Mandatory e-invoicing is no longer a distant policy discussion. Across Europe, tax authorities are moving steadily towards structured, digital invoicing frameworks. France is already well underway, Belgium and Germany are advancing their own approaches, and the UK continues to signal broader digital tax reform.

For most enterprises, the challenge isn’t awareness.

It’s knowing how to prepare for mandatory e-invoicing in a way that’s structured, proportionate, and aligned to how the business actually operates.

E-invoicing readiness doesn’t require rushing or overhauling everything at once. But it does require clarity, early visibility of risk, and a realistic plan.

This guide is designed to help with exactly that.

What this guide covers (and how to use it)

This is not a country-by-country deep dive into regulations.

Instead, it focuses on the core foundations of mandatory e-invoicing readiness that apply across mandates, particularly for enterprise organisations.

In this guide, we’ll cover:

- What e-invoicing readiness really involves for enterprises

- Where organisations typically underestimate effort and complexity

- A practical e-invoicing readiness checklist you can apply today

- How to turn gaps into clear, confident next steps

You don’t need to read this end to end in one sitting. The checklist is designed to be scanned, revisited, and shared internally.

What e-invoicing readiness really means for enterprises

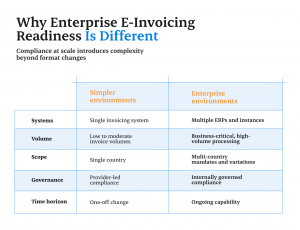

E-invoicing is often described as a simple format change that sees PDFs replaced with structured files. But in practice, it’s far broader.

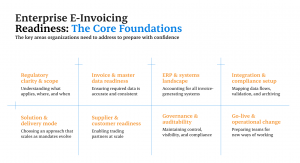

True enterprise e-invoicing readiness spans:

- Regulatory interpretation and scope definition

- Data quality and governance

- ERP and system integration

- Trading partner onboarding

- Controls, auditability, and ongoing compliance

While individual e-invoicing requirements vary by country, these building blocks remain consistent. Enterprises don’t simply adopt compliance: they design, govern, and operate e-invoicing as an ongoing capability.

That’s why preparation matters more than speed.

The enterprise mandatory e-invoicing readiness checklist

While requirements differ across jurisdictions, enterprise readiness for mandatory e-invoicing consistently falls into the same core areas. The checklist below follows the order most organisations encounter them, from early regulatory clarity through to operational change.

You don’t need perfect answers to every point today. What matters is understanding where gaps exist and what to prioritise next.

Regulatory clarity and scope

Before systems or solutions are discussed, enterprises need clarity on what applies, and where.

Use this as a sense check:

- You know which mandatory e-invoicing requirements apply today, and which are coming next

- Timelines, phases, and enforcement models are understood

- Scope across AP, AR, entities, and countries is defined

- Ownership of regulatory interpretation is clear

Why this matters: Uncertainty at this stage often leads to rework later, particularly as mandates expand.

For enterprises trading in France, see our France e-invoicing readiness guide, which outlines how scope, timelines and enforcement are being applied in practice.

For a broader view of how e-invoicing and digital reporting are evolving across Europe, the EU VAT in the Digital Age initiative provides helpful context.

Invoice data and master data readiness

Many mandatory e-invoicing challenges surface long before integration begins.

Sense check:

- Mandatory invoice fields can be populated consistently

- Tax IDs, addresses, and line-level data are clean and standardised

- Invoice variations across systems and entities are understood

- Master data ownership is clearly defined

Why this matters: Structured e-invoicing exposes inconsistencies that PDF-based processes often hide.

ERP and systems landscape

Enterprise invoicing rarely runs through a single, simple system.

Sense check:

- All ERPs and invoice-generating systems are accounted for

- Legacy systems in scope have been identified

- Invoice processes are configurable across platforms

- IT and architecture teams are engaged early

Why this matters: For enterprises, integration, not invoice format, is the core complexity of e-invoicing readiness.

Integration and compliance setup

This is where most mandatory e-invoicing timelines are won or lost.

Sense check:

- Invoice data mapping to required formats is understood

- End-to-end flows (ERP → provider → network → authority) are clear

- Validation rules, signatures, and timestamps are planned

- Archiving and legal retention requirements are covered

Why this matters: This phase carries the highest execution risk if underestimated.

For a deeper view, see our guide to e-invoicing integration and compliance.

Solution and delivery model

Compliance today is only part of the decision.

- The e-invoicing solution can adapt as mandates evolve

- Coverage spans required countries, formats, and networks

- Scalability under peak volumes has been considered

- Vendor dependency is actively managed

Why this matters: Enterprises need solutions that remain viable beyond the first mandate.

Supplier and customer readiness

Mandatory e-invoicing readiness extends beyond internal systems.

- The scale of affected suppliers and customers is understood

- Onboarding and communication approaches are defined

- Exceptions and non-compliance scenarios are planned for

Why this matters: External readiness directly impacts internal performance.

Governance, controls, and auditability

As e-invoicing increases transparency, expectations rise with it.

- Ongoing compliance ownership is clearly assigned

- End-to-end audit trails are accessible and reliable

- Reporting aligns with internal audit requirements

- Tax authority visibility is monitored proactively

Why this matters: Enterprises must govern e-invoicing continuously, not just at go-live.

Go-live and operational change

Go-live marks a shift in how finance teams work, not the end of the journey.

- AP and AR teams are prepared for exception-driven processes

- Training and change management plans are in place

- Policies and controls have been updated

- Support and escalation models are defined

Why this matters: Operational readiness determines sustainability.

How to use this checklist in practice

You don’t need every answer today.

- Identifying e-invoicing readiness gaps early

- Understanding dependencies across teams and systems

- Sequencing work based on risk and regulatory timelines

E-invoicing readiness is progressive. Organisations that start early have more options and fewer surprises.

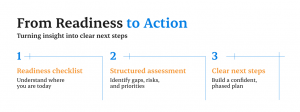

From readiness to confidence

Mandatory e-invoicing is not a one-off project. It is an ongoing enterprise capability that sits at the intersection of finance, tax, and technology.

Enterprises that approach readiness with structure and foresight gain more than compliance: they gain control.

If you want a clearer view of where you stand and what to prioritise next, a structured assessment can help turn uncertainty into a practical action plan.

Get your e-invoicing readiness assessment.

Frequently Asked Questions

Mandatory e-invoicing readiness goes beyond changing invoice formats. It involves regulatory clarity, data quality, system integration, trading partner enablement, and governance to ensure invoices can be issued, received, reported, and audited in line with evolving mandates.

Yes. While the direction of travel is consistent, e-invoicing requirements vary by country in terms of scope, timelines, technical models, and reporting obligations. Enterprises operating across multiple jurisdictions need to account for these differences while building a readiness approach that can scale as mandates evolve.

Enterprises should start preparing as early as possible, even if specific deadlines feel distant. Early preparation helps uncover data, system, and process dependencies that take time to address and reduces the risk of rushed decisions as enforcement dates approach.

Common challenges include inconsistent invoice data, complex ERP landscapes, underestimated integration effort, supplier and customer onboarding at scale, and unclear ownership of ongoing compliance and governance.

An e-invoicing readiness assessment helps enterprises understand where they stand today, identify gaps and risks, and prioritise next steps. It provides structure and clarity, turning regulatory requirements into a practical, phased action plan.