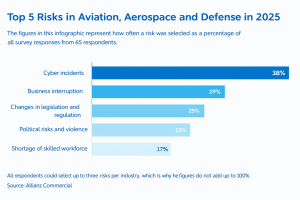

Few industries are as exposed to global disruption as aviation — and today’s geopolitical and security risks are unlike anything the sector has faced before. Airlines now contend with escalating conflicts, sanctions, and cyberattacks, each carrying direct financial implications and new layers of compliance pressure. Leading reports echo these concerns: the Allianz Risk Barometer 2025 ranks geopolitical conflict and cyber risk among the industry’s top threats, while KPMG’s Aviation Leaders Report warns that volatility is squeezing margins and destabilizing supply chains.

Source: Allianz Risk Barometer 2025

Yet many finance teams still rely on manual accounts payable (AP) processes that make it harder to track exposure, ensure accuracy, and prepare for audits. This leaves airlines increasingly vulnerable at the very moment airlines need control. That’s why more finance leaders are turning to AP automation — a solution that strengthens financial controls, improves audit readiness, and flags irregularities before they escalate.

This blog will explore:

- The major geopolitical and security risks airlines face today.

- Why manual processes leave finance teams exposed.

- How AP automation builds compliance and resilience.

By the end, you’ll see how automation turns AP into a strategic tool for resilience and compliance in aviation.

Aviation’s Geopolitical & Security Risks

Aviation Conflicts and Airspace Disruptions

Armed conflicts and political instability are redrawing global flight patterns. Closed airspace forces airlines to reroute, often adding hours to journeys, driving up fuel costs, and reducing capacity.

- The Guardian recently reported that flights across Eastern Europe and the Middle East are frequently diverted, with crews navigating “blind spots” where GPS is jammed.

- The war in Ukraine alone has cost airlines billions in longer routes, stranded assets, and rising operating costs.

- Ongoing Middle East tensions continue to disrupt traffic through one of the world’s busiest aviation corridors.

Industry bodies and analysts confirm the scale of the challenge:

- The International Air Transport Association (IATA) warns that conflict-driven airspace closures are forcing inefficient routings worldwide, adding significant cost pressures and reducing network predictability.

- PwC’s 2025 Aviation Outlook highlights how geopolitical instability fuels price volatility and creates long-term uncertainty for financing, leasing, and supplier relationships.

For airlines, the disruption carries both financial and compliance consequences:

Financial impact

- Unplanned increases in fuel and insurance costs.

- Disruption to supplier contracts and flight schedules.

- Lost revenue capacity from longer flight times and reduced route efficiency.

Compliance impact

- Difficulty validating contracts and payments when jurisdictions shift.

- Increased risk of breaching local regulations when operations move suddenly.

Beyond the immediate disruption of conflicts, airlines must also contend with sanctions and trade restrictions that reshape global partnerships and add fresh layers of compliance risk.

Aviation Sanctions and Trade Restrictions

Sanctions are reshaping aviation’s financial landscape, leaving airlines with far less certainty in global partnerships.

- U.S. and EU sanctions on Russian aerospace suppliers blocked access to aircraft parts and leasing contracts, creating compliance headaches across Europe and Asia.

- IATA warns that such restrictions disrupt competitive dynamics and can change overnight.

- PwC’s 2025 Aviation Outlook notes that sanctions and regulatory barriers are adding significant legal and compliance complexity, particularly for aviation financiers and lessors operating across multiple jurisdictions.

- As Reuters recently reported, new U.S. tariffs on critical imports could put both air safety and supply chains at risk — showing how trade measures extend disruption well beyond the immediate target region.

For finance teams, sanctions mean more than operational disruption — they introduce direct financial and compliance risks such as:

Financial impact

- Payments frozen mid-transfer or blocked outright.

- Supply chain disruption from restricted parts and service providers.

- Added costs for legal reviews and risk monitoring.

Compliance impact

- Staying aligned with fast-changing regulations across multiple jurisdictions.

- Exposure to fines and reputational risk if payments are made to sanctioned entities.

- Heavier due diligence requirements during supplier onboarding and renewal.

