December is typically a season full of festive celebrations, holiday lights, and good cheer. Yet before kicking off the new year, accounting departments face the grueling task of closing the books for the year.

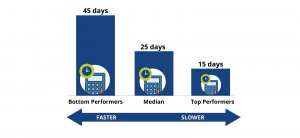

For accounting departments, the year-end close process is a daunting, stressful time of year. Your team is under the gun to report accurately but also in a very quick time frame . Unfortunately, many accounting teams continue to struggle with the annual close. The cycle time for closing is 15 days for top-performing companies, but bottom performers lag with 1.5 months needed to complete the process.

Your year-end close doesn’t have to go down that route. A little planning and prep time can go a long way to making your close-out process smooth. Below we present five steps for an easy year-end close.

Improve your Month-End Process

Who says you have to start your year-end close on January 1? Keep a close eye on your records all year round, and you can cut back considerably on year-end demands. Take care of key tasks every month to improve the quality of your general ledger.

Make it a point to reconcile your bank accounts and review account postings each month for errors or missing bills. This way, you aren’t playing catch up with your monthly reconciliations or checking scores of transactions when January 1 rolls around. Instead, your team can focus on what happened the month before.

Where possible, integrate accounting systems to other systems like Accounts Payable. Integrating applications to the accounting system reduces errors, improves accuracy and data integrity, and eliminates multiple data entries.

As an added plus, a company can make better decisions when its books and records are complete and current.

Keep Your Books Clutter-Free

How tough is it to find a document when your desk is littered with papers? Your accounting records can suffer the same fate. Cluttered books with duplicate or unused accounts make it harder to find what you are looking for. A messy chart of accounts makes your books prone to posting errors.

If your chart of accounts list goes on for pages and pages, you may have more accounts than your company needs. It is helpful to stick to general ledger accounts that are meaningful to your company’s operations. Take the time to review your chart of accounts and disable those you don’t need.

Fewer accounts make it easier to find transactions, limit data entry errors, and improve the overall quality of your general ledger.

According to Deloitte, about 1 in 6 reconciliations end in errors and exceptions, making it crucial to review the accuracy of your general ledger. Wrong cut-off dates, overdue items, and reconciling items without adequate investigation are common issues that delay finance teams by as much as 8 hours per month.

Treat Year-End Closing as a Company-Wide Project

Finance and accounting do most of the work during year-end closing. However, these teams rely on all departments to provide complete and accurate information to close efficiently.

All departments should follow strict cut-off dates for expenditures and revenues.

Establish an accounting calendar involving all relevant departments. Each department should assign an employee accountable for complying with a deadline for activities and turning in information on time.

Without access to complete information, accounting teams cannot determine correct balances. In addition, constant revisions from operations delays the closing process as accounting teams have to reprocess financials.

Complete a Closing Checklist

Companies that falter with year-end closing perform the process reactively rather than following clear and specific steps. While some companies have year-end closing checklists, many of them involve only a few team members. Often, finance leaders and CEOs only receive updates on the status of year-end closing during conference calls.

Rather than having a loose to-do list, companies should impose a year-end checklist, track the status of each task, and set benchmarks. A standard procedure makes training easier, keeps steps from falling through the cracks, and gives a framework to optimize for continuous improvement. Visibility into the process and identifying bottlenecks are crucial to determine areas for improvement during year-end closing.

Documenting and tracking the close process provides an essential building block for developing technology to improve the accounting function. Companies have to understand main tasks and dependencies, task duration, departments involved, and other factors that affect the quality and speed of the closing process.

The year-end checklist should include a detailed set of steps complete with the person accountable for each task, a clear completion schedule, and an emphasis on the value of the task.

Knowing the actual status of the close process allows corporate leaders to have clear expectations on the availability of management reports. Tracking and benchmarking also highlight whether the organization has outgrown the existing accounting technology.

Automate for an Easy Year-End Close

Tight deadlines, delayed paperwork, and sifting through thousands of transactions make closing down the year a stressful and chaotic event. Goals of speed and accuracy often lead to overtime work, but increased pressure can lead to errors. If chaos is how you describe your year-end closing process, it’s time for a new strategy.

Regular maintenance of your accounting books and records can speed up your year-end close. Considering how technology makes it possible to automate 98% of accounting, auditing, and bookkeeping, technology upgrades can provide critical support for finance and accounting functions. Otherwise, manual efforts to bridge technological gaps delay year-end closing and visibility into the organization’s financial health.

When you automate, the quality of your books and records improves. You spend less time fixing mistakes and more time analyzing results. Leveraging automated AP solutions speeds up report processing while improving data accuracy.

Automated AP systems improve visibility throughout the closing process by creating one platform for improved information sharing and faster communication. Giving your employees more visibility on invoices as they move electronically through the system reduces the likelihood of missed expenses and accrual at the end of the year. If your closing process has traditionally been late due to managers who do not approve invoices promptly, automation will help close the gap. Creating a clear audit trail also allows accounting and audit teams to drill down into every transaction if needed, accelerating annual close processes.

Reducing bottlenecks during the annual close means faster access to critical financial data. Taking the guesswork out of decision-making improves the organization’s reaction time to both opportunities and threats. Unlock greater efficiency and better visibility by integrating automated AP systems into the accounting process with SoftCoAP.