Cost overruns are all too common in construction. Material price swings, unforeseen delays, and finance inefficiencies steadily erode already fragile profit margins. According to Digital Construction Week, McKinsey estimates that global construction inefficiencies drive cost overruns in the 20% to 45% range, costing the industry trillions each year. Deloitte’s 2025 Engineering & Construction Outlook adds that high inflation and rising costs continue to squeeze profitability across the sector, leaving contractors under pressure even in periods of strong demand.

Too often, finance is overlooked in this struggle. Yet even small issues — a duplicate invoice, a missed payment deadline, or poor visibility over spend — can determine whether a project ends in profit or loss.

In this blog, we’ll examine:

- The key drivers of cost overruns in construction: material price volatility, project delays, and manual finance errors.

- How AP automation addresses these challenges with accuracy, control, and visibility.

- Why finance efficiency is now essential to sustaining profitability in a high-risk, low-margin industry.

TL;DR

- Construction cost overruns are typically driven by material price swings, project delays, and weak financial controls.

- Manual accounts payable adds avoidable leakage through invoice errors, slow approvals, duplicate payments, and missed discounts.

- AP automation improves accuracy, strengthens approval control, and gives real-time visibility into project spend.

- In a thin-margin industry, better AP control is one of the most practical ways to protect profitability across every project.

Why Construction Projects Run Over Budget

Even in strong markets, construction projects are notoriously difficult to deliver on time and on budget. Thin margins mean that any disruption — from supply chain shocks to manual finance errors — can wipe out profitability.

How Material Price Volatility Drives Construction Cost Overruns

Essential materials like steel, concrete, and lumber are subject to rapid price swings driven by global demand, energy costs, and trade policies.

- In the U.S., construction input prices surged 41.6% between February 2020 and March 2025, according to Associated Builders and Contractors data reported by Newsweek.

- In Europe, Turner & Townsend forecast 2.4% construction cost inflation in 2025, reflecting ongoing upward pressure on materials and project inputs across the region.

These shocks alone are disruptive enough — but when projects are delayed, the financial damage multiplies.

Why Delays in Construction Projects Erode Profitability

Delays are another chronic driver of cost overruns. Whether caused by late material deliveries, labor shortages, or regulatory hold-ups, the result is the same: more time means more expense.

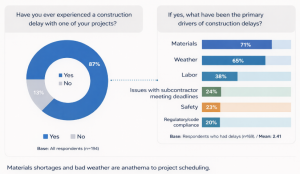

- A 2025 Sherwin-Williams poll reported by Building Design + Construction found that 87% of contractors experienced delays, with material availability and supply chain issues among the leading causes.

Source: Building Design + Construction

- McKinsey research highlights just how damaging this can be: cost overruns averaged 79% above initial budgets, while project delays ran 52% beyond original timelines.

- Case studies by Conlex Consulting show a multiplier effect: even a modest 3.57% time loss from disruption can balloon into nearly 39% productivity losses overall.

The financial fallout is severe. Extended delays inflate labor and equipment rental costs, expose firms to penalty clauses, and strain supplier terms — while reputational damage with clients can limit future opportunities. What makes these setbacks especially damaging is construction’s persistent productivity gap. McKinsey warns that, despite advances in other industries, construction continues to lag on efficiency, leaving firms with less resilience to absorb disruption.

With margins in the low single digits, every week lost can tip a project from profit to loss. And even when work resumes, back-office inefficiencies can continue draining profit — making financial controls as important as operational recovery.

How Manual Finance Errors Undermine Construction Profitability

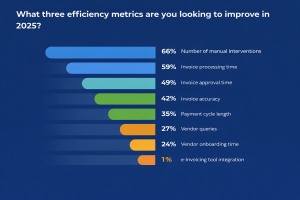

Even when construction sites move smoothly and milestones are achieved, profitability often drains away in the back office. Manual finance workflows introduce error risks that quietly erode margins — and finance leaders know it. According to IFOL’s Accounts Payable Leadership Priorities Report 2025, 66% of AP leaders rank “number of manual interventions” as one of their top efficiency metrics to improve this year, underlining how big a drag manual processes remain.

Source: IFOL Accounts Payable Leadership Priorities Report 2025

- High exception & error handling burden. According to Ardent Partners, around 14% of invoices require manual exception handling, consuming significant processor time and delaying payment cycles.

- Duplicate or missed payments. Manual data entry and weak validation lead directly to duplicate or erroneous payments — unnecessary leakage in an industry with razor-thin margins.

- Supplier disputes and delays. Errors in matching invoices with POs or goods received notes force rework, trigger disputes, and strain supplier relationships.

- Lack of visibility into real costs. Construction’s negative cash flow and delayed billing make weak cost tracking especially harmful, leaving finance leaders blind to overruns until profitability has already evaporated.

Across industries, PwC’s 2024 Finance Effectiveness Benchmarking Study shows that finance functions still devote disproportionate resources to transactional tasks rather than oversight and strategy. In construction — where margins often rest in the low single digits — these inefficiencies can be the difference between profit and loss.

This is exactly why AP automation in Construction is gaining momentum. By cutting manual touches and exceptions, finance teams reclaim visibility, control, and margin integrity.

