Picture this – your accounts payable team drowning in a sea of invoices, purchase orders, and payment requests. If that activity reflects growth in the business, you might initially think it comes with the territory. Unfortunately, when your team starts struggling to keep up and mistakes slip through the cracks, the pressure begins mounting.

Getting payments out the door quickly and efficiently creates a virtuous cycle with the positive side effect of improving capital management. However, with the proliferation of payment methods and channels, managing payments can be a complex and resource-intensive task.

Nine in 10 CFOs are investing in payment digitization already or have plans to do so to streamline and optimize payment workflows. In this guide to B2B payments automation, we’ll explore the challenges of manual payments and how to take your payment processes to the next level, including tips on selecting an automated payment system.

What Is Payment Automation

Payment automation refers to using technology to send accurate payments to vendors, customers, employees, and other beneficiaries with little or no human intervention. While automating payments does focus primarily on the payment transaction, in reality, the reconciliation and approval process begins with capturing invoice data and ends with generating payments.

With automation, companies no longer have to cut paper checks or use online banking portals to process payments manually. By using third-party software, your team can increase workflow efficiency and automate repetitive and time-consuming payment responsibilities. Processing and validating a high volume of transactions becomes faster and less error-prone.

Why Modernize B2B Payments?

Rapid digitization efforts in recent years boosted the growth of the global B2B payments market, though the industry was already ripe for advancement. Before the pandemic, electronic business-to-business (B2B) payment adoption significantly lagged business-to-consumer (B2C) payments, with around a third of B2B payments processed electronically, versus two-thirds of B2C global payments.

Relying on fragmented processes to approve and authorize payments often involves manual processes, cutting checks, or using an online banking portal to make payments one at a time.

With an economic slowdown taking shape, businesses want to shorten cash conversion cycles. Unfortunately, manual processes and legacy systems create obstacles. Payment friction may lead to strained vendor relations and create costly inefficiencies that could hurt business growth and continuity.

As a result, companies are embracing payment automation.

Full-featured platforms and tools to automate payment processes can generate nearly real-time payments. 91% of finance leaders who accelerated payments digitization share that the transition resulted in more efficient operations overall.

B2B Payment Challenges

Executives are reporting discontent with their organization’s existing payments ecosystem. As a result, 68% of company executives expect operations to integrate B2B payment innovations to address pain points. Here are some of the common issues automation can address:

High Cost of Paper Checks

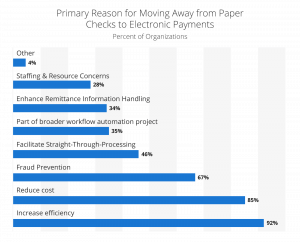

Check payments – one of the most expensive payment options – still account for 25% of B2B payments. For example, the median cost of issuing a paper check is between $2.01 to $4. The top reasons for shifting away from paper checks to electronic payments are to increase efficiency and reduce costs. Paper checks also have the distinction of being the most targeted B2B payment method for fraud.

With payment automation, companies have access to multiple payment types, including wire transfers, ACH, and virtual cards. Businesses are increasingly using virtual cards because as a more secure, efficient, and convenient payment method. Moreover, virtual cards make it easier to reconcile invoices, track expenses in real-time, and control transaction limits digitally.

Poor AP Workflows

Invoice status can be tricky to keep tabs on as invoices move from procurement to accounts payable and payments are disbursed. Without a cohesive payments platform, accounts payable teams don’t have a method of easily scaling payments.

Endorsing invoices for payment via email or routing a payment request manually is part of the problem. This method makes it challenging to track payment requests in real-time and obscures visibility into company finances.

Inaccessible Documentation

Manual payment processes often require filing printed copies of the documents to support a transaction. Most companies follow a process where employees print, file, and store payment documents and attachments for future audits and review. Not only does this process take up a lot of time and resources, but it also takes up expensive real estate. Retrieving documents is also challenging, especially for aged files.

Incorrect and Duplicate Payments

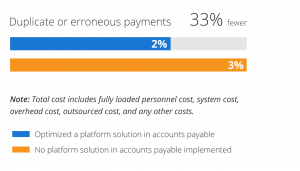

Manual processes create significant room for mistakes from inaccurate data entry or human error. Paying an incorrect amount or paying invoices twice are common problems in a manual environment. Adopting automation solutions for payment processes solves this problem by automating reconciliation and eliminating unnecessary data entry.

According to the IBM Institute for Business Value, organizations that have optimized their accounts payable platform reduce duplicate or erroneous payments by 33%.

