-way matching is the extra layer of verification. As mentioned, not all suppliers consistently provide a receipt. When this happens, employees must intervene to do the verification process where the automation cannot. This is quite tedious. The likelihood of overpaying on an invoice is slight compared to the extra work involved with additional verification in 3-way matching.

With a fully automated process in place, that requires the matching of only a PO and invoice, employees are able to spend more of their time on more valuable tasks.

Quicker Approval of Invoices

Where GRN is not required, most commonly in the purchasing and delivering of services as opposed to specific products, the matching process can be a lot smoother and ultimately quicker.

Where three documents need to be matched, the likelihood of exceptions occurring increases. There may be discrepancies in the data included, or the GRN may not have been provided.

With a reduction in exceptions through 2-way matching, invoices are routed for approval quicker, which means suppliers are paid quicker.

Finding the Right Matching Solution

Ultimately, deciding to use a 2-way system is simply a matter of your company’s needs. When weighing your options, look at the types of goods or services you need. 2-way matching is best for recurring services that are predictable. Just consider office supplies, wherein the costs are consistent. A simplified 2-way match is going to suffice just fine. Even temporary services are best matched with a 2-way system. The purchase order can simply list all associated costs for the specified time period, which renders additional verification unnecessary. The solution will vary for each company, but understanding the benefits of 2-way matching can help you make an informed decision.