In today’s competitive retail landscape, businesses are grappling with the challenge of rising operational costs, fueled by persistent labor shortages and inflationary pressures. According to KPMG, retailers will need to look at reducing their cost base by ~20% to continue to remain competitive. Retailers are increasingly seeking innovative solutions to streamline operations and mitigate these financial challenges. Among these, automation—specifically within finance departments— has become not just an advantage but a necessity in staying competitive.

This blog will delve into the pivotal role of invoice automation in addressing rising retail operational costs, focusing on how automating processes like invoice management and financial reporting can lead to significant cost savings. By showcasing the benefits of this technology, we aim to provide insights into how retail brands can leverage automation to optimize their operations and maintain a competitive edge.

What are the Biggest Operational Costs in Retail Now?

Retailers today are navigating a landscape fraught with rising operational costs, driven by inflation, labor demands, energy expenditures, and fluctuating commodity prices.

1. Inflation

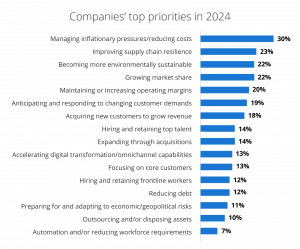

Inflation is exerting immense pressure on the retail sector, affecting both operational costs and consumer spending behavior. The recent economic outlook indicates that these high costs are not a temporary phenomenon but part of a broader trend influenced by global economic shifts and geopolitical tensions. According to Deloitte’s Global Retail Outlook Survey 2024, “managing inflationary pressure/reducing costs” has become the number one priority for retailers in 2024.

As prices for goods and services increase, retailers are caught in a bind, trying to balance the need to remain competitive while preserving profit margins. This challenge is further intensified by consumers, who are increasingly price-sensitive and cautious with their spending. The impact of inflation is seen in every aspect of retail operations, from higher costs of raw materials and transportation to increased wages required to attract and retain talent.

These rising costs necessitate strategic adjustments in pricing, inventory management, and supply chain logistics in order to ensure that retailers meet consumer demands without sacrificing profitability.

2. Labor Shortages

Labor shortages present a significant hurdle for the retail industry. The scarcity of skilled workers has forced retailers to operate with leaner teams, straining existing staff and impacting overall productivity. This shortage is primarily driven by demographic shifts, evolving worker expectations, and the lingering effects of the pandemic, which have collectively reshaped the labor market. According to the Society for Human Resource Management (SHRM), the labor force participation rate in the U.S. is projected to continue to trend down, declining from 61.7 percent in 2020 to 60.4 percent in 2030.

With fewer hands on deck, retailers often struggle to maintain service levels, leading to potential dips in customer satisfaction and loyalty. Additionally, the demand for higher wages to attract and retain employees has led to increased payroll expenses. This pressure is prompting retailers to seek out innovative solutions, such as automation, to reduce reliance on human labor for routine tasks.

3. Energy Costs

Rising energy costs pose a major challenge for retailers aiming to maintain profitability amid escalating operational expenses. According to Bank of Ireland, businesses in Ireland are spending on average €329m per year per county on energy costs – up 57% in a six-year period. This is a trend that is reflected globally.

These costs affect various aspects of the retail business, from store operations to managing supply chain logistics. As energy prices rise due to geopolitical tensions and supply constraints, retailers face higher utility bills and transportation costs, which erode tight margins. Moreover, the drive for sustainability demands investments in energy-efficient technologies, further straining budgets. Retailers must balance these costs while staying competitive and environmentally responsible.

4. Fluctuating Commodity Prices

Retailers face significant challenges with fluctuating commodity prices, which create unpredictability in cost management and profit margins. These variations stem from factors like supply chain disruptions, geopolitical instability, and changes in consumer demand. As essential materials’ costs rise, retailers must frequently adjust pricing strategies, complicating inventory and financial forecasting.

This volatility forces retailers to either absorb costs, impacting margins, or pass them onto consumers, risking competitive positioning and customer loyalty. To navigate these challenges, retailers turn to advanced data analytics and automated systems, with McKinsey & Company reporting how such tools can be used by retailers to forecast price changes, optimize inventory, and maintain stable pricing strategies profitably.

Faced with these challenges, many retailers are turning to automation to streamline operations and mitigate the financial pressures of an increasingly demanding retail environment.

How Does Invoice Automation Help Retailers Mitigate Rising Costs?

Increased Efficiency and Reduced Errors

By transitioning from manual to automated processes, businesses can significantly reduce both time spent on invoice processing and the number of errors that occur, ultimately achieving significant cost benefits. PWC name the “digitization of operations” as one of the most effective ways that retailers can manage costs.