No Audit Trail

Payment approval processes don’t follow a single route. Companies may require multiple approvers for releasing payments. Sometimes, approvers are on leave, and substitute approvers step in. When AP teams have to chase down approvers, you might also end up with verbal approvals where payments occur without a paper trail.

Keeping track of these workflows becomes challenging in a manual payment process, especially if companies have high invoice volumes with a lean team in charge of sending and tracking payments.

Key Features and Benefits of Payment Automation

For years, companies relied on online banking to reduce reliance on manual processes. While traditional banks reduce manual steps when paying vendors, it does little to improve the efficiency of payment workflows. Payment automation solutions go beyond simply making online payments.

Streamlined Payments

AI-powered payment ecosystems deliver greater efficiencies by minimizing repetitive tasks and taking over manual tasks like data entry or chasing down authorizations. Using automation, organizations can consolidate domestic and international payments and follow a single workflow for paying vendors.

A unified interface where all payment communication and processes happen makes it easier to route payment requests to the right people. All payment requests appear in one interface, but they follow different paths depending on the existing payment rules and relevant approvers.

Quicker Approval and Processing

Payment automation allows companies to send all invoices ready for payment in the ERP in a single payment file. The payment software then allows the finance team to select the payment status – whether to hold, stop, or approve payments. Automation improves workflows so finance teams can see all approved invoices waiting on payment in one dashboard. With faster reconciliation and approvals, companies may be able to pay approved invoices in minutes rather than hours.

Reduced Costs

Payment automation decreases operational costs since it:

- Improves productivity by eliminating manual tasks like data entry and manual reconciliation

- Uses fewer resources in payment processing

- Improves accuracy of payments made

- Allows businesses to access cheaper payment methods

Improved Fraud Protection

Fraud prevention is a priority for many organizations, and 71% plan to implement automated digital solutions to address this problem. Payments solutions use full encryption to mitigate fraud and protect the company against security threats.

Payment automation also uses AI to analyze the risk level for each payment transaction. With AI, companies can increase the detection rate for fraudulent payment requests.

Vendor Satisfaction

While automation speeds up payments, it also decreases the chance of errors, leading to fewer disputes with vendors.

Eliminating payment friction and making on-time payments go a long way toward nurturing long-term relationships with vendors. Higher vendor satisfaction could mean receiving special consideration when you have a demanding or urgent order.

Early Payment Discounts

Another special consideration could come from offering early payment discounts. Even if companies have a seamless invoice approval workflow, they can’t capture early payment discounts if actual payment gets delayed.

Making payment automation part of the AP workflow allows companies to take advantage of discounts by paying early. The average early payment discount is 2% but some companies offer as much as 7% to get customers to pay early.

Rebates

A popular option within payment solutions is to make vendor payments via virtual card. Not only are virtual cards often more secure because they can be easily tracked and monitored, but they may also offer cost savings using attractive rebates.

How to Choose a Payment Solution

Finding the right payment automation solution modernizes payments and aligns with strategic growth opportunities.

Consider the following capabilities when choosing a payment automation solution.

Seamless Integration With Existing Systems

Integration with existing systems, your ERP, and accounting software is one of the top considerations in automating payments. Payment automation delivers maximum efficiency if it allows you to sync data points to and from other platforms. A solution that doesn’t work well with other systems results in fragmented processes, additional work, and higher costs.

Reporting Capabilities and Analytics

Payment data holds a wealth of information that organizations can use to improve processes. Look into the payment solution’s reporting capabilities and explore features that could improve decision-making.

Aside from the ability to generate informative reports, payment automation should also support advanced analytics.

With analytics, companies can dive deeper into payment data to understand spending patterns and find opportunities to reduce costs and risks. For instance, businesses can identify suppliers who do not provide discounts and consider raising this benefit during contract negotiations. Analytics can also flag activities indicative of abuse or fraud.

Alignment With Business Goals

Automation should support business objectives and strategy. In selecting a payment automation solution, evaluate the tool’s features and capabilities to see if it offers the return on investment you need.

Fewer than 10% of finance team activities are spent on analysis and action that could spur improved decision-making. If the goal is to turn your accounts payable into a profit center, they need to be freed from transactional work to help on supporting strategic initiatives.

Future Proof Accounts Payable

Higher interest rates have increased the urgency for CFOs to manage costs and improve productivity. As business and economic conditions change, companies have to modernize payment systems to stay competitive. Without an effective way to settle vendor payments, companies stand to lose money due to inefficient operations, lost rebates and discounts, strained vendor relations, and vulnerability to fraud.

With so much at stake, it makes sense to embrace payment automation sooner rather than later. An end-to-end accounts payable solution incorporates invoice processing and automated payments. Start looking for the right payment partner today to start making secure, quick, and seamless business payments.