In 2020, 74% of organizations became the target of payment scams, and companies lost more than $3.6 billion due to fraud. Accounts payable fraud detection is often crippled by the lack of an effective technology stack. In Gartner’s Quick Answer report titled “How Do You Reduce Fraud in the Accounts Payable Process”, analyst Akif Khan outlines the key steps to find and mitigate fraud.

Source: Association for Finance Professionals 2021

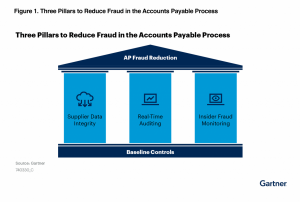

Gartner suggests that the solution to reducing fraud in the AP process requires going behind the “baseline level of internal controls” to minimize the risk of abuse using three pillars: supplier data integrity, real-time auditing, and insider fraud monitoring.

Source: Gartner

These additional capabilities are best implemented through AP automation. Automation provides the opportunity to achieve efficiency and cost savings while boosting security.

Reducing AP processing costs is often a key priority for companies, but what if organizations could tackle the cost element and reduce fraud risk at the same time?

In this article, we’ll examine how organizations can reduce AP fraud using state-of-the-art automation, with the help of Gartner insights.

Single Platform for All AP Activity

The transition to fully or partially remote work has boosted digital communications and payments, exposing additional vulnerabilities to fraud. In a survey by the Association for Financial Professionals, 61% of respondents admitted that business email is the main reason that their accounts payable department is the most susceptible to fraud. Gartner describes business email compromise (BEC) as a common attack criminals use to trick finance teams. Using this attack vector, criminals request changes in banking details using an email that seems to originate from the vendor.

According to the Gartner report, “your main line of defense should not consist of relying on your finance team to play detective.” Rather than having the finance team validate vendor information, companies should leverage automated solutions to ensure secure AP processing.

Vendor onboarding and pre-built integrations with portals also mean fewer emails and less opportunity for fraudsters to mimic legitimate invoices and other payment information. Having a single platform for AP activity supports Gartner’s pillar of ensuring vendor data integrity and reducing accounts payable fraud risks. Preferred vendors can submit invoices and track invoice status while matching and processing invoices.

AP Automation covers every step of the process from:

- Supplier Management

- eProcurement

- Contract Compliance

- Invoice Data Capture

- Invoice Matching

- Invoice Approval

- Posting and ready for payment

Audit the Invoice Process in Real-time

According to the Association of Certified Fraud Examiners, a lack of internal controls contributes to about a third of all fraud cases. Anti-fraud controls allow for faster detection of fraud cases and decrease losses. It’s important to apply controls in real time through a customizable e-procurement process and data validation.

With AP automation, requests for operational spending go through a simple but efficient process that includes real-time auditing – Gartner’s second pillar to mitigating fraud risk. The system checks for duplicate payments and duplicate invoices, and validates information against a list of approved suppliers and authorized limits.

According to Gartner, solutions that automate manual fraud reviews often check for the following irregularities:

- Checking for duplicates by comparing all invoice information, not just the invoice number.

- Flagging invoices with recent changes in key information like the bank account or a non-typical expense.

- Detecting potentially anomalous invoices with invoice values higher than historical invoices from the vendor.

Solutions designed for invoice monitoring reduce blind spots in the AP process since all invoices have to undergo real-time auditing before getting paid.

Since the company’s procurement policy is built into the system, only payments in compliance with corporate policy would be approved automatically. Exceptions and irregularities will require manual review, strengthening controls against fraudulent activity without slowing down the approval process.

Reduce Errors

Accurate data entry and invoice matching are time-consuming but crucial to avoid accounts payable fraud schemes. However, 51% of companies with manual AP systems struggle with data entry and inefficient processes, while 31% consider invoice-to-payment matching a pain point.

A traditional AP workflow relying on manual data entry makes accounts payable fraud detection prone to human error. As a result, inaccurate account numbers might appear on invoices, allowing criminals to siphon off corporate funds.

AP Automation solutions which use AI and machine learning to configure invoice approval workflows, reduce processing delays and increase accuracy. With high levels of automation resulting in a “no-touch” invoice system, AP staff only need to investigate exceptions. Automatic scans for duplicate payments and consolidated payment insights maximize accounts payable fraud detection.

Heightened Security Features

Fraud is more likely to thrive when multiple employees process invoices outside of a secure network. It’s hard to keep track of responsible parties or consistently ensure due diligence before approval. Automated AP systems provide more security by requiring multi-factor authentication and multiple approvals from the vendor side to change critical data.

Adding another layer of security reduces accidental or fraudulent payments. You can limit access to invoices and appoint the authorizer, approver, and manager.

Better tracking of who makes invoice or documentation changes also leaves a transparent audit trail. Monitoring for insider fraud is the third pillar in the Gartner report for reducing fraud risk. Gartner points out that with automation, companies secure AP processing and prevent fraud by:

- Giving vendors direct control over critical information like their bank information to ensure safe and secure payments.

- Validate delivery and fulfillment risk for both physical and digital goods if the invoice has an unusual point of contact or delivery address.

- Defining areas that require multiple approvers to ensure separation of duties for critical areas like payment.

Removing unnecessary human intervention reduces opportunities to manipulate information that causes invoice fraud. Three-way matching between the invoice, purchase order, and delivery receipt (GRN) supports straight-through processing that achieves enhanced security throughout the process. Analyzing easily accessible transactional data is also an effective method to detect insider fraud.

Manage Supplier Contracts

Best practices in supplier management involve supplier performance evaluation. But periodic reviews of existing contracts are equally important. Companies lose as much as 9% of their annual revenue due to poor contract development and management.

Auto-renewing contracts without evaluation or renegotiation can leave the door open for fraud. For example, recurring payments to a suspicious account could go unnoticed without regular contract reviews. Value leakage due to fraudulent or inaccurate billing practices comes with financial consequences, but it could also affect supplier relations.

Automation solves the problem by integrating procure-to-pay systems with systems to manage existing vendor contracts. Managing contracts in one place allows managers to effectively monitor contracts and receive alerts when it’s time for periodic reviews.

Address Accounts Payable Fraud Risks, Automate AP

Traditional methods of handling payable information can’t keep up with the rapid-fire demands and high-volume transactions of organizations. Aligning procurement with accounts payable on one single source of truth minimizes errors and improves controls.

Accounts payable automation promotes cost control, efficiency, and accuracy. Tap into modern enterprise solutions to combat fraud with SoftCoAP.