SoftCo for Financial Services

Automating the Financial Services Industry

Automating the Financial Services Industry

Procure to Pay Automation plays a crucial role in helping Financial Services organizations comply with strict regulations like GDPR, SOX, and AML. Procure to Pay automation provides enhanced control, accuracy and audit trails, meeting SOX’s internal control requirements and ensuring secure data handling for GDPR compliance. SoftCoP2P for Financial Services, designed for the financial industry with a decade of collaboration experience with leading financial institutions including Lloyds Bank, Cantor Fitzgerald and Crown Agents Bank, boosts efficiency and process transparency, reducing compliance risks. SoftCo Compliant Archive makes these records easily accessible, properly indexed, and retained for the required period as mandated by regulations.

In addition to meeting core compliance obligations, SoftCoP2P delivers unrivalled savings. Smart Matching, powered by AutoML Machine Learning, removes manual elements of invoice matching, resulting in an industry-leading 90% touchless invoice processing. Smart Coding and Smart Routing also utilize Machine Learning to automatically determine the correct routing and coding of invoices, resulting in 89% faster processing of non-PO invoices compared to manual environments. Surcharge processing is automated regardless of the way in which they are presented, reducing the time to process by 95%.

SoftCoP2P is truly global, handling multiple entities and multiple currencies in multiple languages. It eliminates maverick spending and delivers efficiencies, cost savings and 100% visibility & control over the entire procure to pay process. SoftCoP2P software boosts your key vendor relationships by providing an efficient onboarding process and full visibility over the status of their invoices. The solution enforces and optimizes pricing agreements with your preferred vendors. It also manages the request, purchase, and control of contract-based spend.

“The SoftCo platform has contributed to creating a frictionless process,

saving considerable time and effort.”

Europe

$30m+

10,000

Infor SUNSystems

Crown Agents Bank is a UK-regulated provider of wholesale foreign exchange and cross-border payment services. When Crown Agents Bank was acquired by a private equity firm in 2016, it was apparent that they needed a solution to streamline and automate their Accounts Payable and Procurement processes. The onset of the global pandemic and the subsequent move to remote working further accelerated this strategy.

SoftCo has provided Crown Agents Bank with an end-to-end Procure-to-Pay solution that encompasses all elements from Vendor Management to Procurement, including invoice capture, matching, query management, and invoice approval.

Crown Agents Bank dramatically reduced the time and costs associated with manual invoice processing across tasks such as recording invoice details, authorization, approval, journal posting and VAT returns. The auto-match feature enabled straight-through processing of invoices, saving hundreds of hours of employee time. The bank can now easily track expenses, identify growth opportunities, and decrease both processing times and human error. The cloud-based solution has also enabled their teams to continue their work with improved visibility and efficiency.

R.J. O’Brien’s primary challenge was to overhaul its disjointed AP processes, which were causing delays and inefficiencies in invoice processing across different global jurisdictions. The company needed a global solution with an intuitive user experience, a strong approval process where users could authorize invoices conveniently via email and full integration into their Infor Sun ERP system.

SoftCo are providing R.J. O’Brien with end-to-end AP automation including smart capture, matching, coding, and approval, delivering the scalable solution needed to meet RJO’s continued growth globally. Key factors in choosing SoftCo was spend control through PO conformance, high automation rates driven by AutoML Machine Learning and the intuitive user interface. SoftCoAP fully integrates with RJO’s existing ERP system, Infor Sun.

As a result of choosing SoftCo, R.J. O’Brien have now benefitted from streamlined operations, maintaining headcount with increased scalability, improved oversight and controls and the ability to process their invoices consistently and efficiently.

“Invoices have been growing and we haven’t had to increase our headcount in any material capacity”

United States

570+

10,000

Infor SUNSystems

“With SoftCo Compliant Archive we have a system capable of fully managing our document lifecycles, ensuring we always meet compliance obligations.“

SoftCo Vendor Management delivers the benefits of working efficiently with preferred Vendors. Purchasing is optimized, costs reduced, and administration is eliminated. The cloud-based solution ensures Vendors have full online visibility of all orders and invoices and queries and disputes are addressed immediately.

