France’s e-invoicing mandate is moving ahead, and the path to compliance is now more clearly defined.

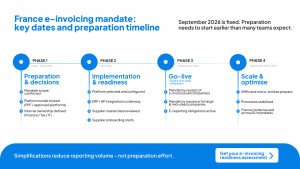

Recent announcements from the French government have introduced simplifications to electronic invoicing and e-reporting obligations. However, the September 2026 go-live date remains unchanged, and the core structure of the reform is now largely stable.

For large enterprises, the biggest risk is no longer regulatory uncertainty. It’s assuming there’s still time to wait.

France has one of the most advanced e-invoicing mandates in Europe and will act as a reference point for other EU countries. Finance teams that understand what’s confirmed (and start preparing now) are far less likely to face disruption as deadlines approach.

What’s confirmed in the France e-invoicing mandate

Several elements of the French e-invoicing reform are now clearly defined and can be planned against with confidence.

The scope of the mandate is clear

France is introducing mandatory e-invoicing and e-reporting requirements for VAT-registered businesses established in France. According to official French government guidance on the scope of the e-invoicing reform, this includes:

- Mandatory e-invoicing for domestic B2B transactions between VAT-registered companies established in France

- Mandatory e-reporting for:

- Cross-border B2B transactions (EU and non-EU, with limited exceptions)

- B2C transactions

- Payment reporting obligations for certain services

Who is affected – including foreign sellers and buyers

While the French e-invoicing mandate primarily applies to businesses established in France, cross-border scenarios introduce additional responsibilities that finance teams need to understand early.

In practice:

- If a foreign seller is not established in France, the French buyer typically has the obligation to report purchase through e-reporting.

- If a foreign seller is VAT-registered in France, that seller may have direct e-reporting obligations, depending on the transaction type.

- These distinctions are particularly relevant for large enterprises with:

- Centralised AP teams

- Shared services models

Understanding who reports what is essential to avoid gaps in compliance and unexpected manual workarounds once the mandate is live.

The implementation timeline is fixed

The phased rollout remains unchanged:

- 1 September 2026

- All companies must be able to receive electronic invoices

- Large and mid-sized companies must issue electronic invoices

- 1 September 2027

- SMEs and micro-enterprises must issue electronic invoices

The platform model is locked in

All e-invoice and e-reporting data must flow through:

- The government’s Public Invoicing Portal (PPF), or

- A government-approved private platform

Every company will need to select a compliant platform — this is not optional, and platform choice directly affects integration, scalability and supplier onboarding.

For a practical overview of how platform-based e-invoicing works, see our Guide to e-invoicing.

Structured invoice formats replace PDFs

The French mandate marks a clear operational shift away from unstructured invoices.

Under the new model, invoices must be issued in approved structured or hybrid formats, such as:

- Factur-X

- UBL 2.1

- CII

For finance and AP teams, this effectively means:

- No more “any old PDF” invoices arriving in inboxes

- Invoice data is transmitted in regulated, structured formats

- Validation, routing and reporting become system-driven rather than manual

This shift has major implications for:

- ERP configuration

- Supplier onboarding

- Exception handling processes

It’s one of the clearest examples of why e-invoicing readiness is about operating model change, not just regulatory compliance.

No new data requirements before go-live

The French government has confirmed that no additional mandatory data fields will be introduced before September 2026, in order to protect IT development already underway.

This gives finance and IT teams a stable foundation to move forward with system design and configuration.

What’s changed: recent simplifications explained

In August 2025, the French government announced several simplifications aimed at reducing administrative burden. These changes, summarised in EY’s Tax Alert on France’s September 2026 e-invoicing simplification measures, are meaningful. But they don’t reduce the need for preparation.

Key simplifications include:

- Removal of line-item e-reporting for international incoming invoices (EU and non-EU services)

- No requirement to submit blank e-reports when no taxable transactions occur

- Simplified B2C e-reporting, including removal of daily transaction count reporting and simplified VAT margin calculations for margin schemes

- Exclusion of certain non-EU transactions between French-established taxpayers

- Deferral of some obligations for non-established taxpayers until September 2027

These changes reduce reporting volume and friction. What they don’t change is the underlying requirement for compliant systems, accurate data and coordinated supplier processes.

Simplification should be viewed as time to prepare properly, not a reason to delay.