The Financial Benefits of AP Automation in Construction

For construction firms, the financial pressures of price volatility, delays, and manual errors are impossible to ignore. Left unchecked, these issues bleed profitability from already thin margins. This is where accounts payable automation in construction makes a measurable difference — not as a back-office upgrade, but as a frontline safeguard for project profitability.

Improving Invoice Accuracy in Construction Finance

Invoice accuracy is one of the weakest links in construction finance. Mis-keyed data, missing approvals, and mismatched purchase orders can trigger duplicate payments or supplier disputes — both of which drain cash flow and damage relationships. According to IFOL’s AP Automation Trends 2025, 66% of AP teams still enter invoice data manually, highlighting just how exposed firms remain to costly human errors.

- Validation against POs and contracts: Automated checks flag discrepancies before payments are processed.

- Digital audit trails: Comprehensive records provide visibility, compliance, and accountability.

- Reduced manual intervention: Workflows route invoices automatically, cutting down exceptions and rework.

With automation in place, finance leaders can trust their data and protect margins from silent leakage.

Capturing Early Payment Discounts with AP Automation in Construction

In an industry where margins are measured in single digits, even modest efficiency gains can protect profitability. One overlooked opportunity is early-payment discounts — but manual AP processes often move too slowly to take advantage of them. PWC, in partnership with IDC highlights that modern AP capabilities make it easier for organizations to take advantage of early-payment discounts, proving that automation isn’t just about efficiency; it directly enables savings.

- Streamlined approvals: Automated workflows route invoices directly to the right decision-makers, cutting out delays that cause discounts to be missed.

- Predictable processing: Faster cycle times ensure suppliers receive payment on time, consistently qualifying firms for available discounts.

- Stronger supplier relationships: Reliable, early payments not only unlock savings but also improve collaboration with vendors in tight supply markets.

Real-Time Spend Visibility for Cost Control

Cost overruns thrive in the dark. When finance teams rely on manual AP, project managers often don’t see a full financial picture until weeks — or even months — after money has already been spent. By then, it’s too late to correct course.

Real-time visibility changes that dynamic. Automated AP platforms provide live, centralized oversight of every transaction, giving finance leaders the clarity they need to control costs as they happen.

- Live dashboards: Finance teams track liabilities, outstanding invoices, and project-by-project spend in real time.

- Early warning indicators: Overspending risks can be flagged before they escalate into major budget overruns.

- Cash flow forecasting: Real-time data supports proactive procurement and funding strategies, ensuring liquidity is aligned with project needs.

For construction firms competing on razor-thin bids, this agility can be the difference between finishing a project in profit or slipping into loss. By replacing lagging reports with live insight, Construction AP automation transforms financial oversight from reactive to proactive — a decisive advantage in an industry where margins leave no room for error.

Pulling the Levers Finance Leaders Can Control

While construction firms can’t control external forces like material price swings or site delays, they can control the efficiency of their financial operations. By tightening AP processes, automation reduces waste, safeguards already-thin margins, and builds resilience against disruption. In an industry where so much is unpredictable, finance efficiency is one lever leaders can pull today to protect profitability tomorrow.

Securing Construction Profitability with AP Automation

Cost overruns and thin margins are long-standing realities in construction — but today the risks are sharper than ever. Volatile material prices, inevitable delays, and manual finance inefficiencies all eat directly into profitability that’s already under intense pressure.

Accounts payable automation gives finance teams a lever they can actually control. By ensuring invoice accuracy, capturing early-payment discounts, and delivering real-time visibility into project spend, AP automation protects margins where it matters most. Often, it’s the smallest efficiencies — a faster approval, a secured discount, a timely cost insight — that determine whether a project ends in a profit or loss.

For construction leaders, the message is clear: outdated manual processes no longer belong in a high-risk, low-margin environment. Those that act today will have the financial resilience to manage risk and protect profitability in every project.

Discover how SoftCo AP for Construction helps firms reduce costs, strengthen compliance, and safeguard profitability — project after project.

Frequently Asked Questions

Cost overruns in construction are usually driven by a mix of material price volatility, project delays, labor shortages, and weak financial controls. Manual finance processes often add hidden costs through invoice errors, late payments, and poor spend visibility, making overruns harder to spot early.

AP automation reduces construction cost overruns by eliminating manual invoice errors, preventing duplicate payments, and giving finance teams real-time visibility into project spend. This allows issues to be flagged early — before small overruns turn into major margin losses.

Construction accounts payable is complex, with high invoice volumes, multiple suppliers, and project-based spend. When AP is handled manually, errors, delays, and missed approvals are common — all of which directly erode margins in an already low-margin construction environment.

Yes. Construction companies can improve margins through AP automation by reducing payment errors, capturing early-payment discounts, and tightening cost control across projects. While it won’t stop external shocks like material inflation, it removes avoidable financial leakage.

Implementing AP automation in construction requires careful alignment with existing ERPs, approval workflows, and project-based spend structures. Modern AP automation solutions are built to integrate with these environments, supporting complex supplier relationships and multi-project operations while improving control and visibility across accounts payable.