SoftCo non-PO invoice handling reduces processing time by up to 90%, with industry leading compliance and audit checks. SoftCo Non-PO Smart Coding intelligently identifies and learns coding patterns allowing it to automatically code invoices, saving time and eliminating error.

SoftCo eProcurement (electronic procurement software) ensures a quick and efficient purchasing process for all operational spend, in full compliance with your organization’s procurement policies. SoftCo eProcurement software streamlines capital, recurring and operational spend.

SoftCo Accounts Payable Automation delivers an accelerated, secure invoice approval process with configurable automated workflows. With multiple verifiers and approvers, invoices are routed for approval, automated email notifications are sent, followed by reminders. Un-actioned invoices are routed to an alternative approver, ensuring minimal process delay.

The SoftCo Compliant Archive solution offers intelligent storage and powerful search tools for vast quantities of document types (paper, email, PDF, XML, EDI, etc.). All documents are securely stored with strict access control measures. The system efficiently indexes and categorizes documents during the capture stage, ensuring instant availability on fast magnetic media while meeting regulatory compliance requirements.

SoftCoPay transforms payments from a cost center to a profit center by reducing costs, earning rebates, mitigating payment risk, and optimizing payment type. Payments are streamlined into an easy to use workflow. The seamless process, from receipt of invoice to vendor payment, delivers control and transparency with straightforward reconciliation through your ERP and a fully auditable payment process.

SoftCo Accounts Payable Automation captures all invoice data, regardless of the format received from your Vendors, using advanced Data Capture technology or via SoftCo’s outsource data capture service. Processing times are improved, and keying errors eliminated.

SoftCo Pre-Approved Spend functionality enables a seamless drawdown on pre-agreed budgets and the generation of purchase orders for spend with preferred vendors, without delay. Department budgets are not exceeded and spend with your vendors is controlled.