Invoice automation solutions automate processes in a number of different areas to help retailers achieve reduce costs:

Vendor Management

- Streamlines communication and transactions with vendors, reducing the chance of miscommunications and transactional errors.

- Enhances relationship management by providing real-time data and insights into the status of invoices and payments, facilitating better negotiation and collaboration.

eProcurement

- Eliminates manual paperwork and reduces errors in order processing.

- Increases procurement efficiency by automating requisitions and approvals, resulting in faster processing times and reduced costs.

Invoice Data Capture

- Reduces manual data entry errors by automatically extracting data from invoices.

- Ensures data accuracy and speeds up the invoice processing time, allowing staff to focus on higher-value tasks.

Invoice Matching

- Automatically matches invoices with purchase orders and delivery receipts, ensuring all data is correct and consistent.

- Reduces discrepancies and facilitates quicker resolution of mismatches, minimizing delays and errors.

Invoice Coding

- Automates the assignment of correct accounting codes, reducing the risk of misclassification.

- Improves accuracy in financial reporting and compliance with financial regulations.

Invoice Approval

- Streamlines the approval process by automatically routing invoices to the correct personnel.

- Speeds up approvals, reducing bottlenecks and ensuring timely payments, which helps in avoiding late fees and maintaining good vendor relationships.

Payment Automation

- Facilitates the automatic scheduling and execution of payments, ensuring timely disbursements and improved cash flow management.

- Reduces the risk of late payments and associated fees while enhancing relationships with vendors through consistent and reliable payment cycles.

By implementing automation across these tasks, retailers can significantly reduce operational costs and errors, thereby enhancing efficiency and maintaining competitiveness in a challenging economic landscape.

Enhanced Financial Reporting Accuracy

Invoice automation is a game-changer for retailers seeking to enhance financial reporting accuracy. By automating invoice management, retailers can ensure consistent and precise data capture, which minimizes human errors and maintains financial integrity. This technology streamlines the entire financial reporting process by providing real-time data processing, allowing for timely and insightful financial analysis that yields the following benefits for retailers:

Improved Decision-Making

- Enhanced financial reporting provides real-time insights into financial health, aiding strategic planning and informed decision-making.

Increased Transparency and Accountability

- Accurate reporting fosters trust among stakeholders by maintaining transparency and providing a clear view of financial performance.

Improved Productivity & Performance

- Retailers can use insights from accounts payable productivity and vendor payments performance to optimize cash flow, negotiate better terms with vendors, and boost overall financial health, ultimately cutting operational costs and enhancing competitive positioning.

Regulatory Compliance

- Seamless integration with existing financial systems facilitates adherence to financial regulations by ensuring accurate and consistent financial records and audit trails.

Resource Optimization

- Streamlined reporting processes free up human resources to focus on higher-value activities instead of manual data entry and reconciliation.

Cost Control

- Timely and accurate financial data aid in monitoring expenses, identifying cost-saving opportunities, and managing budgets effectively.

Enhanced Competitive Edge

- Access to precise financial data helps retailers stay agile, adapting quickly to market changes and maintaining a competitive advantage.

Risk Mitigation

- Consistent and precise financial reporting reduces the likelihood of errors, decreasing financial discrepancies and associated risks.

By leveraging enhanced financial reporting, retailers can achieve greater efficiency, compliance, and competitiveness in an increasingly demanding market.

How SoftCo Helps Retail Brands to Automate Their Finance Departments

Improving Efficiency in Retail Finance

SoftCo has vast experience in helping retailers navigate the challenges of rising retail operational costs through advanced automation solutions. SoftCoP2P for Retail significantly reduces the errors and inefficiencies that retailers commonly experience with manual accounts payable processes. SoftCo streamlines the entire procure-to-pay process, from procurement to invoice capture, matching and approval and finally payment to vendors. SoftCo also enables contract compliance and 100% control of project spend, all of which cut down on processing times and reduce errors, leading to substantial cost reductions for retailers.

Furthermore, the robust financial reporting capabilities found in SoftCoP2P for Retail enhance data accuracy and provide real-time insights over AP productivity, invoice processing rates and payments performance. These insights enable better decision-making and cost management, allowing retailers to maintain financial transparency and compliance while optimizing resources.

Renowned retail brands like Superdry, Primark, and Logitech have successfully implemented SoftCo’s solutions, achieving notable cost savings and operational efficiency. Interested in learning how SoftCo can streamline your retail finance operations? Schedule a free demo to discover the tangible cost savings and efficiency gains SoftCoP2P brings to retail brands.