According to the Q1 2020 Deloitte CFO Survey, 99% of CFOs anticipate an increase in flexible working within the financial divisions of companies as a fall-out of Covid-19. While there are many benefits to remote working such as lower business expenses, better access to applicants, increased employee productivity and reduced carbon footprint, Remote working also brings with it many challenges.

Roles such as accounts payable have struggled to adapt to this new way of life because the success of the role is heavily dependent on being in the office. Organizations that process invoices manually or rely on on-premise solutions which were built based on staff being physically in the office, are facing new challenges, risks and costs which need to be addressed urgently.

This four-minute blog will evaluate these challenges and provide solutions.

Longer Processing Times

Remote working has exposed the vulnerability in manual invoice processing. Invoices continue to stream into closed premises, laying untouched and unprocessed. To rectify the situation accounts payable teams take turns visiting the office to collect invoices. Despite their best efforts, the strategy is deeply flawed.

Entering the office on a rotational basis not only jeopardizes employee health but is time-consuming as accounts payable staff collect paper invoices, open them, review and scan them. Approval and payment still need to be sought remotely, resulting in the process being drawn out and ineffective.

The processing delay has significant consequences to payment deadlines, as companies miss early payment discounts and suffer late payment charges. A Sidetrade report revealed that since Covid-19 took hold, there has been a surge in late payments and unpaid invoices throughout Europe. Their data shows that the average unpaid invoices (10+ days after their due date) before Covid-19 was 15.5%. During this pandemic, the volume of unpaid invoices has jumped to 31.9%, with Spain, France, and the UK being amongst the biggest offenders.

![]()

Late payment fees not only damage cash flow but if an invoice is forgotten about and goes unpaid due to the poor process in place, the damage it can do to a vendor relationship can be irreparable.

Risk of Fraud

Trying to gain visibility over the number of invoices circulating within the business is almost impossible for those using a manual system. Remote working leaves accounts payable in the dark about the volume of invoices, their urgency and their legitimacy, which can result in increases in fraud.

Levels of fraud have increased significantly as criminals take advantage of finance staff working from home where there are clear weaknesses in processes. Europol have issued warnings about new fraudulent vendor websites and domain names coming online. Fake vendors with names that sound like real companies are taking advantage and hoping that AP process their invoice for payment before detection.

Equally, less oversight due to remote working within these manual environments could result in internal fraud. Fake accounts being established, duplicate invoices being knowingly approved for payment are a lot more likely within an organization if approval processes are inadequate.

In an environment that is already financially challenging, a large fraud or scam incident could push a business over the line and into bankruptcy. An automated AP system catches any abnormal accounting behavior or data anomalies and instantly flags them to be checked. With employees freed from the shackles of approvals and data entry, they can investigate exceptions and ensure unauthorized invoices aren’t approved. Automated AP also creates transparent audit trails of invoice approvals.

(To learn more about how to detect and prevent accounts payable fraud, read our blog here).

Audit and Compliance Complications

Remote working also interferes with the ability to correctly archive invoices. In the office, invoices are routinely stored away in cabinets to be later accessed for audits for example. However, with offices closed and accounts payable not in the one location, companies have started to run into audit and compliance complications.

Invoices, purchase orders, contracts, and other transactional information are generally requested during an audit. Remote working means companies are dependent on the AP team to correctly store this information at home, and when they do return to the office, that the documentation is filed away appropriately.