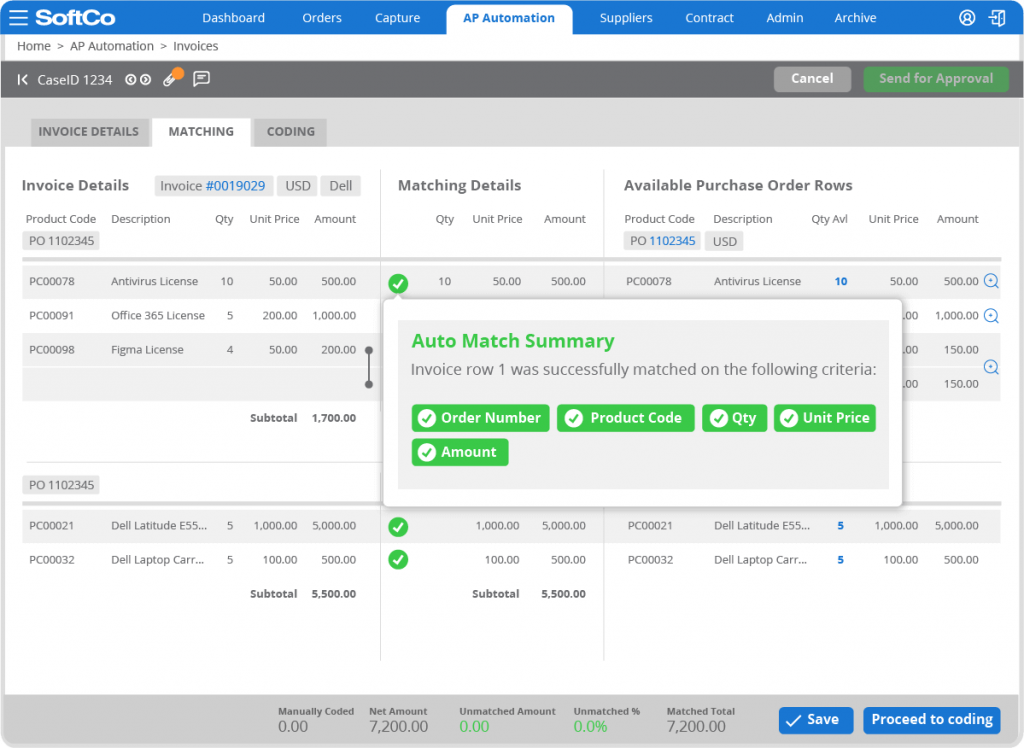

The SoftCo Matching Engine uses advanced RPA technology removing all manual elements of invoice matching, delivering an error-free, efficient process for all invoice types. The SoftCo Smart Matching engine applies Machine Learning technology to even the most complicated matching scenarios, such as incomplete data, missing product codes, and FX conversions to deliver 90% match rates.

SoftCo delivers industry leading analytics to empower organizations to make informed decisions. SoftCoP2P offers both SoftCo Advanced Analytics, part of the SoftCo solution, and the ability to integrate with 3rd party analytics tools. The platform provides accurate, real-time information over AP productivity, invoice processing rates and payments performance.

Financial Management: From Theory to Practice

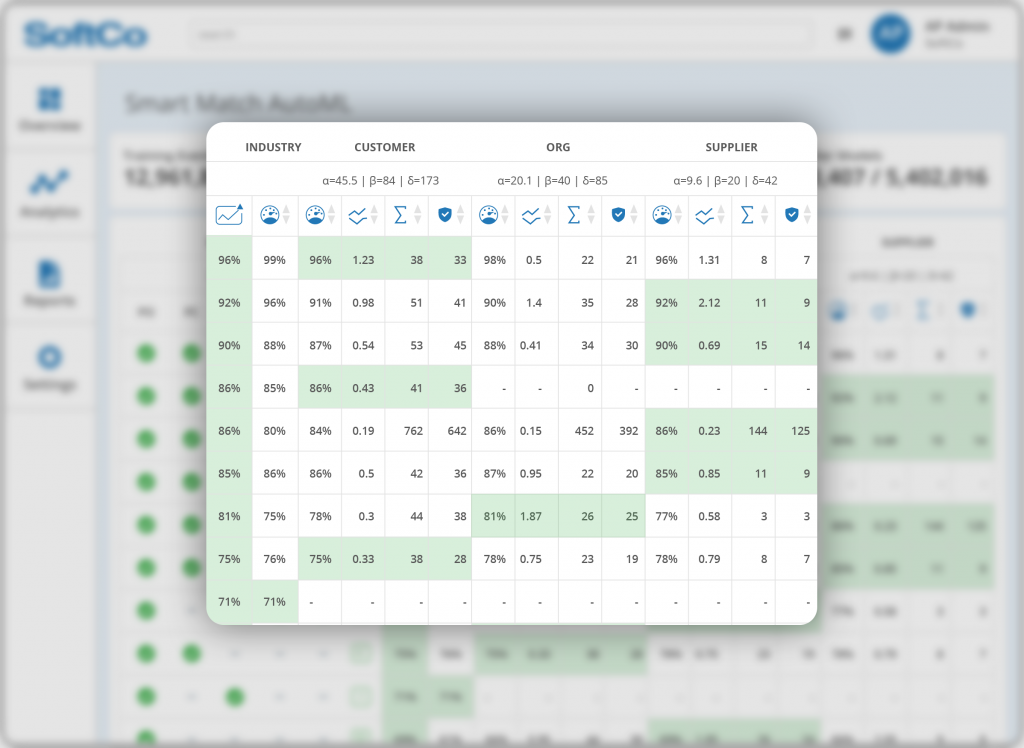

SoftCo’s unique AutoML Machine learning automates the time-consuming and iterative tasks associated with Invoice Automation, delivering unparalleled savings for the customer, with full auditability and control.

Utilizing millions of real data from Industry, Operations, Organizations, and Suppliers, the SoftCo AutoML Machine Learning engine ‘learns’ and improves based on 250+ match ‘patterns’ and applies this automation to SoftCo Smart Matching models, including tolerance, aggregation, and confidence match criteria. SoftCo AutoML uses real-time dynamic data. Instead of relying on stale static data, the engine learns immediately every time an invoice finishes processing, constantly improving automation customized to the specific organization.