While these simplifications ease reporting volume, they don’t change the underlying move toward structured, regulated invoice exchange. Companies that rely heavily on PDF-based processes will still need to adapt their systems and supplier interactions well ahead of the 2026 deadline.

What’s still evolving – and why waiting increases risk

Some aspects of the French mandate will continue to be clarified through the Finance Bill for 2026 and related guidance, including:

- The treatment of specific cross-border and non-EU transactions

- Certain payment reporting mechanics

- How France’s framework will align with future EU initiatives such as VAT in the Digital Age (ViDA)

These open points affect how companies comply — not whether they must comply.

For large, multi-entity organisations, waiting for complete certainty often leads to compressed implementation timelines, rushed supplier onboarding and higher operational risk.

For a CFO-level view of how timing impacts compliance risk, see our 2026 e-invoicing CFO guide.

Enforcement and penalties: why compliance can’t be an afterthought

While detailed penalty frameworks continue to evolve, the direction of travel across Europe is clear: e-invoicing mandates are increasingly enforced in practice, not just on paper.

Recent enforcement activity in other EU countries, such as Belgium, has shown that authorities are willing to take a more active role when businesses fail to meet their obligations. France’s mandate is designed to support real-time tax visibility, making non-compliance more visible over time.

For large enterprises, the risk isn’t just financial penalties. It includes:

- Operational disruption

- Manual intervention at scale

- Reputational exposure

- Increased scrutiny from tax authorities

This is why many organisations are choosing to prepare early, rather than testing the boundaries of enforcement after go-live.

What finance teams should do now to prepare

For enterprises, e-invoicing readiness is less about understanding the mandate and more about operational readiness, particularly around data quality, supplier behaviour and the move to structured invoice formats.

As SoftCo’s e-invoicing implementation specialist Andrew Martin explains:

“What finance teams often underestimate isn’t the mandate itself, but the quality of the data flowing into their systems. Supplier master data needs to be clean — no duplicates, correct legal names, VAT numbers and IBANs — or e-invoicing quickly breaks down in practice. Just as importantly, suppliers need to invoice consistently and accurately, with the right legal identifiers and valid PO references. Getting these basics right early makes everything else significantly easier.”

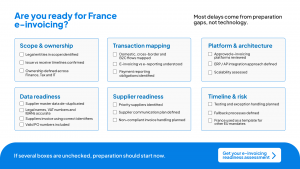

In practical terms, finance teams should be focusing on:

- Confirming which legal entities are in scope and when

- Mapping domestic, cross-border and B2C transaction flows

- Assessing ERP and AP system readiness across countries

- Reviewing and cleansing supplier master data

- Planning supplier onboarding and communications

- Evaluating approved e-invoicing platforms early

If several of these areas are still unresolved, that’s common, but it’s a strong indicator that preparation should start now.

For broader context on why early action matters, see E-invoicing isn’t optional anymore — here’s why.

France as the blueprint for EU e-invoicing readiness

France is not an isolated case. It’s part of a wider shift toward mandatory, near-real-time tax reporting across Europe.

Organisations that prepare early for the French mandate are better positioned to reuse processes, data models and operating patterns as similar requirements emerge in other EU countries. Those that wait often end up solving the same problems repeatedly, under increasing time pressure.

An e-invoicing readiness assessment can help finance teams understand where they stand today, identify gaps, and plan a realistic path to compliance – in France and beyond.

Frequently Asked Questions

The mandate begins on 1 September 2026, when all companies must be able to receive e-invoices and large and mid-sized businesses must issue them. SMEs and micro-enterprises follow in September 2027.

Domestic B2B transactions between VAT-registered businesses established in France must be e-invoiced. E-reporting also applies to cross-border B2B and B2C transactions, with some limited exceptions.

It depends. If a foreign supplier is not established in France, the French buyer typically has the e-reporting obligation. If the supplier is VAT-registered in France, they may have direct reporting duties.

No. The mandate requires invoices to be exchanged in structured or hybrid electronic formats such as Factur-X, UBL 2.1 or CII. This marks the end of unstructured PDF invoices for in-scope transactions.

While enforcement details continue to evolve, non-compliance can lead to operational disruption, increased manual processing, and potential penalties. Early preparation significantly reduces these risks.