At the same time, the industry’s growing reliance on digital systems has opened a new risk frontier — with cyberattacks now among the fastest-escalating threats facing airlines worldwide.

Aviation Cyberattacks and Digital Vulnerabilities

As airlines become more reliant on digital systems, they also become prime targets for cybercrime.

- The FBI has warned — as reported by Forbes in July 2025 — of escalating airline cyberattacks, ranging from ransomware to attempts to disrupt flight operations.

- ICAO’s Safety Report 2025 identifies cybersecurity as one of the industry’s top risks.

- And as IATA’s Cybersecurity Fact Sheet notes, “as the attack surface increases, the industry requires a better understanding of the necessary security measures to sustain and assure safety, reliability and resilience.”

The scale of the threat is growing rapidly:

- A 2024 study by SecurityScorecard found that ransomware is now a top threat in aviation, with 7% of companies reporting breaches in the past year and 17% showing evidence of compromised machines.

- The CSC 2.0 Turbulence Ahead report noted that cyberattacks against aviation rose by 131% in 2023 compared with 2022.

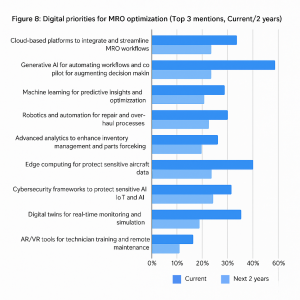

- Accenture’s Commercial Aerospace Insight Report 2025 ranks cybersecurity frameworks to protect sensitive aircraft data among the industry’s top digital priorities for maintenance and operations.

Source: Accenture’s Commercial Aerospace Insight Report 2025

For airlines, the consequences span both financial and compliance risks:

Financial impact

- Direct losses from downtime and ransom demands.

- Reputational damage leading to reduced bookings.

- Higher insurance premiums as cyber liability grows.

Compliance impact

- Breaches of GDPR and ICAO cybersecurity standards.

- Regulatory penalties for inadequate safeguards.

- Gaps in financial controls when systems are taken offline.

Viewed together, these risks underline a central truth: airlines dependent on manual AP processes are falling behind. Addressing this weakness is essential — and it starts with rethinking how finance operates.

Why Manual AP Processes Fail Airlines

Even as risks grow more complex, many airlines still rely on outdated, manual processes to manage their accounts payable. These practices increase exposure by limiting visibility, accuracy, and resilience at the very moment finance teams need them most.

According to IFOL’s Accounts Payable Automation Trends 2025, 66% of AP teams still manually enter invoice data into ERP systems, and 63% spend more than 10 hours per week processing invoices — time that could otherwise be spent strengthening financial controls.

The risks are well documented. The SSON State of Accounts Payable 2025 report found that:

- 41% of AP leaders identify compliance and tax regulation complexities as a major challenge.

- 41% struggle with invoice matching errors that can directly lead to financial loss or fraud.

- 29% point to fraud and security risks as ongoing concerns.

Source: SSON State of Accounts Payable 2025

For airlines, these vulnerabilities aren’t just operational headaches — they represent compliance breaches waiting to happen in an already volatile environment.

Tracking Exposure

Manual processes make it nearly impossible to maintain a real-time view of which suppliers, contracts, or payments are tied to high-risk regions or sanctioned entities. As The CFO has noted, airlines face growing financial instability in part because of poor visibility into risk exposure.

- No centralized monitoring of supplier risk.

- Delays in spotting vulnerabilities — especially when data entry is manual.

- High risk of errors in tracking sanctioned entities.

Ensuring Accuracy

In a fast-moving environment, accuracy is everything. Spreadsheet-driven reconciliations and paper-heavy workflows leave too much room for error — and errors in this space can quickly become compliance violations.

- Missed regulatory updates when sanctions change.

- Inconsistent or incomplete audit trails.

- Increased likelihood of fines due to incorrect or late filings.

Maintaining Audit Readiness

Manual systems also make it difficult to prepare for audits efficiently. In a disrupted environment, that lack of readiness adds unnecessary cost and risk.

- Difficulty compiling consistent records across jurisdictions.