Machine Learning (ML) is a game-changer in automating both PO and Non-PO invoicing, with full transparency and auditability. Manual invoice processing can cost $16 per invoice, whereas high invoice automation, driven by AutoML reduces processing costs by over 90%. The same ML technology is applied to the coding and routing of invoices, which are optimized by AutoML based on continuous learned patterns.

The results are unrivaled, and the savings exceptional. SoftCo delivers 90% straight through processing for PO invoices and 89% faster processing of Non-PO invoices.

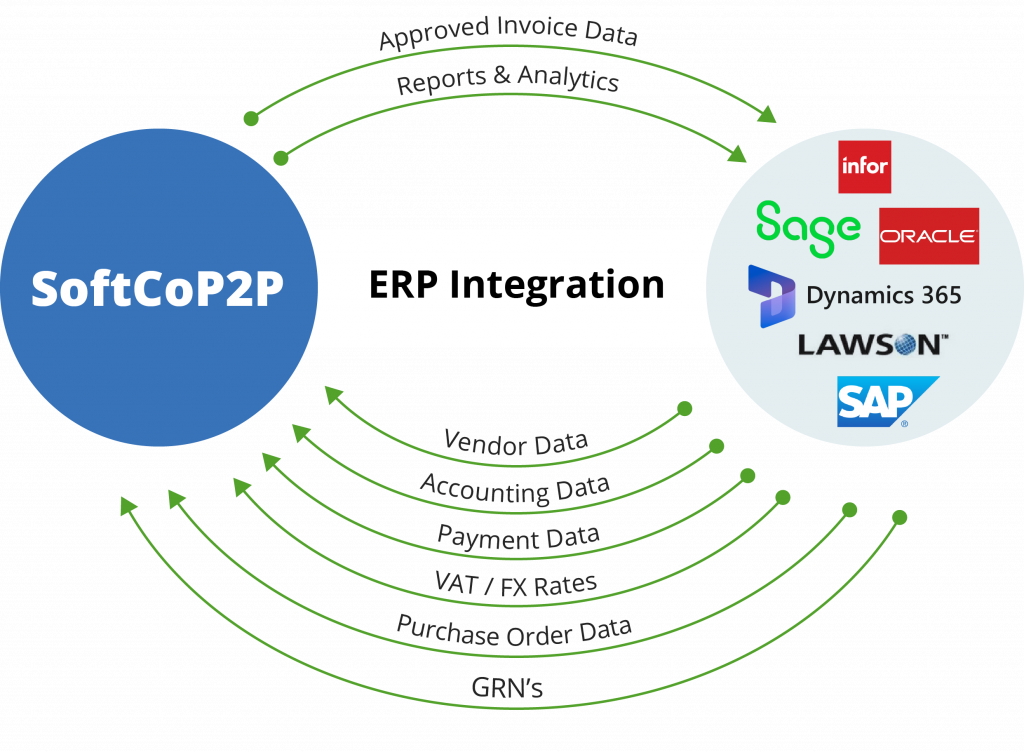

Seamless, secure and timely integration with the Finance system or ERP is a key part of any P2P or AP Automation solution. Integrating your ERP with SoftCo will expand its capabilities, making it a more powerful business tool than ever before. SoftCo SmartConnect is a secure, highly configurable cloud based platform which manages all of the data exchange between the ERP and SoftCo. SoftCo integrates seamlessly with existing ERP systems at a single point, thus offering access to real-time information and data.

SoftCo SmartConnect has seamlessly integrated with over 200 ERP’s including Microsoft, Oracle, SAP, Infor, Sage and multiple industry specific and even bespoke ERP’s.

eBook

Retail organizations are encountering industry-specific challenges. Learn how automation can resolve the significant challenges of manual AP processes and the value it adds to the retail supply chain.

On-Demand Webinar

Learn how SoftCoAP simplifies and accelerates the process of capturing and accounting for different types of surcharges, to ensure accuracy over the true costs of goods and materials.

Blog

Here we run-through 7 important accounts payable performance metrics that can be monitored to ensure that your AP department is running both efficiently and effectively.