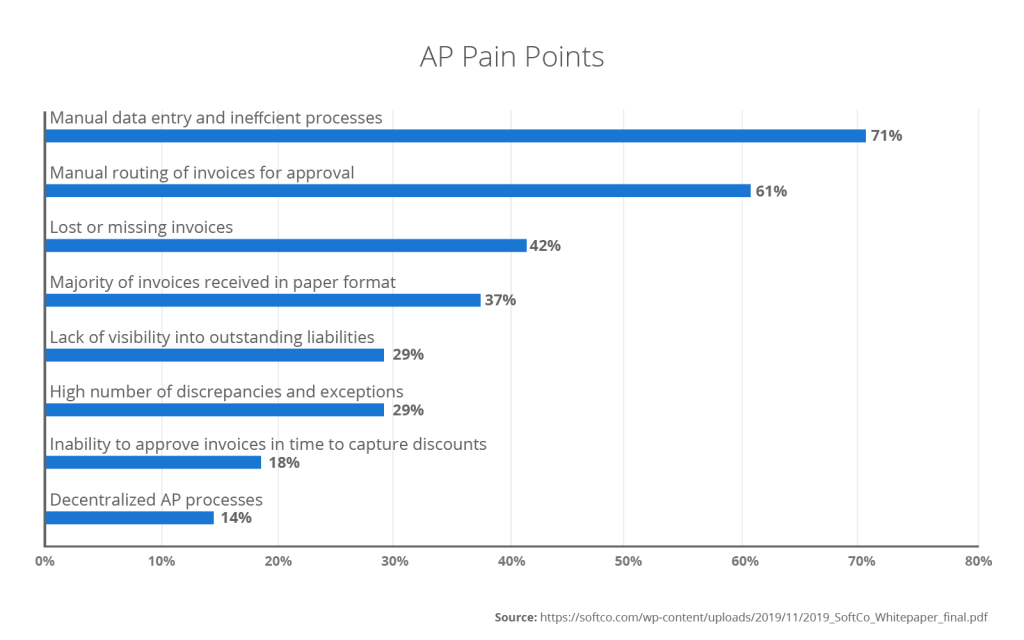

The situation shows the vulnerability of manual processes. This Levvel report shows that 42% struggled with lost or missing invoices before the pandemic. The added complexity of remote working will only accentuate the problem and puts enormous pressure on AP staff.

The Solution

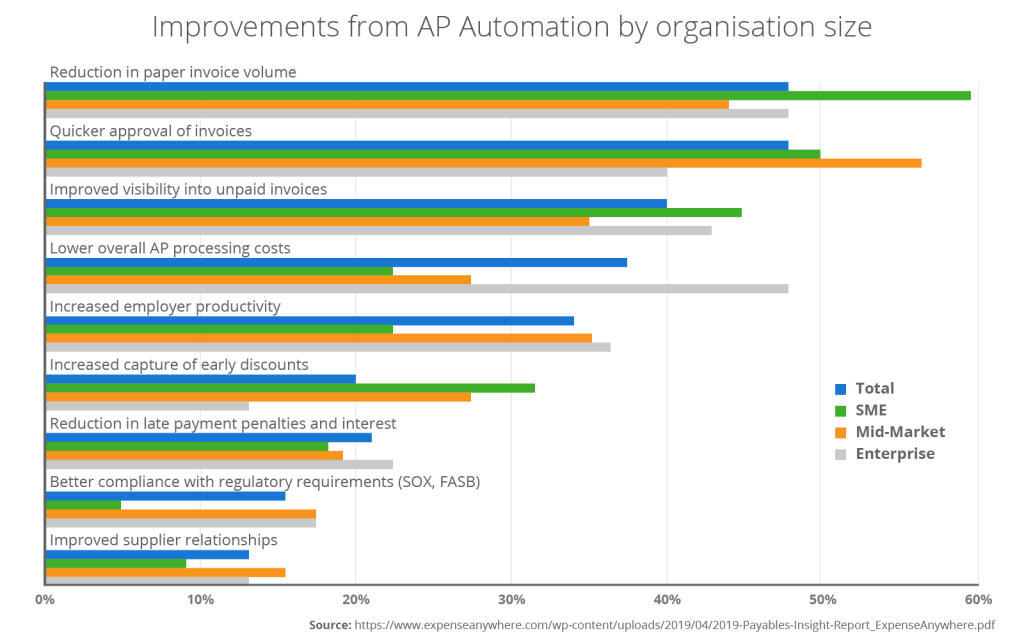

Capturing early payment discounts and speeding up processes can be achieved whilst accounts payable work remotely. Accounts Payable Automation eliminates the need to physically go into the office, saving staff precious time and importantly, protecting their health. A cloud-based platform allows AP to prioritize what invoices to pay to capture discounts but to also avoid late payment fees. It also provides much-needed visibility into the volume of invoices an organization has and the outstanding payment. This allows meaningful financial analysis to take place to determine payment runs and identify areas where the business can cut costs.

The detection of fraudulent invoices increases exponentially with secure approval workflows in place and full visibility into the invoices in circulation within the company. Automation also provides remote working teams with a cloud-based compliant archive. Automation solves the problems that arise for AP whilst working remotely and it comes as no surprise that Everest Group recently reported that companies expressed regret at not advancing further into the cloud and implementing more automation before the pandemic hit.

Conclusion

It’s reasonable to assume that no one anticipated the extent of the impact Covid-19 would have on the workforce and the way we run our current operations. Before the crisis hit, companies managed to ‘get by’ using manual, paper-based processes. However, remote working has highlighted just how vulnerable manual processes are, and how stressful it has been for accounts payable to adapt. Senior finance leaders are now at a crossroads, switch to automation, or be left behind.