Companies are embracing payment automation in a big way. More than three-quarters of businesses automate at least some of the AP and AR process. By 2025, it will be possible to complete 80% of transactions between buyers and vendors electronically. Taking electronic payments a step further with automated payment software allows businesses to gain full visibility and control. Failing to modernize can put organizations at a significant competitive disadvantage.

Source: Corpay

Benefits of Automating Payments

1. Centralize All Payment Activity

Many businesses use multiple payment options – cash, check, ACH, and virtual cards. While access to different payment methods expedites payment processing, managing payments becomes more complex.

Effective payment automation solutions create a single workflow for executing all payment methods. Rather than paying invoices one at a time, you can upload one payment file for multiple invoices. Payment technologies also have dashboards that allow comprehensive reporting and enable payment management for multiple invoices in one platform.

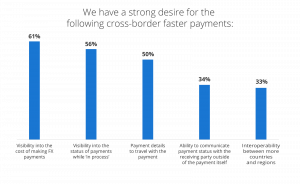

2. Higher Visibility Into Cross-Border Payments

Making cross-border payments is one of the biggest pain points when it comes to paying vendors. Paying international vendors is often a risky, expensive, and slow process.

Payment automation technologies allow businesses to centralize all payments and settlements and integrate features needed to complete cross-border payments. Modern payment solutions provide a smarter way to process international payments directly from invoices, improve financial risk management, and reduce foreign currency conversion costs. With the right payment partners, companies can achieve visibility into the cost of foreign exchange payments, payment status, and the payment details sent to the bank.

3. Simplify Interaction With Multiple Bank Systems

Most companies originate payments from more than one account. Issuing payments is more complex for large companies as 48% use more than 6 banks and 31% have 3 to 5 banks.

In a manual environment, you have to log in to different banking apps to initiate payment. You also need to monitor transactions to know the payment status for each invoice.

With so many steps involved, it’s easy for employees to pay with the wrong account. Errors are also likely to happen which could lead to more work.

By automating payments, you only have to monitor one dashboard to manage all aspects of paying the approved invoice.

4. Generate Revenue from Spend Through Rebates

Vendors often offer rebates to encourage customers to pay faster. Claiming rebates for B2B transactions can potentially bring in about 2-3% in revenue based on your annual vendor spend. Capturing early payment discounts is much easier with vendor payment software.

Now, businesses can also earn rebates by using a virtual credit card for paying for goods and services. Card providers issue cash rebates to customers based on the amount paid for their supplies. This extra cash creates a tangible impact on your net income by reducing your monthly spending.

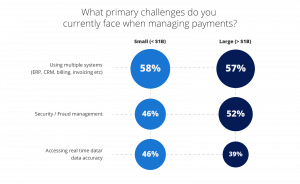

5. Build Scalable Controls to Mitigate Fraud Risk

Security and fraud management is a primary challenge for 52% of large companies. In 2021, 98% of B2B companies reported fraud attacks and lost about 3.5% of their annual sales revenue to fraud.

As fraudulent schemes that target AP departments become more sophisticated, companies require a better fraud detection strategy. One effective way to increase payment security as a company grows is through automating payments.

Payment automation solutions strengthen security through features such as:

- Straight through processing – fewer manual touch points reduce the likelihood of tampering with payment information.

- Full encryption to reduce unauthorized access and security breaches.

- Verification capabilities.

- Faster reconciliation with AI.

- Access to dashboards which improves oversight over all payment transactions.

- Upgradable platforms that users can upgrade to improve security and compliance based on emerging threats.

Automation makes it possible to maintain the same level of control without adding headcount. About 50% of companies using technology to verify payment details during onboarding and when vendors request to update banking information are very satisfied with their existing fraud control. On the other hand, only 17% of businesses that use manual solutions feel the same.

Automated solutions use sophisticated software and powerful AI algorithms that can detect, learn, and adapt to catch potential fraud in your payment ecosystem.

6. Deeper Insights to Support Proactive Business Strategies

Payment automation gives companies access to technology that generates data-rich reports so you can gain deeper insights about your business. By leveraging technology that uses AI algorithms and machine learning, decision-makers have faster access to insights that may have taken your finance team weeks to compile manually.

Deeper insights enable proactive decision-making. You can mine information that helps you uncover new ways to reduce costs and increase efficiencies.

7. Plug Control Gaps Through Continuous Monitoring

Manual processes create room for payment errors to happen. A mistake like an extra zero, transposing numbers, duplicate payments, or the incorrect vendor leads to confusing data and time wasted for resolving errors.

Automating payments creates less room for error and fraud since the system monitors the payment and you have full transparency over all invoices ready for payment.

Real-time visibility into the payment status allows you to verify whether vendors have been paid or not faster. With automation, you can make on-time payments, and avoid penalties and fines.

Modern payment solutions make it possible to reconcile transactions without human intervention. Matching transactions automatically adds another layer of control by improving internal control and making it easier for AP teams to identify potential red flags.

Turn AP Into a Profit Center With Automation

With payment automation, your business can move away from expensive check payments and start optimizing electronic payments.

Decreasing check usage by 10% saves $1.2 billion for the industry every year. Rebates, prompt payment discounts, and money saved through payment automation all contribute to achieving the gold standard for AP departments – becoming a profit center.

Automation unlocks smarter ways to pay. Addressing pain points in the payment process improves the bottom line and increases your company’s resilience.