- Significant staff time spent preparing audits instead of strategic work.

- Higher risk of audit failure during periods of disruption.

Manual AP processes magnify the very risks airlines face today — from compliance breaches to missed red flags. In an environment where disruption is the norm, finance teams can’t afford to be reactive. This is where AP automation changes the equation, giving airlines the control, visibility, and resilience they need to stay ahead.

Discover how SoftCo AP automation gives aviation finance leaders the visibility, control, and resilience needed to stay ahead of disruption.

How AP Automation Strengthens Airline Compliance and Resilience

Automation flips the script. Instead of finance teams scrambling to keep pace with disruptions, AP automation gives airlines the tools to stay ahead.

Momentum is building across the industry:

- According to IFOL’s AP Leadership Priorities Report 2025, 61% of AP leaders identify digital transformation, automation, and AI integration as their top investment priorities.

Source: IFOL’s AP Leadership Priorities Report 2025

- IFOL’s AP Automation Trends 2025 shows that AI use in AP has grown from just 7% in 2024 to 29% in 2025 — more than a fourfold increase in a single year as finance teams look to boost efficiency and strengthen financial controls.

- Yet adoption still lags behind the scale of the threat. The SSON State of Accounts Payable 2025 report found that 60% of AP leaders believe their department’s fraud risks are higher than three years ago, while only 7% report that risks have fallen — largely thanks to automation.

Source: SSON State of Accounts Payable 2025

This widening gap highlights a critical reality: automation is advancing, but it has not yet scaled widely enough to offset growing risks. For airlines, faster adoption is essential to strengthen controls before vulnerabilities escalate further.

Improves Audit Readiness

Automation ensures every invoice, payment, and approval is captured digitally — with a clear, accessible audit trail.

- Instant retrieval of transaction histories across multiple jurisdictions.

- Automated audit reports reduce preparation time and cost.

- Consistent, standardized records ready for regulators.

Flags Irregularities Faster

Machine learning and automated checks can flag duplicate invoices, unusual payment patterns, or potential fraud far faster than manual reviews.

- Early alerts for suspicious supplier activity.

- Automatic cross-checking against sanction lists.

- Reduced risk of fraudulent or duplicate payments.

Strengthens Financial Controls

Automation removes the guesswork and inconsistency of manual handling. Controls are embedded directly into workflows, reducing error and enforcing compliance by design.

- Enforced approval hierarchies for all payments.

- Integration with ERP systems for end-to-end visibility.

- Built-in compliance checks that adapt to regulatory changes.

With manual AP, finance teams are always reacting. With automation, they’re anticipating, preventing, and controlling. For airlines navigating today’s unpredictable environment, that shift makes the difference between vulnerability and resilience.

Turning Compliance into Resilience

The aviation industry continues to operate against a backdrop of volatility and risk. Conflicts, sanctions, and cyberattacks aren’t just operational challenges — they are direct threats to financial stability and compliance. Manual processes leave airlines exposed at precisely the moment they need clarity and control.

AP automation changes that equation. By improving audit readiness, detecting irregularities early, and embedding financial controls, automation enables finance teams to move from firefighting to foresight. It transforms compliance from a box-ticking exercise into a source of resilience and competitive strength.

Discover how SoftCo AP Automation for Aviation helps airlines safeguard compliance, strengthen financial control, and stay ahead of disruption — before the next crisis hits.

Frequently Asked Questions

Aviation finance teams are navigating sanctions, airspace closures, volatile fuel costs, and cyberattacks — all of which disrupt financial operations and increase compliance complexity.

Sanctions can freeze payments, block access to parts or services, and require constant monitoring of supplier relationships. Manual AP systems make it harder to stay compliant in real time.

Manual AP increases the chance of errors, delayed approvals, and compliance breaches — especially when operations are spread across jurisdictions impacted by sanctions or cyber threats.

Automation enforces built-in controls, matches invoices against sanction lists, and creates a full digital audit trail — reducing exposure and improving audit readiness.

Look for global ERP integration, sanction screening, AI-powered matching, and multi-jurisdiction support. Real-time visibility and exception handling are essential.